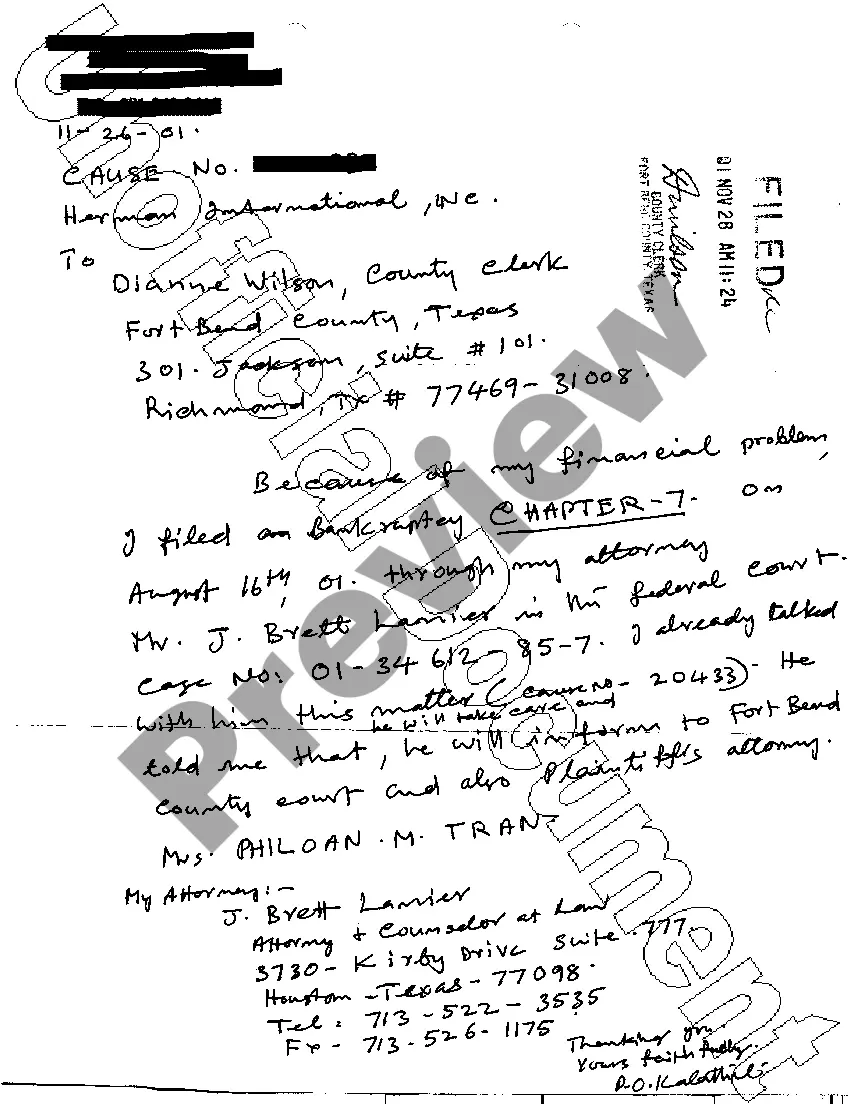

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Of Instruction To Bank After Death For Funeral In Miami-Dade

Description

Form popularity

FAQ

Basic Contents of a Letter of Instruction Firstly, it contains personal information, such as the executor's names and contact details. Secondly, it goes into specifics about the deceased's assets, delineating bank accounts, safety deposit boxes, and real estate properties, among other assets.

Estate Plan Letter of Instruction. Dear ______________ (Executor, Agent, Trustee, Loved One, Etc.) I am writing this letter to provide you with important information you will need to know in the event of my incapacity or death. Please refer to this letter for assistance as you deal with my affairs.

7 elements to include in your letter of last instruction Contact information. Legal form, document, and property locations. Personal and financial passwords. Beneficiary information. Guidance for pets. Funeral or memorial service wishes. Legal and financial information and wishes.

A letter of instruction is a document that lists all of your important financial account information in one place. This important estate planning document is intended to help your family members (or executors) if something happens to you.

A letter of instruction is an informal letter to an executor, personal representative, and/or other family members that provides important information about your assets and final wishes after death.

It's a good way to let to those trusted to take care of your affairs know what you would want them to know. Since the letter of instruction is not a legal document, it does not need to be notarized or signed in the presence of witnesses or with any other special formality.

A letter of instruction is an informal letter to an executor, personal representative, and/or other family members that provides important information about your assets and final wishes after death.

In order to initiate probate, a petition must be filed in the proper circuit court which would be the court in the county in which the decedent resided at the time of his (or her) death, or I the county where the decedent owned property. If the decedent had a will, the will must be filed along with the petition.

If an asset does not have a named beneficiary or rights of survivorship, it will have to go through probate to change ownership pursuant to the Florida Probate Rules (2024). The most common assets that go through this process are bank accounts, real estate, vehicles, and personal property.