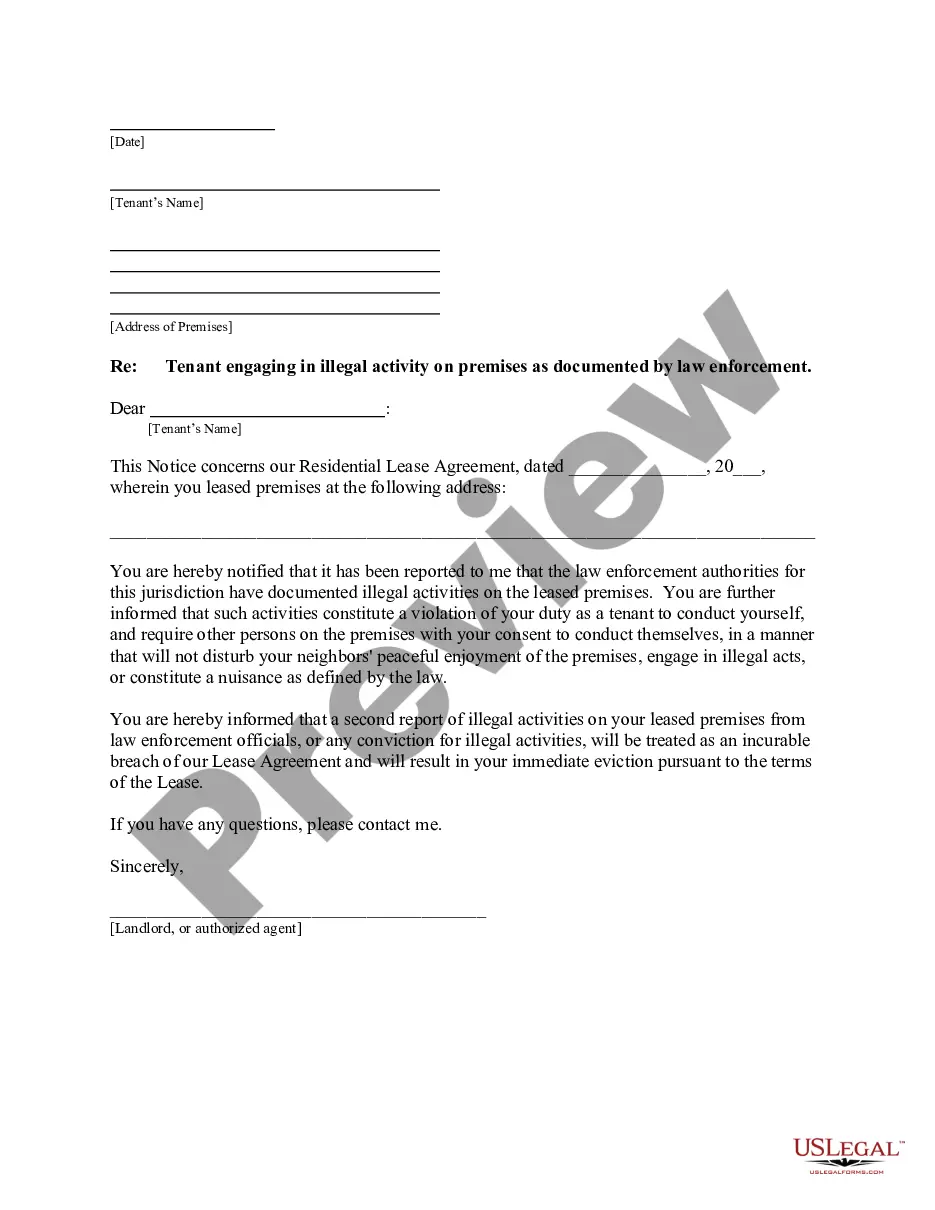

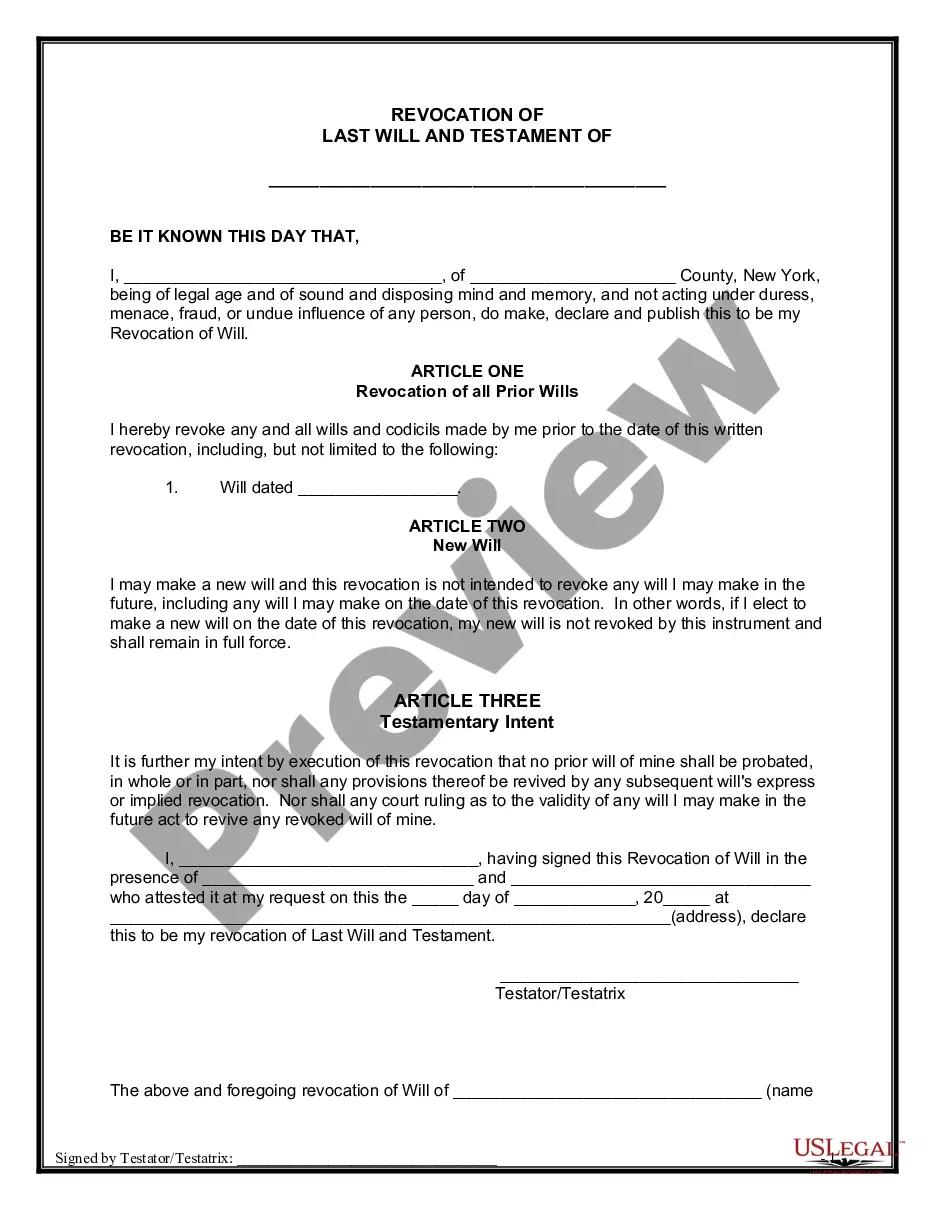

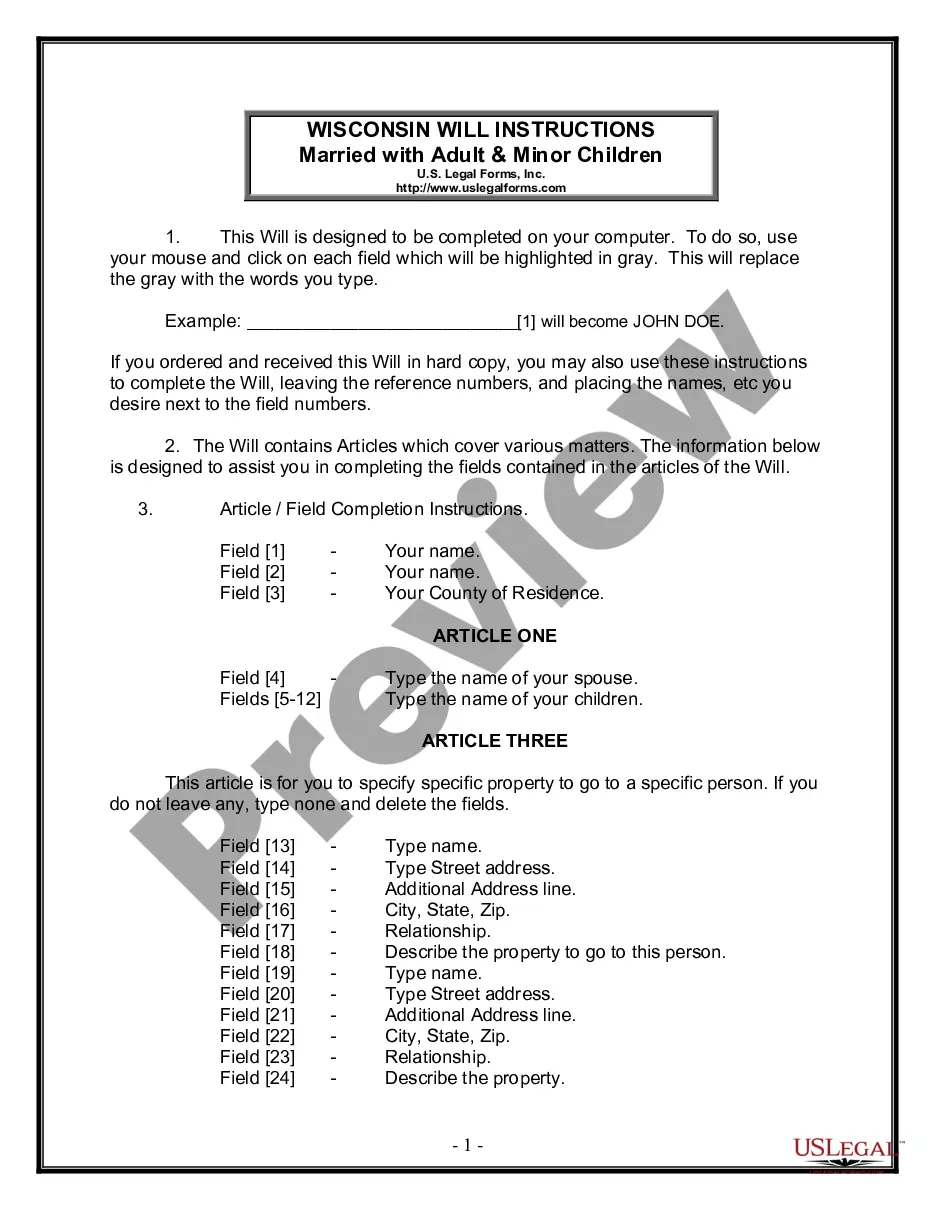

This form is a sample letter in Word format covering the subject matter of the title of the form.

Next Of Kin Letter To Bank With Bank In Miami-Dade

Description

Form popularity

FAQ

The bank account will go to the named beneficiary of the account or of your will.

There is no form. Find his birth certificate and/or his death certificate. You can be stated on that death certificate as his next of kin.

Under Florida law if a decedent does not leave a valid will, then his estate will go to his legal heirs. Generally, a decedent's next of kin is his or her surviving spouse and children.

To add a beneficiary to a bank account, you will need to fill out a type of document known as a beneficiary designation form or a Totten trust, which you generally can obtain from your bank directly or online from the website for your bank. Once you've completed the paperwork, you must submit it to your bank.

Please note that “next of kin” is defined as “those persons who would be heirs at law of the ward or alleged incapacitated person if the person were deceased and includes the lineal descendants of the ward or alleged incapacitated person”. §744.102(14).

Proving next of kin To establish their legal rights and begin planning the next steps, next of kin must prove their relationship to the deceased. They'll need to provide an affidavit, which is a notarized legal document that establishes their relationship.

Florida Next of Kin Law – Intestate Succession To the descendants of the decedent. If there is no descendant, to the decedent's father and mother equally, or to the survivor of them. If there is none of the foregoing, to the decedent's brothers and sisters and the descendants of deceased brothers and sisters”