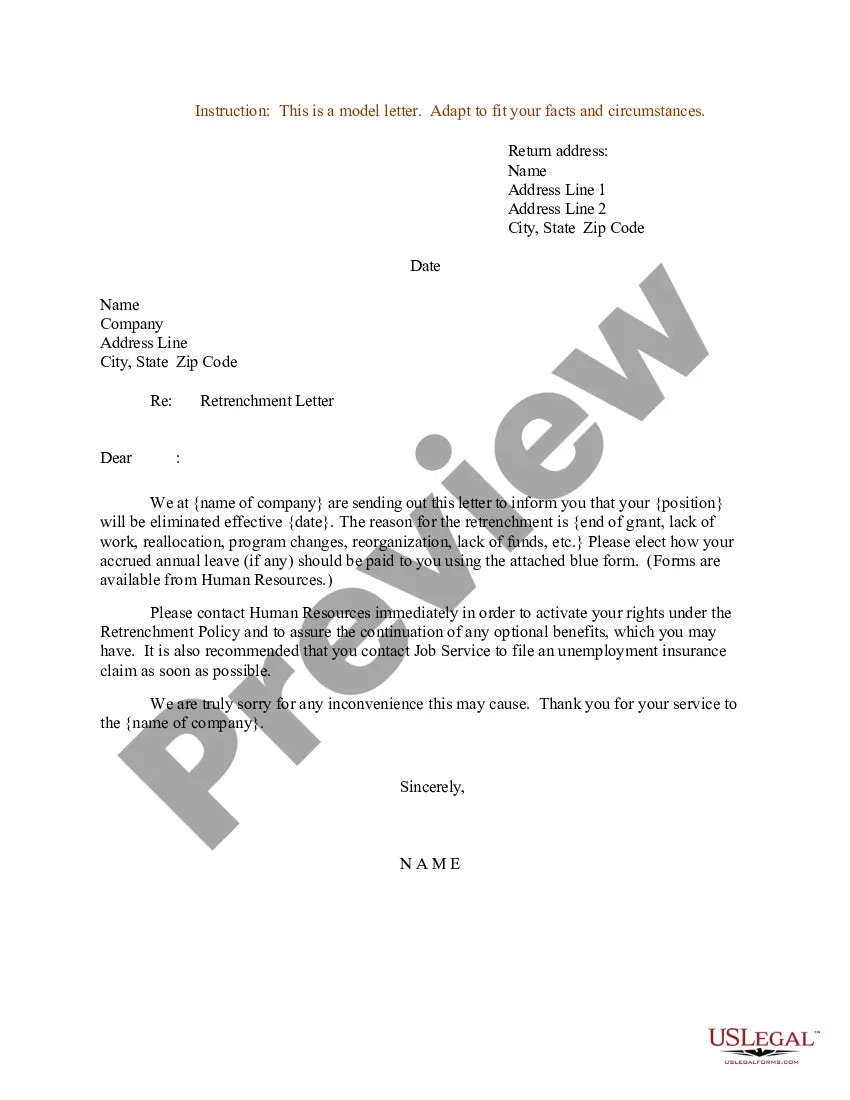

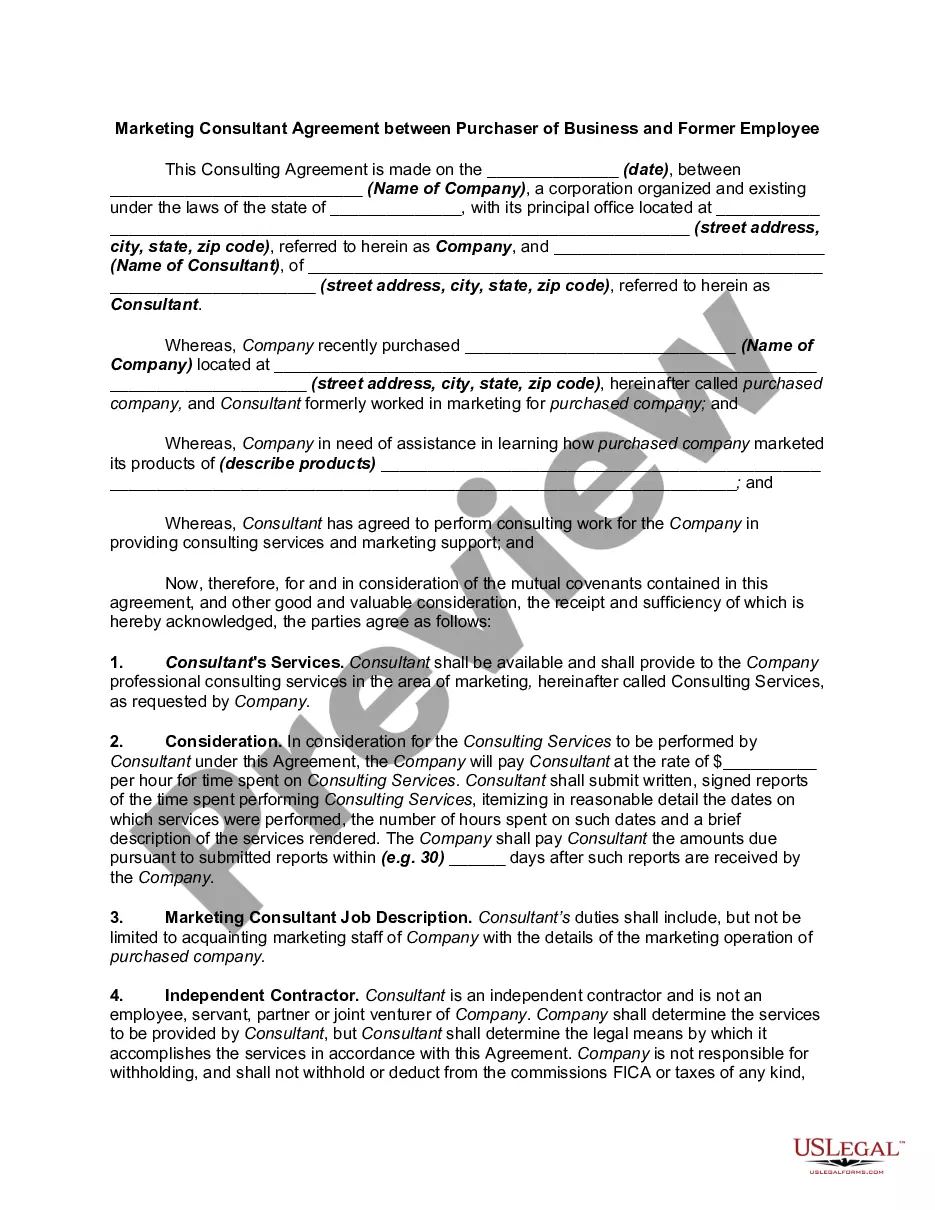

This form is a sample letter in Word format covering the subject matter of the title of the form.

Next Of Kin Letter To Bank With In Phoenix

Description

Form popularity

FAQ

Any time someone dies with more than $100,000 in real property or $75,000 in personal property, their estate must go through probate ing to Arizona probate law. Even if the person has a will, the court must still decide whether or not the will is valid.

Opening Probate While some states allow up to six years to probate an estate, the state of Arizona will only accept probate cases that are opened within two years of the decedent's passing (ARS 14-3108).

3: Financial Assets Bank accounts and brokerage accounts, business ownership interests, stocks, bonds, and other financial assets are also subject to probate. However, bank accounts, life insurance policies, and retirement accounts that have a designated beneficiary are not considered probate assets.

Once signed and notarized, the affidavits must be filed with the probate court in the county where the property is physically located. A certified copy of the death certificate and a copy of the will, if any, must be attached to each affidavit, along with title documents for real estate and other large assets.

A person's next of kin is their closest living blood relative , including spouses and adopted family members. The designation as next of kin is important in the context of intestate succession , as a decedent 's next of kin is prioritized in receiving inheritance from the decedent's estate .

Next of kin refers to a person's closest living relative(s). Individuals who count as next of kin include those with a blood relation, such as children, or those with legal standing, such as spouses or adopted children.

An heir may need a next of kin affidavit to get an inheritance. This notarized document establishes the heir's claim to estate property. Depending on the jurisdiction, this affidavit may be sufficient to legally transfer some types of property to the heir.

When a person passes away, their assets are distributed in ance with either their estate plan or California's intestate succession laws. However, certain assets, including most bank accounts, can pass directly to beneficiaries, without the need for probate or the court's intervention.

But the most common order of priority for inheritance is: Spouse or domestic partner. Children. Parents.