Form with which a corporation may resolve to authorize an officer or representative to file necessary official documents for a given purpose.

Official Resolution Form For Nonprofit In Illinois

Description

Form popularity

FAQ

Here is a quick overview of the main steps to dissolve and wind up your nonprofit corporation under Illinois law. Authorizing Dissolution. Plan of Distribution. Articles of Dissolution. Winding Up. Notice to Creditors and Other Claimants. Federal Tax Note. Additional Information.

To obtain recognition as a 501(c)(3), tax-exempt entity, Form 1023 must be filed with the Internal Revenue Service. Form 1023 is a comprehensive look at an organization's structure and programs.

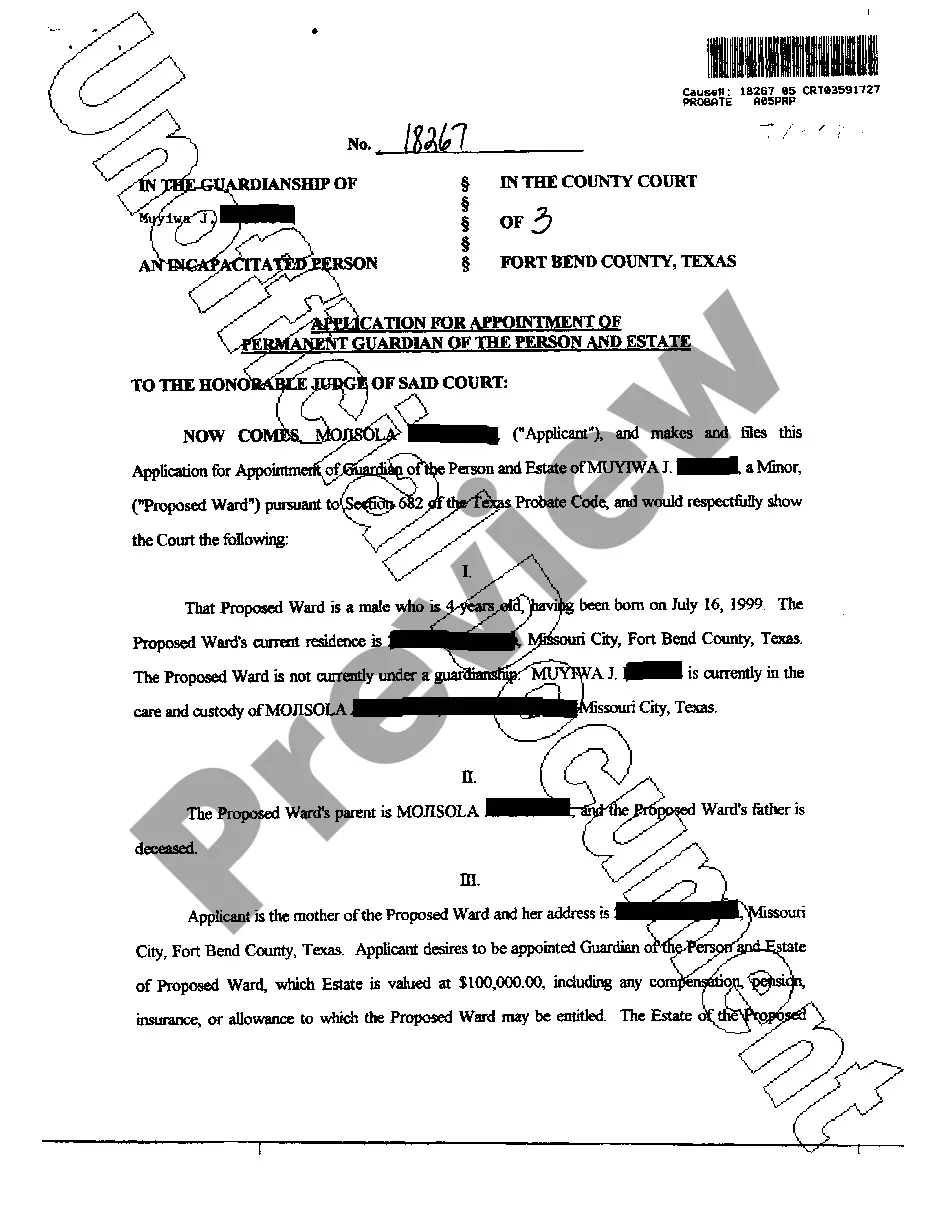

A corporate resolution formally documents specific decisions or actions taken by a company's board of directors or shareholders. It typically addresses key issues like authorizing contracts, appointing officers, or approving major business transactions.

What Are the Components of a Nonprofit Board Resolution Template? The board meeting date. The number of the resolution. A title of the resolution. The resolution itself (what is being voted on) The name and vote of each voting member of the board. The Chairperson's name and signature.

These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners. Corporate resolutions are necessary business documents for corporations, whether they be for-profit or nonprofit.

There must be at least three directors. They do not have to be Illinois residents or corporation members, but you may require these and any other qualifications you choose. Restrictions and qualifications may be outlined in the Articles of Incorporation under the Other Provisions section or in the corporate by-laws.

Typically, corporations require these documents when an agreement between the owners and the board may enable business transactions and decisions.

Bylaws document the rules for how the corporation shall be governed. Resolutions are prepared as needed to document important decisions and actions taken by the board of directors on behalf of the corporation.

Corporate resolutions are necessary business documents for corporations, whether they be for-profit or nonprofit.