This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter To Close Trustee Accounting For Beneficiary In Bronx

Description

Form popularity

FAQ

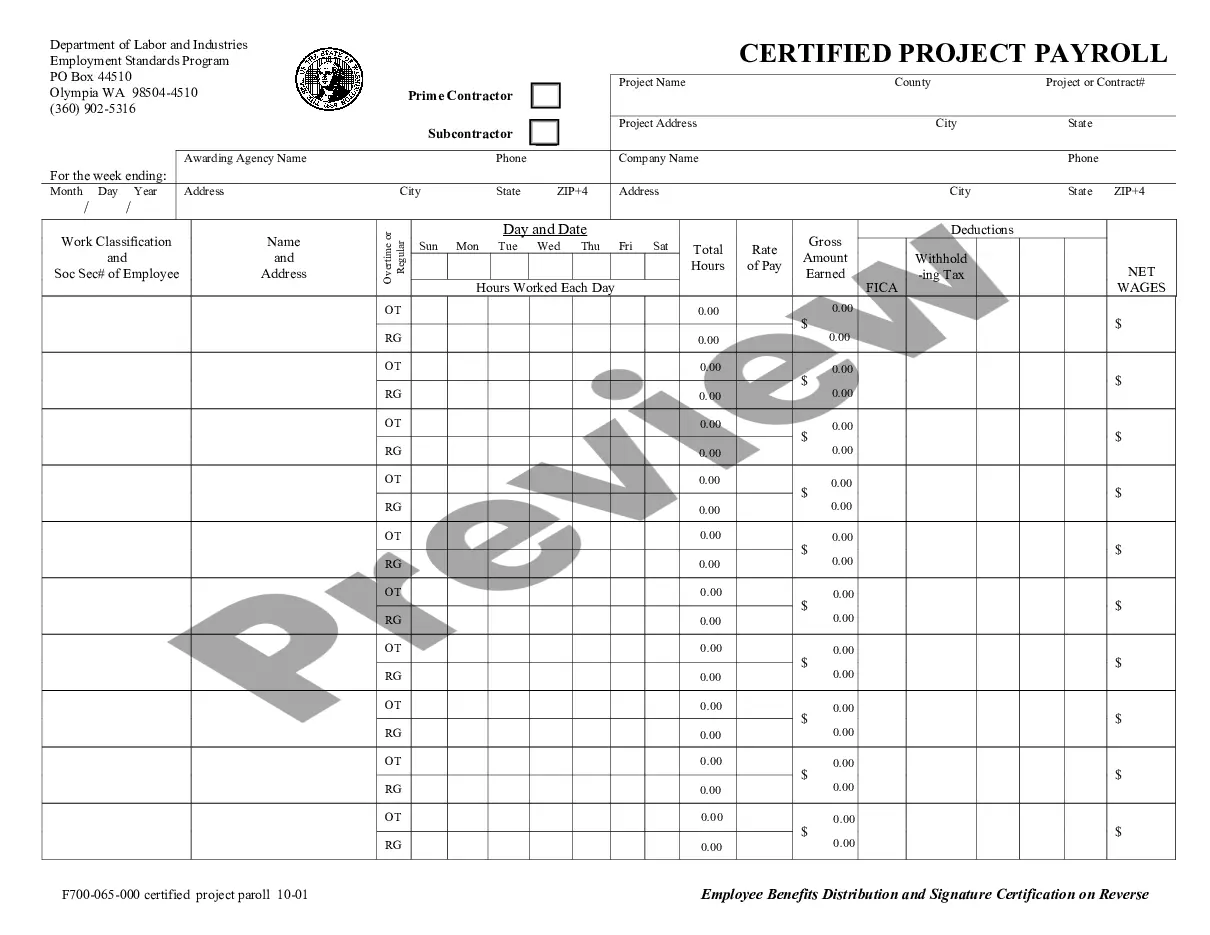

How Do I Prepare an Accounting? Gather Financial Documents: Collect all relevant financial records, including bank statements, receipts, and invoices. Track Transactions: Record all transactions related to the estate, including income, expenses, and distributions.

Steps To Prepare Final Accounts Gathering Financial Data: Recording Transactions In The Journal: Posting Entries To The Ledger: Preparing The Trial Balance: Making Adjusting Entries: Preparing The Adjusted Trial Balance: Preparing The Trading Account: Preparing The Profit And Loss Account:

California statutory law requires a trustee to account annually to current trust beneficiaries, i.e., those who are currently entitled to receive distributions of income and principal during the accounting period. Any trustee, other than the settlor(s) who established the trust, has a duty to account.

Dear Beneficiary, I am writing to inform you about the distribution of assets from the estate of Mary Johnson, who passed away on March 15, 2023. My name is the appointed executor of Mary's estate. Assets and Liabilities: List all assets and liabilities, providing a clear picture of the estate.

Steps to Prepare Final Accounting Gather Financial Records: Maintain Accurate Records: Prepare the Report: Review and Submit: Distribute Remaining Assets:

How Do I Prepare an Accounting? Gather Financial Documents: Collect all relevant financial records, including bank statements, receipts, and invoices. Track Transactions: Record all transactions related to the estate, including income, expenses, and distributions.

If you can provide evidence in your court petition that the trustee is refusing to give accounting, and thus, has committed a breach of trust, the court is likely to grant your petition to compel the trustee to produce an accounting. In the petition, you can also seek reimbursement of your attorney fees and costs.

A letter, directly to the trustee, making a demand for an accounting is the first step. In some instances, in addition to making a demand for an accounting of the financial assets, a request for an inventory of the personal property of the decedent is also a good idea.

Upon court motion: Beneficiaries can petition the court for a formal accounting; if the court grants the petition, the executor must provide one.

Per California probate code sections 16060 and 16062, trustees must: Keep beneficiaries 'reasonably' informed about how they manage the trust. Provide an accounting at least once annually. Provide an accounting at the termination of a trust or when a trustee changes.