Form with which a corporation may alter the amount of outstanding shares issued by the corporation.

Issued Shares For Cash Journal Entry In Orange

Description

Form popularity

FAQ

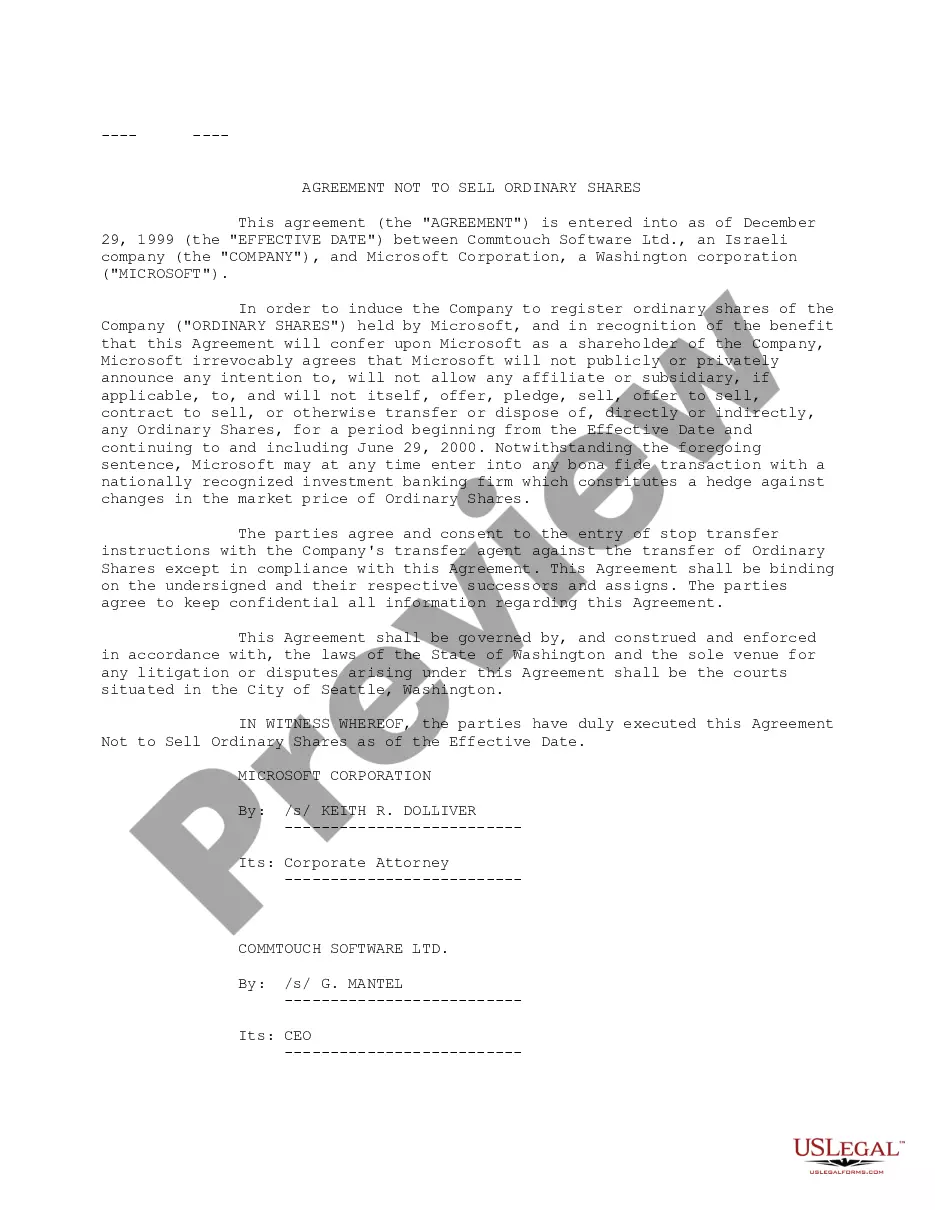

The accounting treatment of rights share is the same as that of issue of ordinary shares and the following journal entry will be made: Bank A/c To Equity shares capital A/c Dr. Bank A/c To Equity Share Capital A/c To Securities Premium A/c Dr.

The number of issued shares is recorded on a company's balance sheet as capital stock or owners' equity, while the shares outstanding (issued shares minus any shares in the treasury) are listed on the company's quarterly filings with the Securities and Exchange Commission.

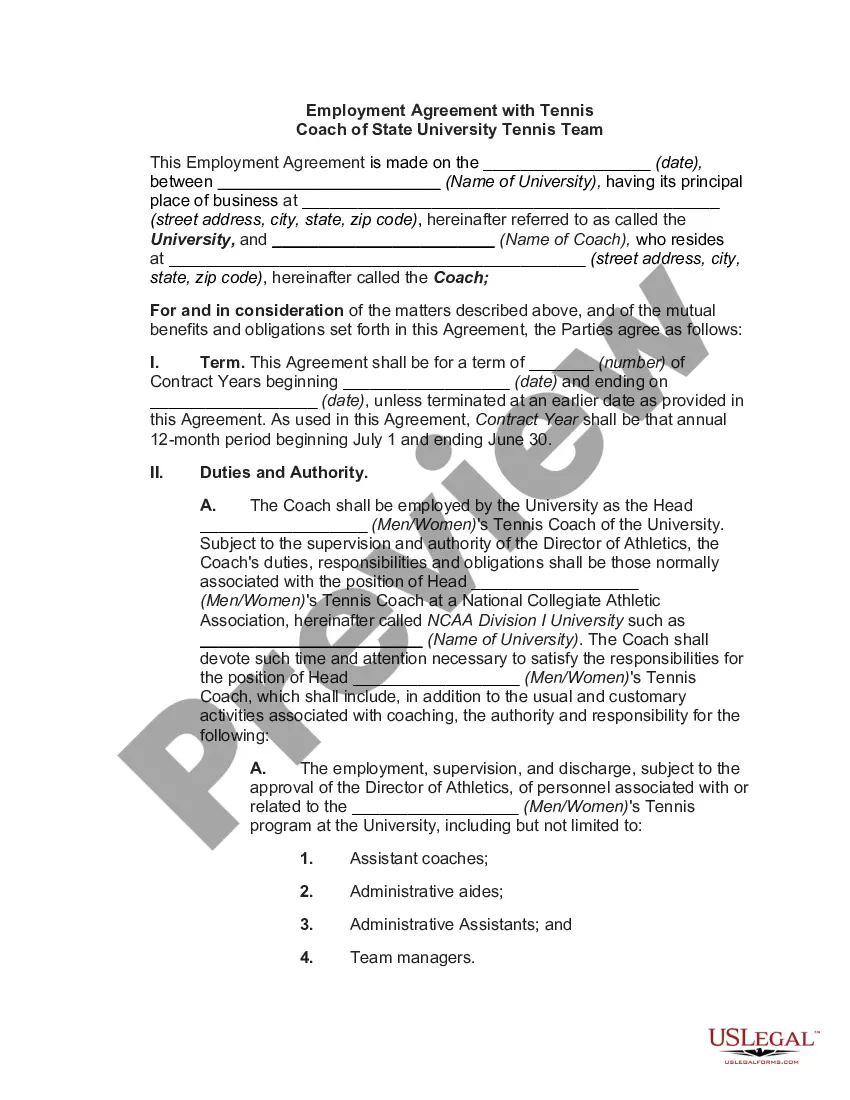

On the other hand we credit common stock to record the increase in the company's Equity. This meansMoreOn the other hand we credit common stock to record the increase in the company's Equity. This means that the company now has more funds available to invest in its operations.

Accounting for issue of shares depends upon the type of subscription. Whenever a company decides to issue shares to public, it invites applications for subscription by issuing a prospectus. It is not necessary that company receives applications for the number of shares to be issued by it.

The number of issued shares is recorded on a company's balance sheet as capital stock or owners' equity, while the shares outstanding (issued shares minus any shares in the treasury) are listed on the company's quarterly filings with the Securities and Exchange Commission.

Issue of Shares at Par means to issue the shares for an amount equal to the face value of shares. For example, if the face value of shares is ₹20 each and they are issued at ₹20 each, then it will be Issue of Shares at Par.