This form is a sample letter in Word format covering the subject matter of the title of the form.

Letter Of Instruction To Bank After Death With Trust In Virginia

Description

Form popularity

FAQ

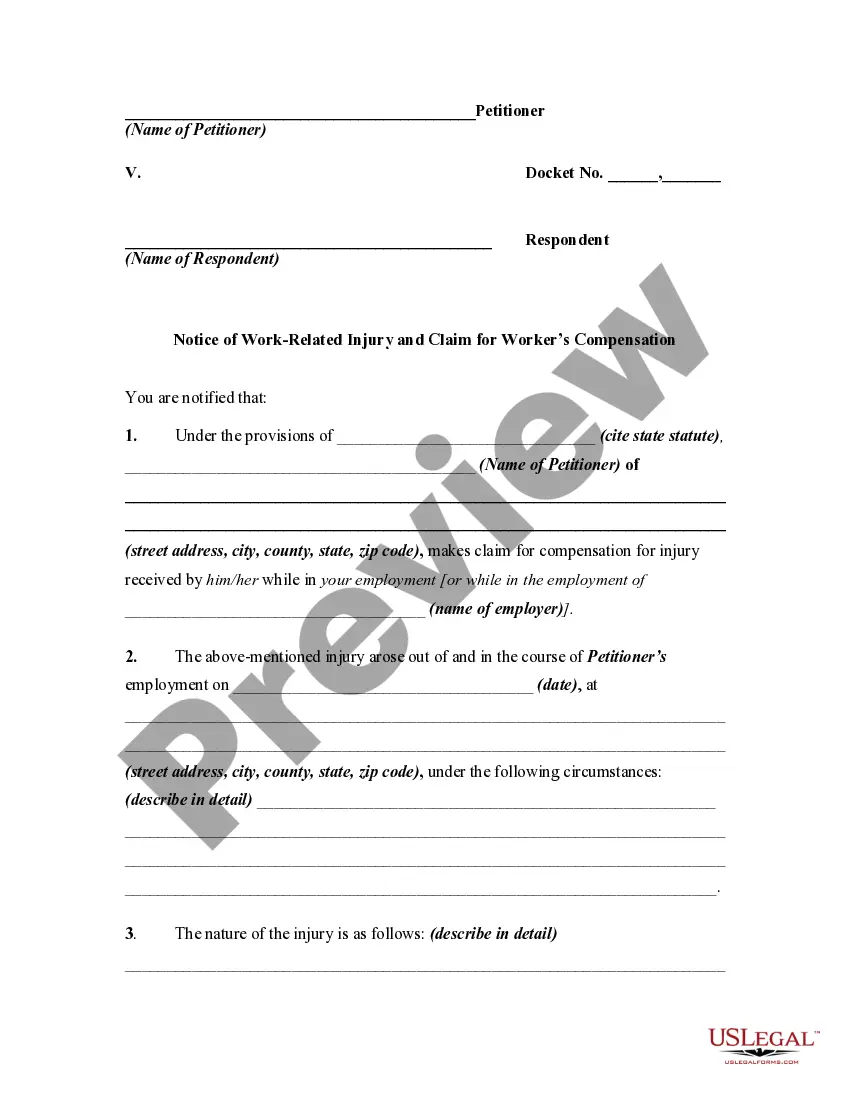

Start the letter with your introduction and the reason for writing the letter. Moreover, request the bank manager to settle the deceased account. Additionally, you have to provide details like account numbers and other documents. Signature – Use “Faithfully” or “Sincerely” as signatures and then mention your name.

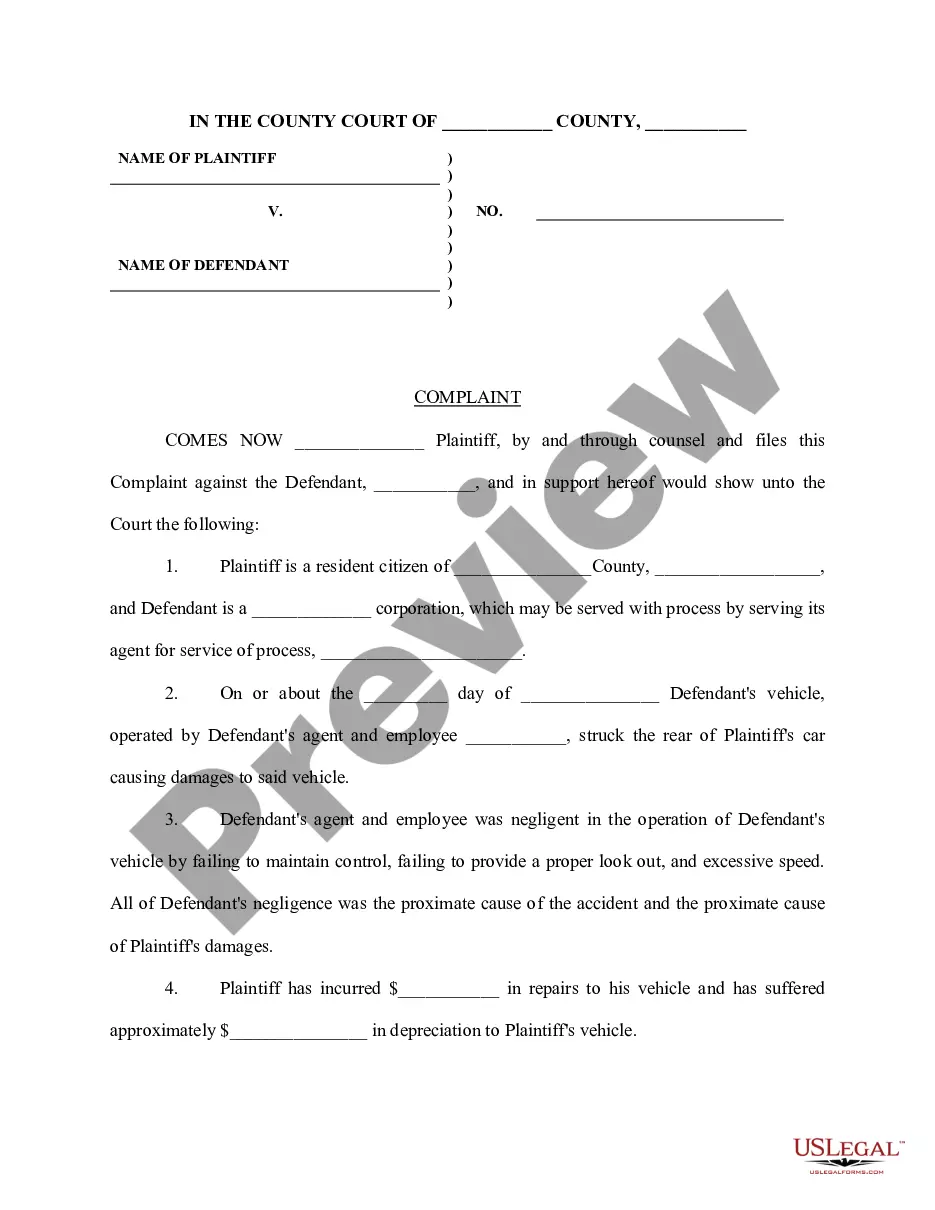

Steps to Closing Out a Trust After Death Step 1: Notify Beneficiaries and Creditors. The first task for the successor trustee is to notify both the beneficiaries and creditors. Step 2: Inventory and Value Assets. Step 3: Settle Debts and Taxes. Step 4: Distribute Assets to Beneficiaries. Step 5: Dissolve the Trust.

A letter of instruction is a cheat sheet for anyone involved in settling your affairs. Unlike a will, this letter has no legal authority. However, it can provide an easy-to-understand explanation of your overall estate plan to your executor and lay out your wishes to your family for things not covered by the will.

By federal and state law, a trust can remain open for up to 21 years after the death of anyone living at the time the trust was created. The special needs trust remains in effect throughout the person's lifetime.