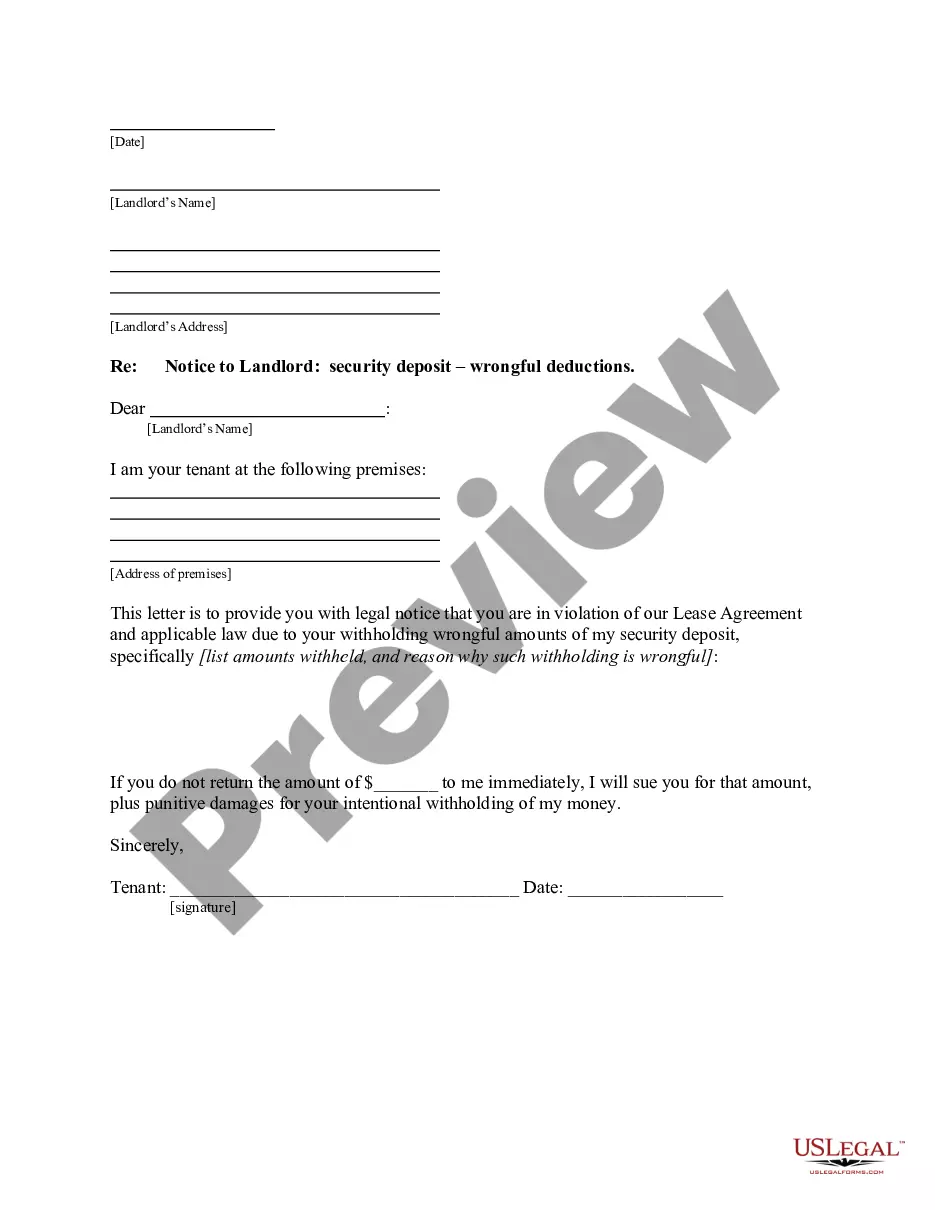

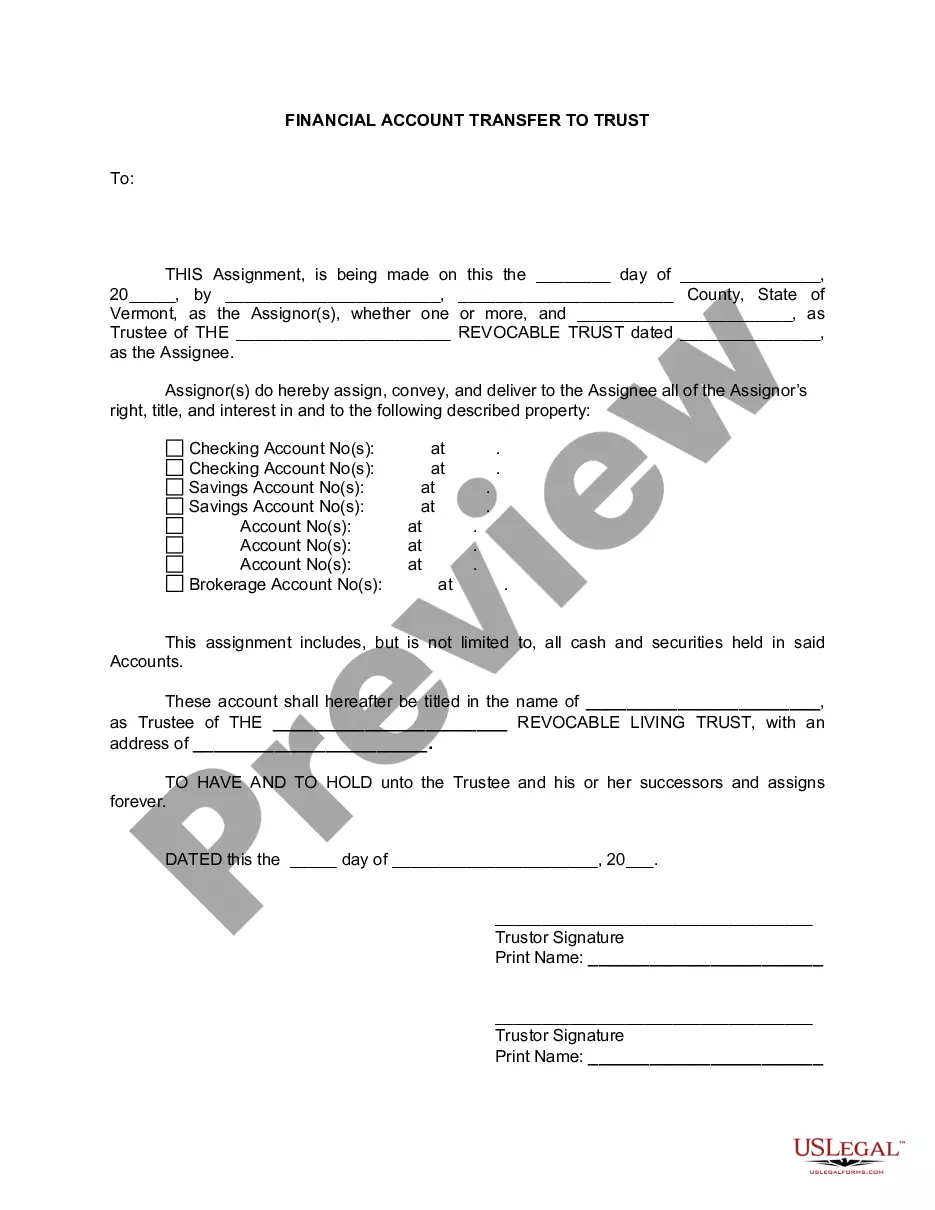

This form is a sample letter in Word format covering the subject matter of the title of the form.

Decedent Account Bank Fort Collins In Montgomery

Description

Form popularity

FAQ

The executor of the estate needs to follow these basic steps. Step 1: Begin the probate process. Step 2: Obtain a tax ID number for the estate account. Step 3: Bring all required documents to the bank. Step 4: Open the estate account.

Visit Banks in Their Area You will need to provide documentation to prove both that the account holder died and you have the legal authority (as a designated beneficiary, joint account holder or executor/administrator) to access the account.

Who can access and close the deceased's bank account? The executor named in the will can do this, or if no executor has been nominated, the administrator (main beneficiary). They'll contact the bank in question with proof of death to begin the process. The Death Certificate is typically accepted as proof.

In these cases, simply visit the bank with a valid ID and a certified copy of the death certificate. You will then have access to the account, allowing you to withdraw the funds as needed.

Six Steps of the Probate Process Step 1: File a petition to begin probate. You'll have to file a request in the county where the deceased person lived at the time of their death. Step 2: Give notice. Step 3: Inventory assets. Step 4: Handle bills and debts. Step 5: Distribute remaining assets. Step 6: Close the estate.

How to open an estate account Step 1: Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. Step 2: Obtain a tax ID number for the estate account. Step 3: Bring all required documents to the bank. Step 4: Open the estate account.

The death certificate gives us the information needed to verify the identity and legal residence of our customer as well as confirm date of death. Other legal documents. We may require additional documents such as a last will and testament, formal trust, birth or marriage certificate, or proof of legal name change.

Once you've been appointed as the personal representative of a loved one's estate, you should open an estate checking account. An estate checking account serves as a temporary account to manage the estate's financial affairs.

It's best to open an estate account with the decedent's bank in the state where they lived.

When a bank account owner dies, the process is fairly straightforward if the account has a joint owner or beneficiary. Otherwise, the account typically becomes part of the owner's estate or is eventually turned over to the state government and the disbursement of funds is handled in probate court.