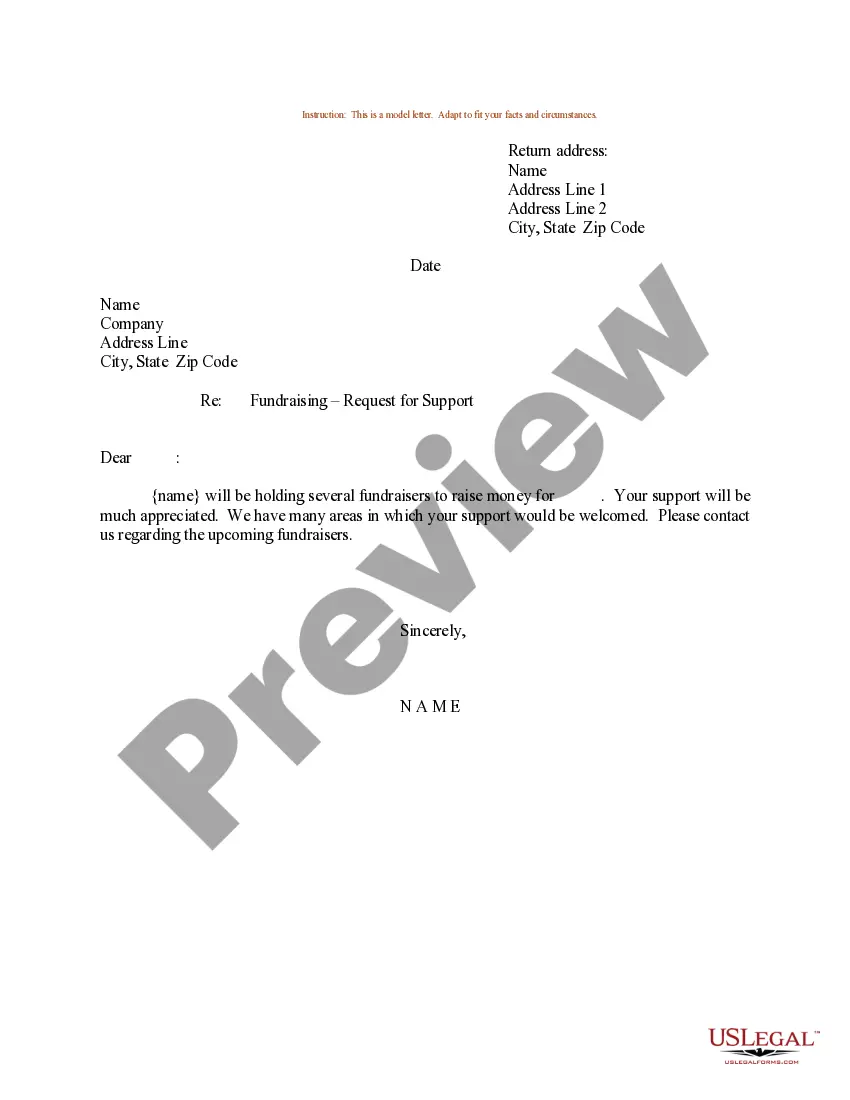

This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter To Close Trust Account With The Same Email In Ohio

Description

Form popularity

FAQ

Under section 5804.11(B) of the Code, “a noncharitable irrevocable trust may be terminated upon consent of all of the beneficiaries if the court concludes that continuance of the trust is not necessary to achieve any material purpose of the trust.” Because such a termination cannot occur Page 4 3 unless the court so ...

There are four main approaches: Vesting. The easiest way to dissolve a trust is to have a vesting date. Revoked. A trust may contain a provision which allows for the trustee or settlor to revoke the deed. Consent. In some instances, a trust can be dissolved upon the consent of the beneficiaries. Court Termination.

Irrevocable trusts generally end after the death of the grantor, when the trustee distributes all of the assets to the beneficiaries. The grantor can also specify an end date or a condition that must be met before the assets can be distributed.

Specifically, a trust can be terminated if all the beneficiaries consent and the court concludes that the continuance of the trust is not necessary to achieve any material purpose of the trust. Upon ordering such a termination, the court must distribute the property as agreed by the beneficiaries.

Specifically, a trust can be terminated if all the beneficiaries consent and the court concludes that the continuance of the trust is not necessary to achieve any material purpose of the trust. Upon ordering such a termination, the court must distribute the property as agreed by the beneficiaries.

Only the trustee can close the trust account. Check the bank's requirements for closing accounts to see what documentation you need to bring with you, usually personal identification and any papers you received when you first set up the trust account.

Seeking Legal Counsel The trustee should have a trust lawyer to guide them through how to dissolve a trust after the grantor's death. Your trust lawyer can help to identify any dissolving trust tax implications. A trust lawyer can help you understand can a trustee revoke a revocable trust.