Letter To Close Account After Death Without Will In Clark

Description

Form popularity

FAQ

Respected Sir/Madam, I am writing to you with a heavy heart to inform you of the demise of my husband, Mr. Rajeev Singh, who had a savings account in your esteemed bank. It is a difficult time for our family, and I need to settle his financial affairs.

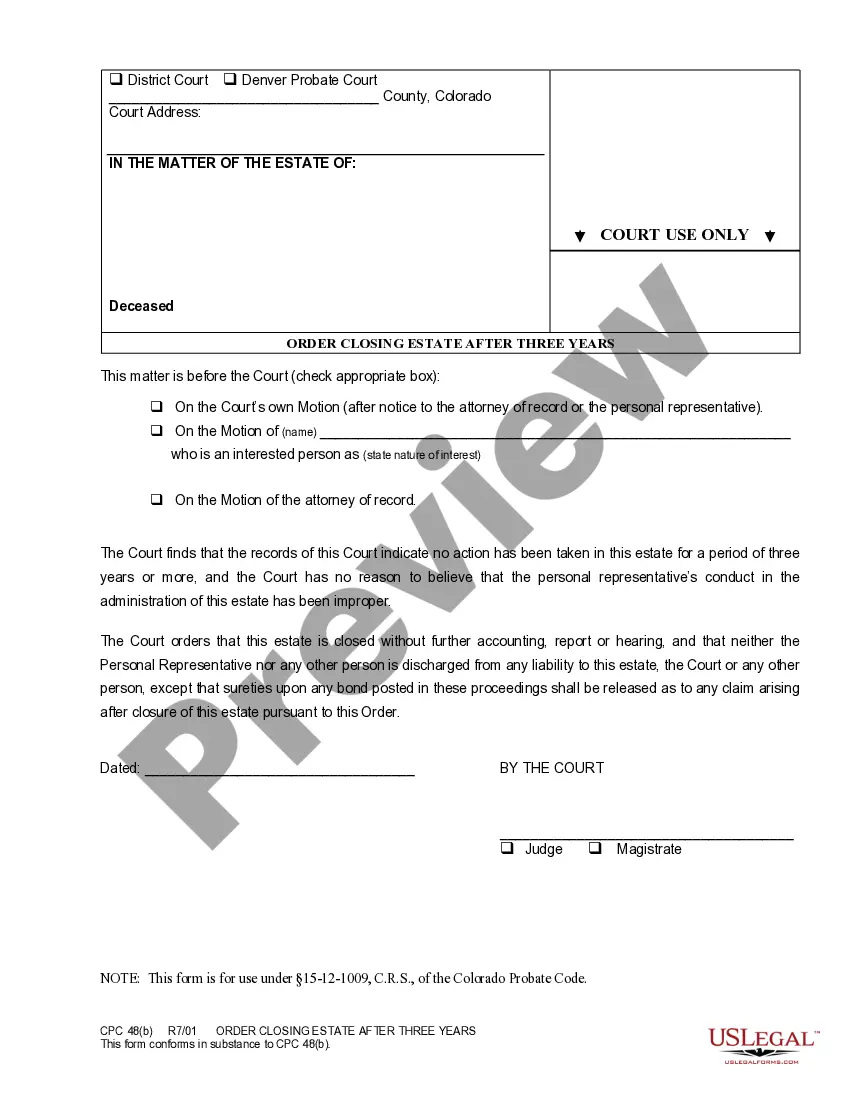

If there's no will or no executor named in the will: If there is no will or the person who should handle the estate is not named in the will, a relative or legal representative must request permission from the probate court to close the account.

If there's no will, the bank could ask for evidence of your relationship to the deceased. You'll also need the death certificate. When you've registered the death, you will be issued with a death certificate. This will act as formal notification for the bank to begin closing the account.

In California, an account holder should complete a Totten trust document. A Totten Trust is a payable-on-death account with a named beneficiary. When the account owner dies, the contents of the Totten Trust automatically pass to the beneficiary.