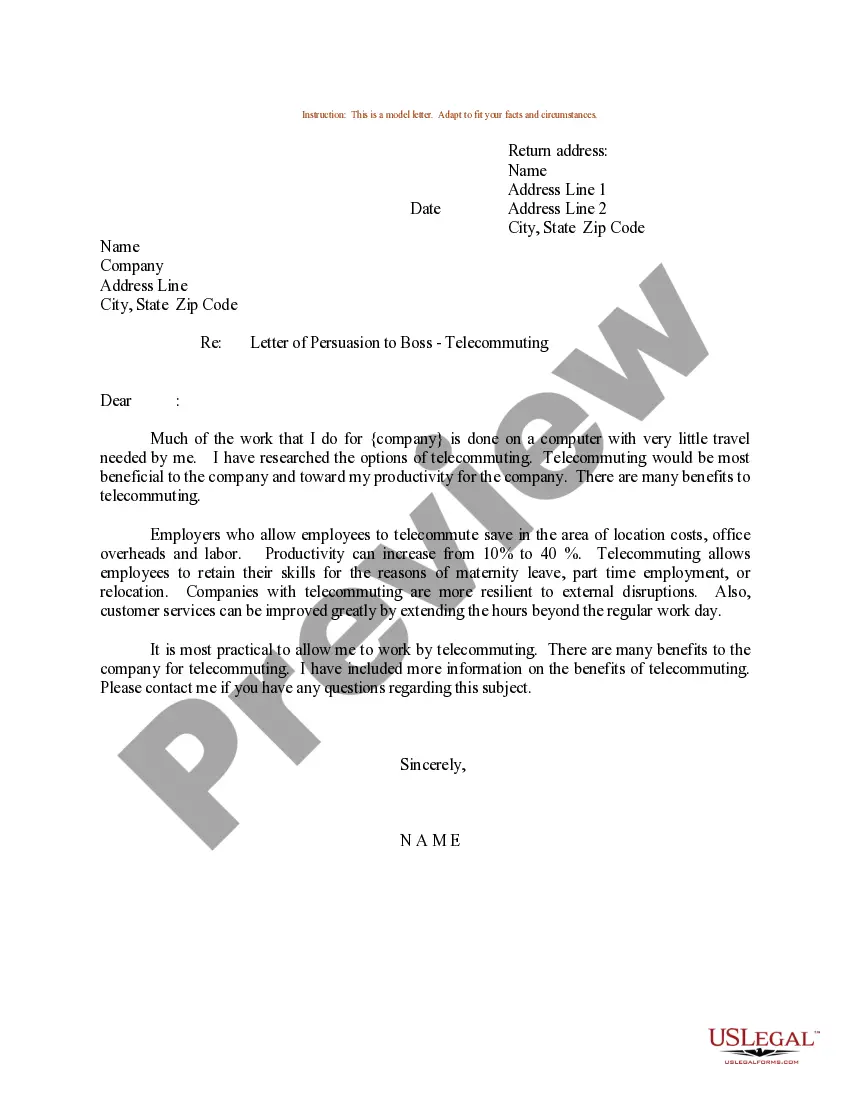

This form is a sample letter in Word format covering the subject matter of the title of the form.

Next Of Kin Letter To Bank With Deceased Person In King

Description

Form popularity

FAQ

The bank is likely to ask for two forms of your identification (usually a passport or driver's licence, or a proof of address with a utility bill) and a copy of the will. If there's no will, the bank could ask for evidence of your relationship to the deceased. You'll also need the death certificate.

Request to add the other person to your savings or checking account. The person will provide proof of identification to the bank, along with other basic information like their birth date and Social Security number.

How to add or change a beneficiary Speak to a banker and let them know the following. Provide the beneficiary's name, date of birth, address, phone number and SSN. A form will be created with this information and mailed to you. After you get the form, review it for accuracy.

Start the letter with your introduction and the reason for writing the letter. Moreover, request the bank manager to settle the deceased account. Additionally, you have to provide details like account numbers and other documents. Signature – Use “Faithfully” or “Sincerely” as signatures and then mention your name.

Banks typically don't ask account holders to designate a beneficiary. Rather, they must request to add a beneficiary and fill out a beneficiary designation form provided by the bank.

Proving next of kin They'll need to provide an affidavit, which is a notarized legal document that establishes their relationship. Once this is complete, the next of kin will receive a letter of testamentary from the probate court.

To add a beneficiary to a bank account, you will need to fill out a type of document known as a beneficiary designation form or a Totten trust, which you generally can obtain from your bank directly or online from the website for your bank. Once you've completed the paperwork, you must submit it to your bank.

While it can vary by state, the next of kin order is generally: Your spouse. Your children and grandchildren (both biological and adopted) Your parents. Your siblings (some states prioritize full siblings over half-siblings, while other states consider them both equally)

When a person passes away, their assets are distributed in ance with either their estate plan or California's intestate succession laws. However, certain assets, including most bank accounts, can pass directly to beneficiaries, without the need for probate or the court's intervention.

NEXT OF KIN DETAILS Your name Date of Birth Your contact details Next of Kin Name/s Relationship to You Address of Next of Kin Contact details of next of kin Date of Form