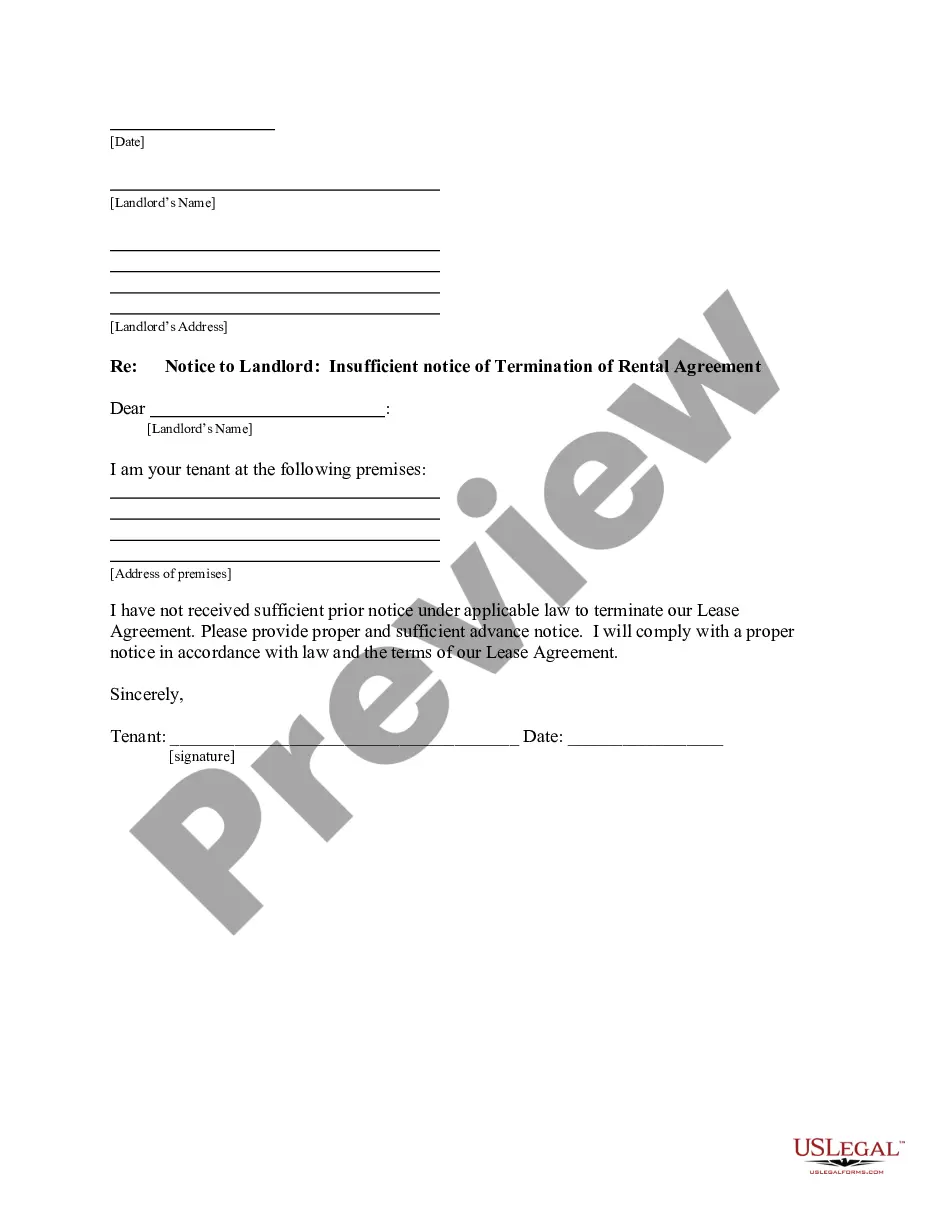

This form is a sample letter in Word format covering the subject matter of the title of the form.

Next Of Kin Letter To Bank With Spouse In San Antonio

Description

Form popularity

FAQ

Joint Bank Account Rules on Death Joint bank account holders generally have the right of survivorship, which grants the surviving account holder ownership of the entire account balance.

If your husband passed away and you are not listed on his bank account, the account will likely go through probate unless it is a joint account or has a named beneficiary. Probate is a legal process where the court oversees the distribution of assets.

In Texas, your bank accounts could be subject to probate, or they might bypass the process entirely if you've made the right arrangements. If you've named a beneficiary or set up a Payable-on-Death (POD) account, those funds can often be transferred directly to your heirs without going through probate.

No Beneficiary on Bank Account If there is no beneficiary listed on the bank account, the account typically goes through probate, and the funds will be distributed ing to the deceased's will or state laws if there is no will.

They'll need to provide an affidavit, which is a notarized legal document that establishes their relationship. Once this is complete, the next of kin will receive a letter of testamentary from the probate court. This gives them the executive powers to act on the estate's behalf.

When a person passes away, their assets are distributed in ance with either their estate plan or California's intestate succession laws. However, certain assets, including most bank accounts, can pass directly to beneficiaries, without the need for probate or the court's intervention.

To fill out this affidavit, begin by providing your personal information and details about the deceased. Ensure you have all required documents that prove your relationship to the decedent. Lastly, complete the sections regarding the next of kin and sign before a notary public.

Next of kin refers to a person's closest living relative(s). Individuals who count as next of kin include those with a blood relation, such as children, or those with legal standing, such as spouses or adopted children.

Parent, sibling, child, spouse, uncle-these are all examples of next of kin. If you want to specify someone to act on your behalf legally there is paperwork that you must complete. You can get these documents from your doctor, lawyer or even a hospital.

Your closest relatives are your next of kin. You might describe your parents as your next of kin. You can use the phrase next of kin to describe your family members, especially those who are closely related to you, like your children, spouse, siblings, or parents.