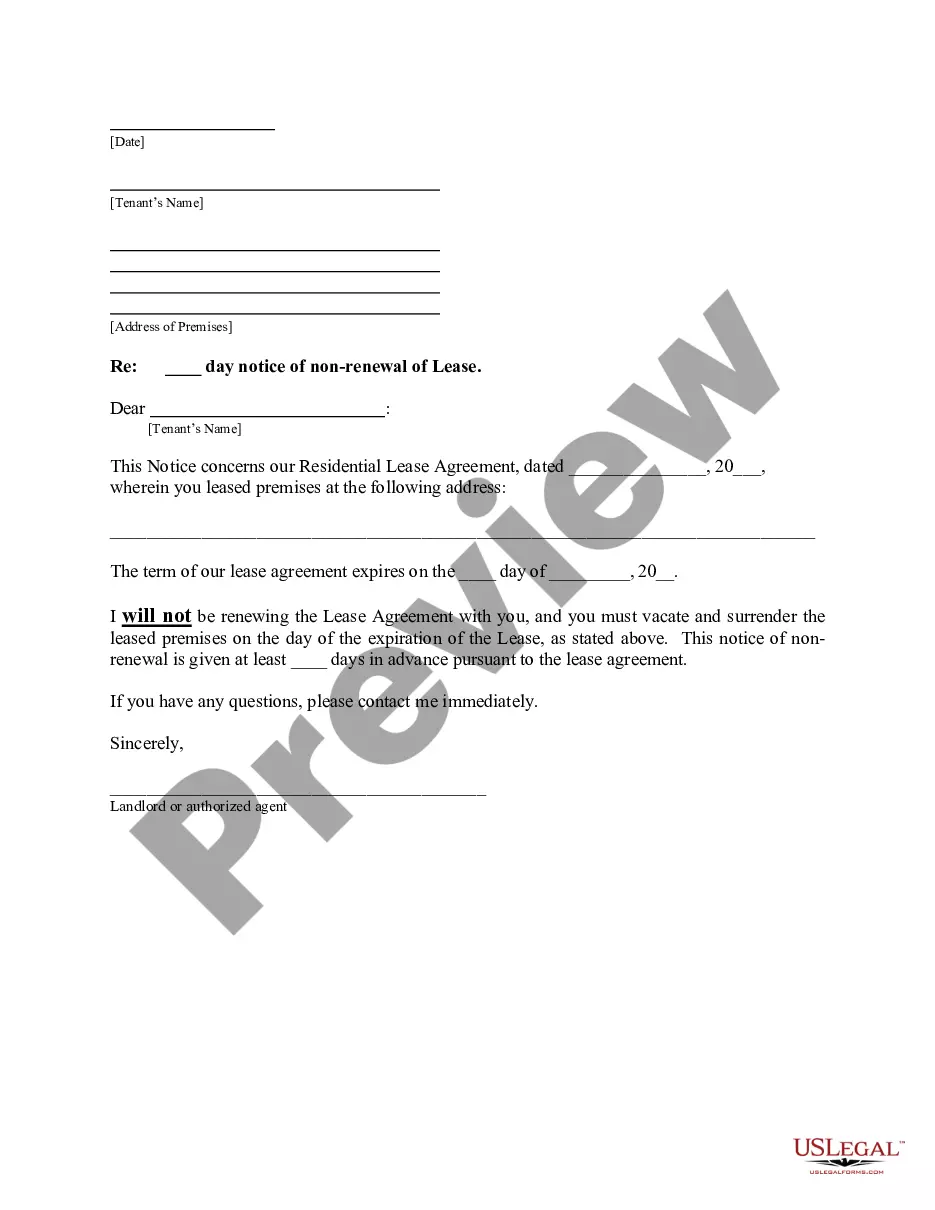

This form is a sample letter in Word format covering the subject matter of the title of the form.

Next Of Kin Letter To Bank For Death In Dallas

Description

Form popularity

FAQ

The next of kin must notify their banks of the death when an account holder dies. This is usually done by delivering a certified copy of the death certificate to the bank, along with the deceased's name and Social Security number, bank account numbers, and other information.

Banks typically don't ask account holders to designate a beneficiary. Rather, they must request to add a beneficiary and fill out a beneficiary designation form provided by the bank.

After receiving notification of an account holder's death, a bank will take prompt steps to secure the assets. For an account owned by a single individual, this typically includes: Account status review: The bank reviews the account to confirm its ownership status and determine whether it has a beneficiary designation.

The bank is likely to ask for two forms of your identification (usually a passport or driver's licence, or a proof of address with a utility bill) and a copy of the will. If there's no will, the bank could ask for evidence of your relationship to the deceased. You'll also need the death certificate.

The bank is likely to ask for two forms of your identification (usually a passport or driver's licence, or a proof of address with a utility bill) and a copy of the will. If there's no will, the bank could ask for evidence of your relationship to the deceased. You'll also need the death certificate.

In Texas, your bank accounts could be subject to probate, or they might bypass the process entirely if you've made the right arrangements. If you've named a beneficiary or set up a Payable-on-Death (POD) account, those funds can often be transferred directly to your heirs without going through probate.

There is no form. Find his birth certificate and/or his death certificate. You can be stated on that death certificate as his next of kin.