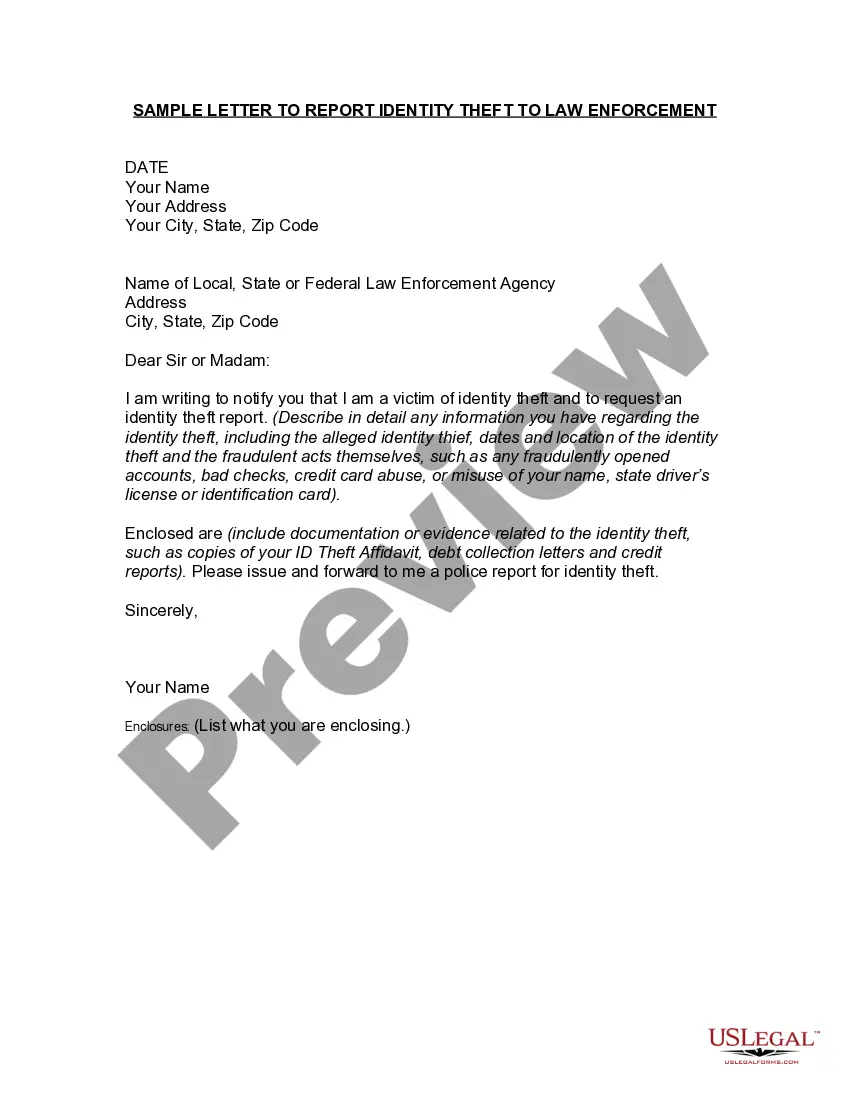

This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Of Instruction To Bank After Death Without Will In San Jose

Description

Form popularity

FAQ

It's not a replacement for a will, and in fact it's not even a legal document. But it can be incorporated into the necessary legal documents as a guide and the key to making sure everything is accounted for and accessible to the family members left behind.

Estate Plan Letter of Instruction. Dear ______________ (Executor, Agent, Trustee, Loved One, Etc.) I am writing this letter to provide you with important information you will need to know in the event of my incapacity or death. Please refer to this letter for assistance as you deal with my affairs.

Basic Contents of a Letter of Instruction Firstly, it contains personal information, such as the executor's names and contact details. Secondly, it goes into specifics about the deceased's assets, delineating bank accounts, safety deposit boxes, and real estate properties, among other assets.

It's a good way to let to those trusted to take care of your affairs know what you would want them to know. Since the letter of instruction is not a legal document, it does not need to be notarized or signed in the presence of witnesses or with any other special formality.

The next of kin must notify their banks of the death when an account holder dies. This is usually done by delivering a certified copy of the death certificate to the bank, along with the deceased's name and Social Security number, bank account numbers, and other information.

The bank is likely to ask for two forms of your identification (usually a passport or driver's licence, or a proof of address with a utility bill) and a copy of the will. If there's no will, the bank could ask for evidence of your relationship to the deceased. You'll also need the death certificate.

In California, an account holder should complete a Totten trust document. A Totten Trust is a payable-on-death account with a named beneficiary. When the account owner dies, the contents of the Totten Trust automatically pass to the beneficiary.