This form is a sample letter in Word format covering the subject matter of the title of the form.

Sample Letter Of Death Notification To Bank For Credit Card In Tarrant

Description

Form popularity

FAQ

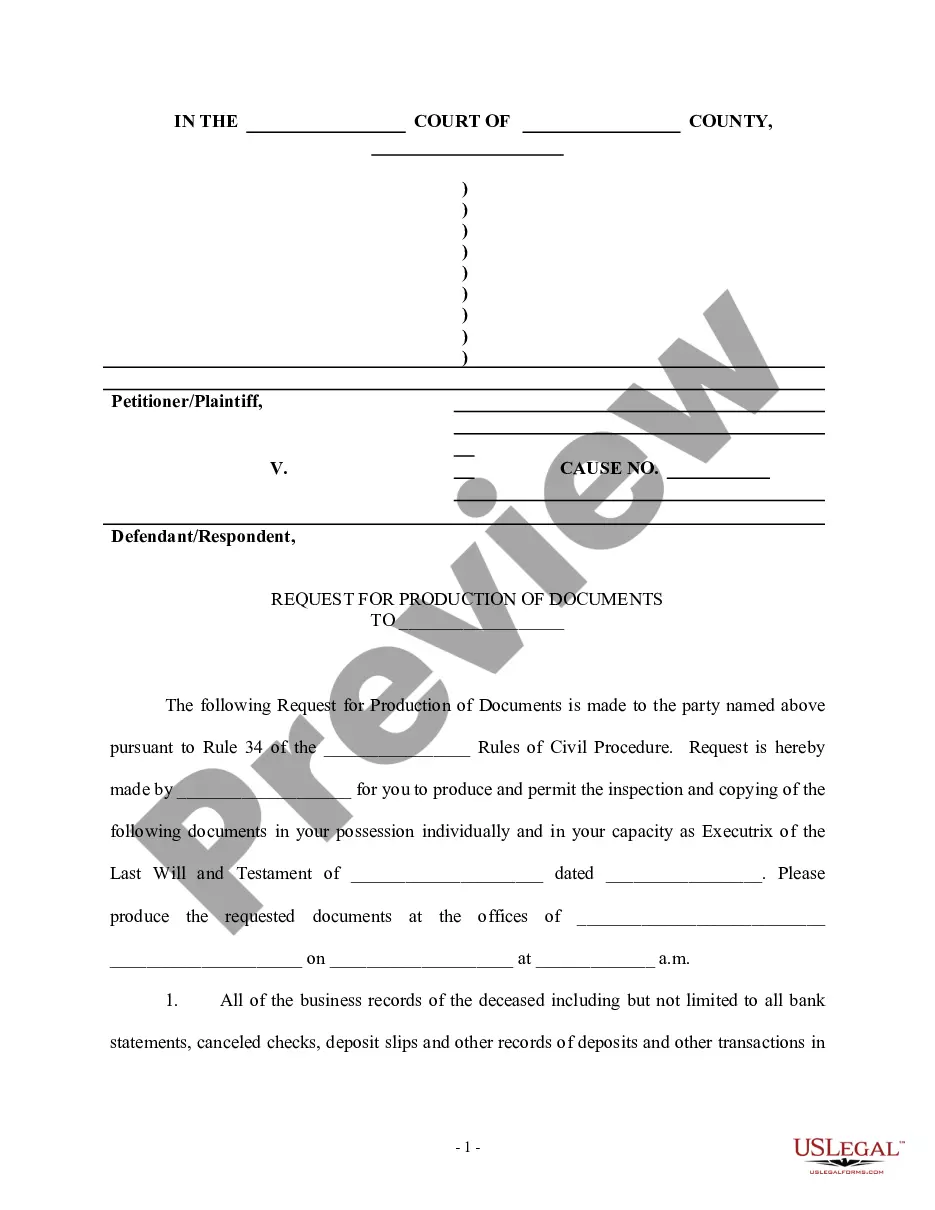

Step 1: Notify the three major credit bureaus You will need to provide a certified copy of the death certificate, a copy of your identification, and proof of your authority over the estate (e.g., a marriage certificate for a spouse or a Letter of Testamentary or court order naming you as the executor).

Provide copies of the death certificate or CRDA to each of the bureaus to show proof of death. You may even do so online. This allows the bureaus to update the portfolio and flag the accounts, which may also prevent possible identity theft should someone try to steal credit card information or SSN.

Sample letter to creditors after death As the representative of decedent's first name, I am writing to inform you that they have passed away. Please cancel their account immediately. If there is an outstanding balance on the account, please notify me as soon as possible at the included address.

If your loved one had credit cards, those credit cards will need to be canceled once they pass away. This is not typically something that automatically happens once someone dies, so it's an important task to complete. Try to get organized beforehand with the names of accounts and passwords.

Yes, it is your responsibility. You may be asked to send in proof of death like a copy of the obituary or death certificate. Most credit card companies write off the debt owed when the card holder is deceased. It usually only takes one phone call....

For instance, if a debt was incurred during the marriage, the surviving spouse might be responsible for it. However, if the debt was incurred before the marriage or is classified as separate property, it's typically only the deceased's estate that is liable for repayment.

Using the credit report as your guide, contact all banks and credit card companies at which the deceased had an open account and close those accounts as quickly as possible. You will need to provide a certified copy of the death certificate to close the account.

Start the letter with your introduction and the reason for writing the letter. Moreover, request the bank manager to settle the deceased account. Additionally, you have to provide details like account numbers and other documents. Signature – Use “Faithfully” or “Sincerely” as signatures and then mention your name.

Using the credit report as your guide, contact all banks and credit card companies at which the deceased had an open account and close those accounts as quickly as possible. You will need to provide a certified copy of the death certificate to close the account.