Exchange Of Agreement Meaning In Washington

Description

Form popularity

FAQ

Posted 29th May 2024 in Help & Advice. Once a property has been sold the focus of both seller and buyer will usually turn to the key stages of exchange of contracts and completion. Exchange of contracts is the point at which both the buyer and seller are legally committed to the sale.

A “binding contract” is any agreement that's legally enforceable. That means if you sign a binding contract and don't fulfill your end of the bargain, the other party can take you to court. You might encounter binding contracts frequently, whether you're signing a rental lease agreement or just bought a car.

In Washington, the basic maxim is “An agreement is enforceable if its terms are reasonably certain.” The terms of a contract are “reasonably certain” if they provide the ability for determining a breach/default and for giving an appropriate remedy in case of breach/default.

A contract is an agreement between parties, creating mutual obligations that are enforceable by law. The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality.

A 1031 exchange agreement is a tax deferral strategy that allows individuals or businesses to sell an investment property and reinvest the proceeds into a like-kind property, without incurring immediate capital gains taxes.

WPI 301.01 (7th ed.) A contract is a legally enforceable promise or set of promises. In order for a promise or set of promises to be legally enforceable, there must be mutual assent and consideration. Use this instruction when the existence of a contract or its terms is at issue.

Washington State doesn't require you to have a written operating agreement for your LLC. ing to WA Rev Code § 25.15. 006 (2020), the operating agreement may be verbal or implied. However, having a written operating agreement on file is in your company's best interest.

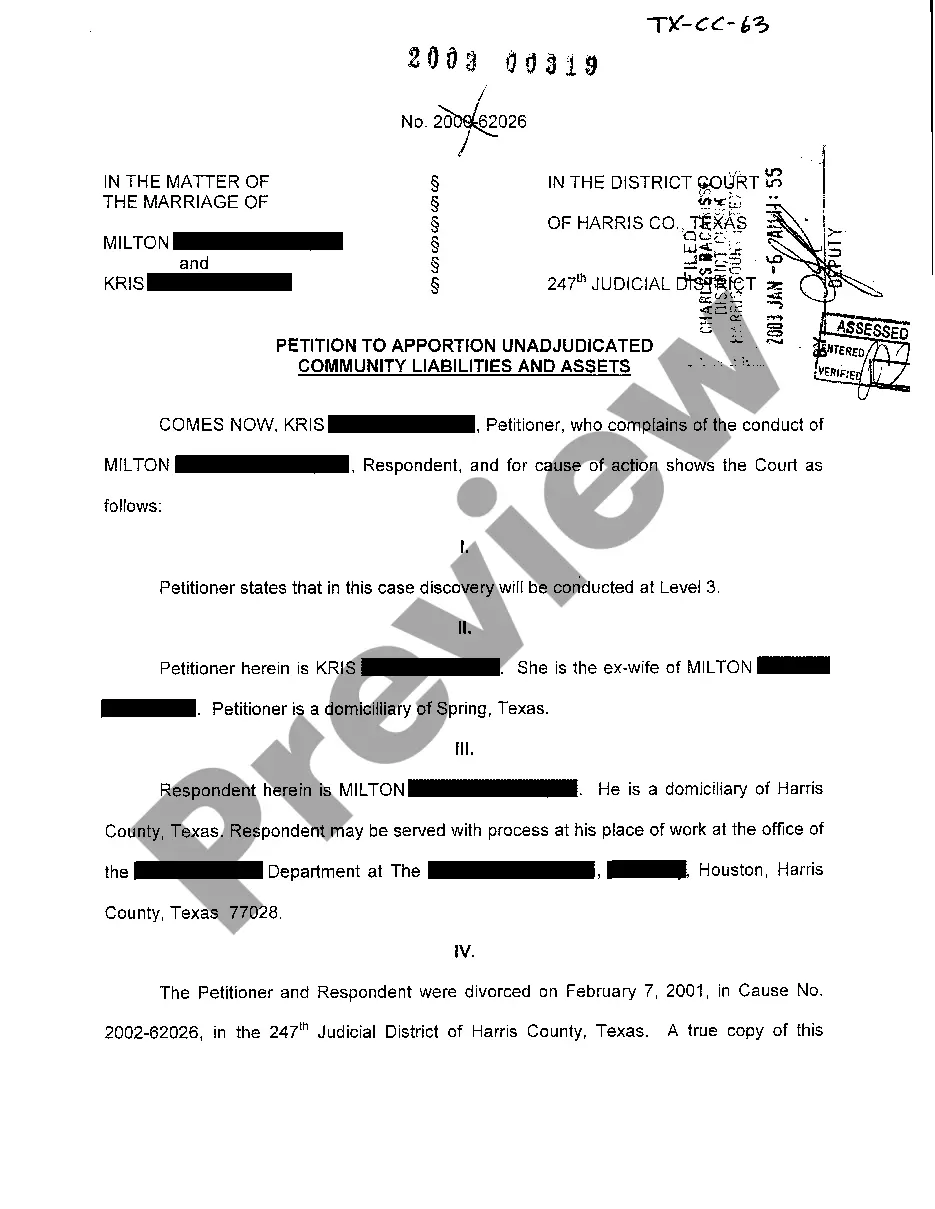

To use a Washington state community property agreement, you and your spouse or partner must agree to leave everything to each other, complete the document, and sign it in front of a notary public. When one spouse or partner dies, the survivor will become the owner of the deceased person's property, without probate.