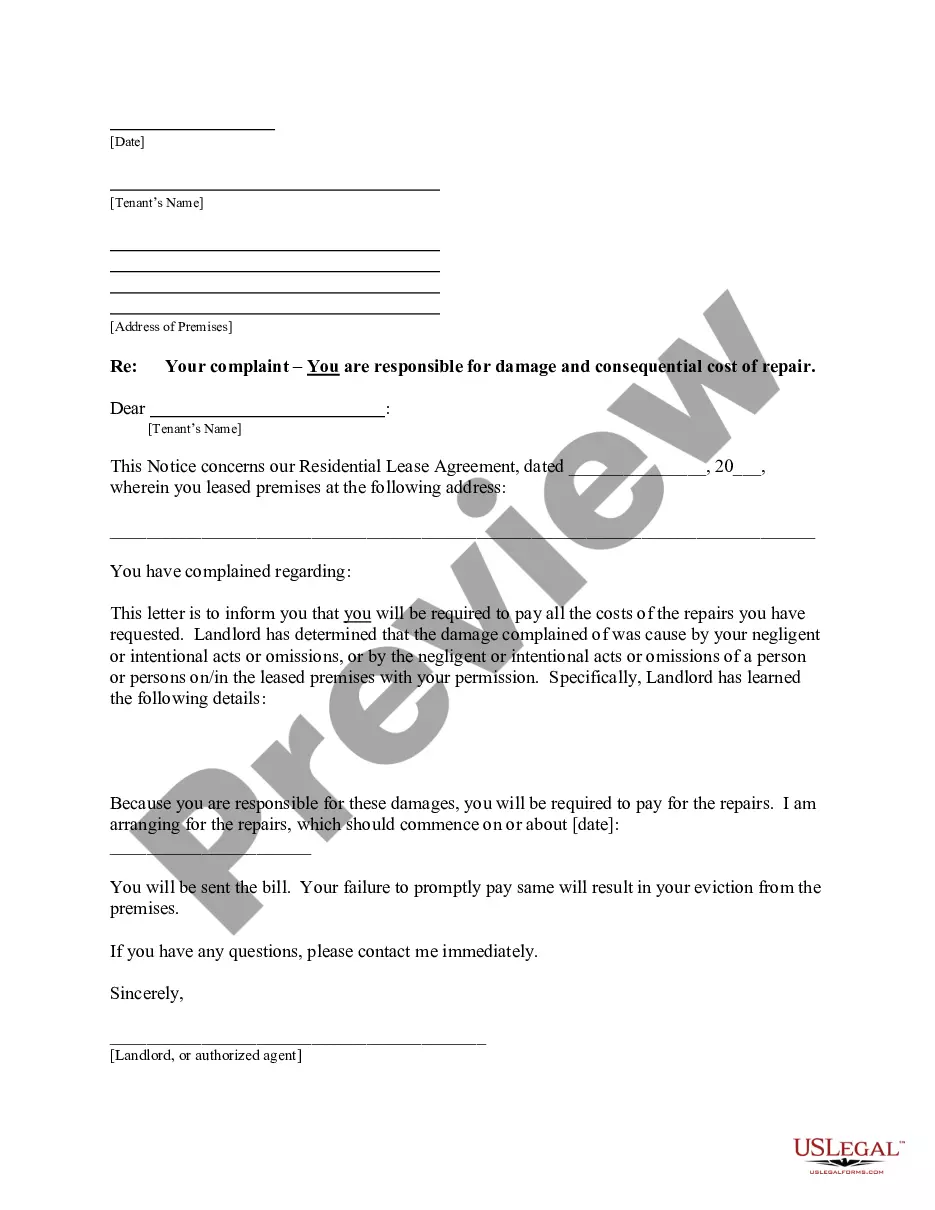

This form is a sample letter in Word format covering the subject matter of the title of the form.

Next Of Kin Letter To Bank For Death In Maryland

Description

Form popularity

FAQ

What Not to Do When Someone Dies: 10 Common Mistakes Not Obtaining Multiple Copies of the Death Certificate. 2- Delaying Notification of Death. 3- Not Knowing About a Preplan for Funeral Expenses. 4- Not Understanding the Crucial Role a Funeral Director Plays. 5- Letting Others Pressure You Into Bad Decisions.

If the account holder established someone as a beneficiary, the bank releases the funds to the named person once it learns of the account holder's death. After that, the financial institution typically closes the account. If the owner of the account didn't name a beneficiary, the process can be more complicated.

Your valid ID, such as a state-issued driver's license or ID card, U.S. passport, or military ID. Proof of death, such as certified copies of the death certificate. Documentation about the account and its owner, including the deceased's full legal name, Social Security number, and the bank account number.

If there's a will without a named executor, the court will issue a Letter of Testamentary; if there's no will, the court will issue a Letter of Administration. Present either of these letters to the bank along with the death certificate to close the account.

Family members or next of kin generally notify the bank when a client passes. It can also be someone who was appointed by a court to handle the deceased's financial affairs. There are also times when the bank learns of a client's passing through probate.

When a person passes away, their assets are distributed in ance with either their estate plan or California's intestate succession laws. However, certain assets, including most bank accounts, can pass directly to beneficiaries, without the need for probate or the court's intervention.

If a person has named beneficiaries for their financial accounts or life insurance policies, those designations will generally override any claim made by next of kin.

To fill out this affidavit, begin by providing your personal information and details about the deceased. Ensure you have all required documents that prove your relationship to the decedent. Lastly, complete the sections regarding the next of kin and sign before a notary public.

Regardless of what your will says, whoever is named as the designated beneficiary on each account will receive that asset.