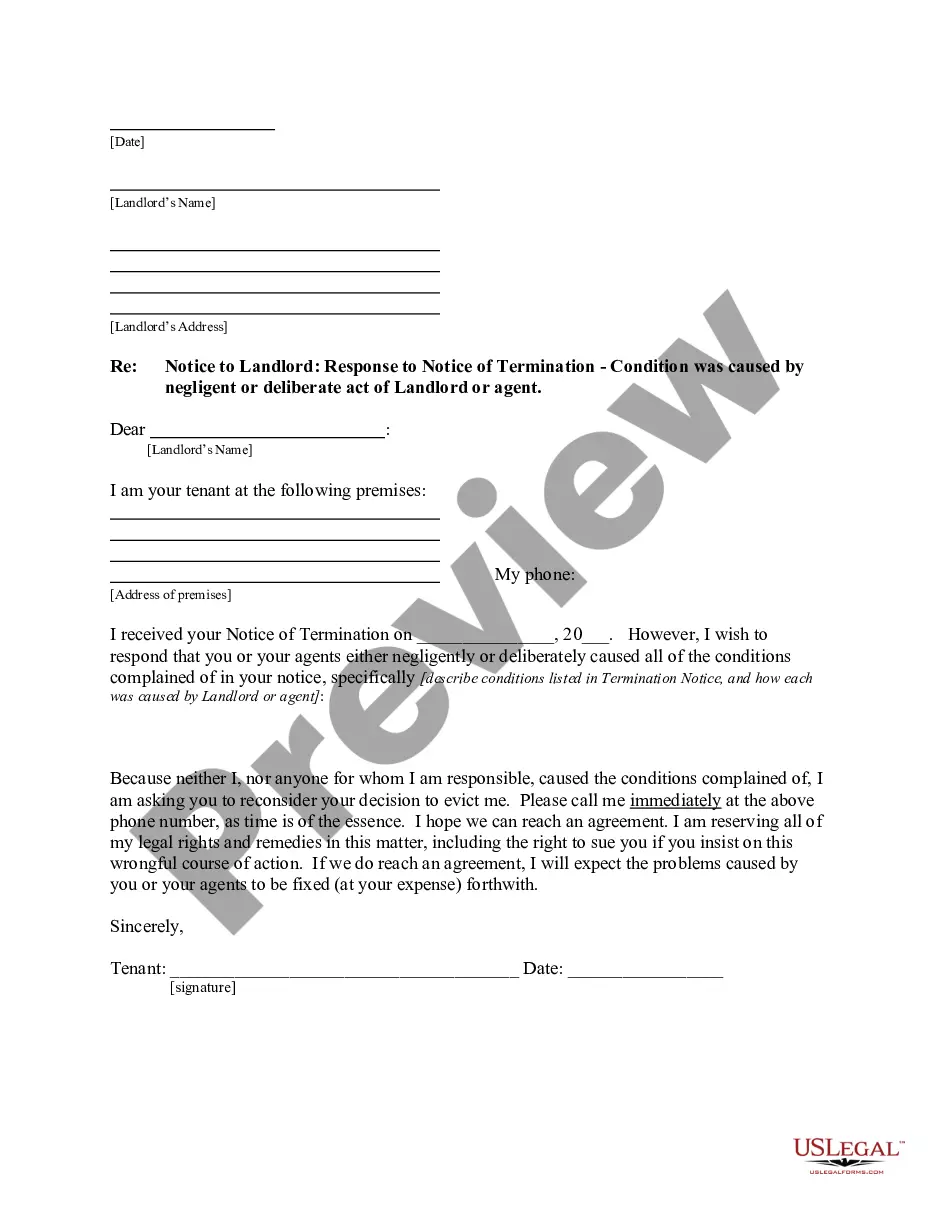

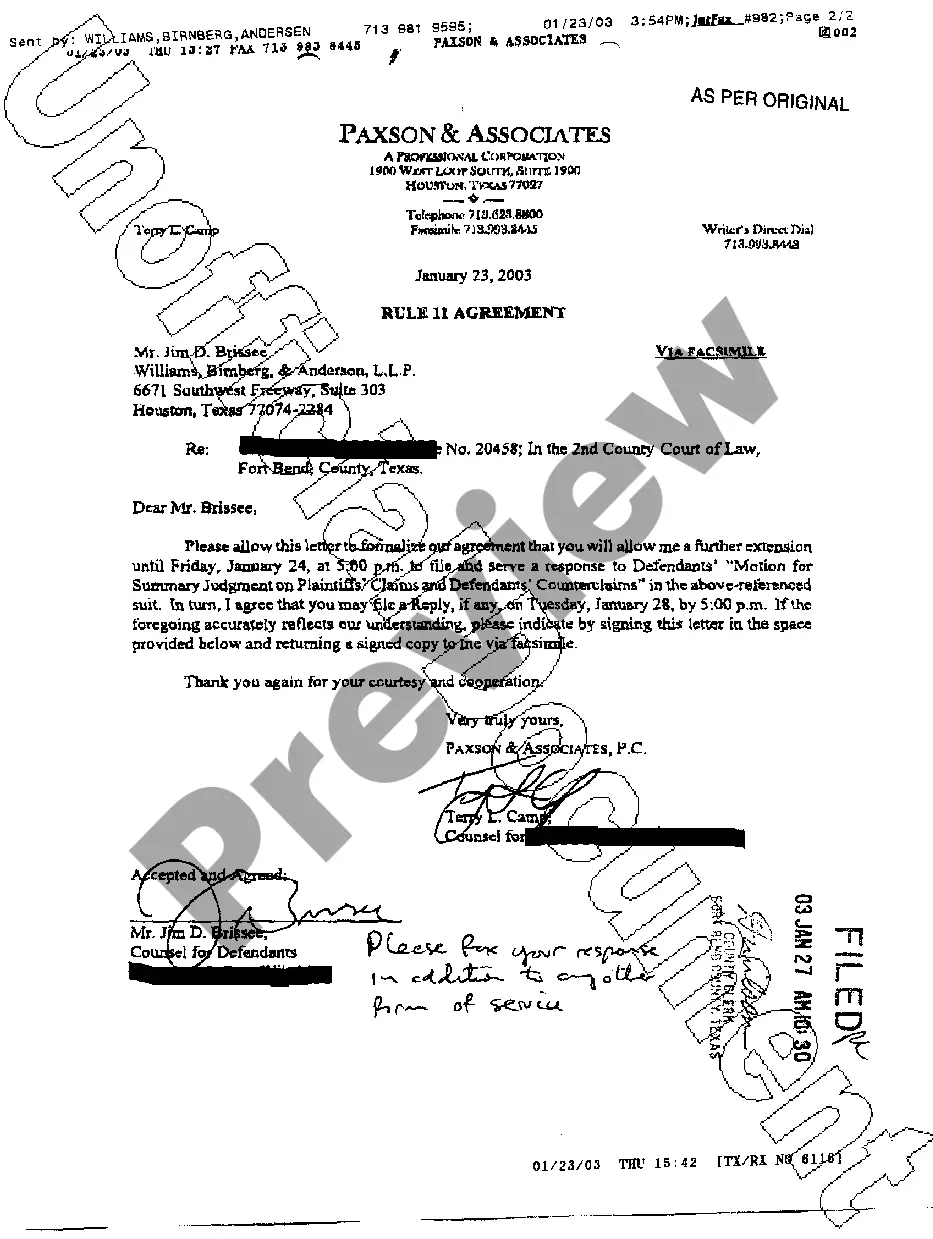

This form is a sample letter in Word format covering the subject matter of the title of the form.

Account Estate Bank With In Chicago

Description

Form popularity

FAQ

The best banks to open an estate account As for some of the best banks for opening an estate checking account, the following are some popular choices: Estate Services. Charles Schwab's Schwab One® Estate Account.

Any bank can handle an estate account. It isn't exactly rocket science, the main difference being the signer on the account was court-approved. Pick your favorite bank and go there.

Once you've been appointed executor or personal representative by the probate court, you'll probably want to open a bank account in the name of the estate. Usually, an account for an estate is registered in this or a similar way: "Estate of Gerald S. Smith, Deceased, Pamela S. Smith, executor."

You will need to provide documentation to prove both that the account holder died and you have the legal authority (as a designated beneficiary, joint account holder or executor/administrator) to access the account.

The first step to opening an estate account is to be appointed by the court as the estate's personal representative. If there is a will, the person named in the will to serve as executor will typically file a petition to admit the will to probate.

It's best to open an estate account with the decedent's bank in the state where they lived.

Just make an appointment at your local financial center and an associate will be happy to assist you. You'll need to provide your probate document and the EIN number to establish the account. These items may take additional time to resolve and/or require more documentation.

Just make an appointment at your local financial center and an associate will be happy to assist you. You'll need to provide your probate document and the EIN number to establish the account. These items may take additional time to resolve and/or require more documentation.