Letter Credit Attorney Without In Travis

Description

Form popularity

FAQ

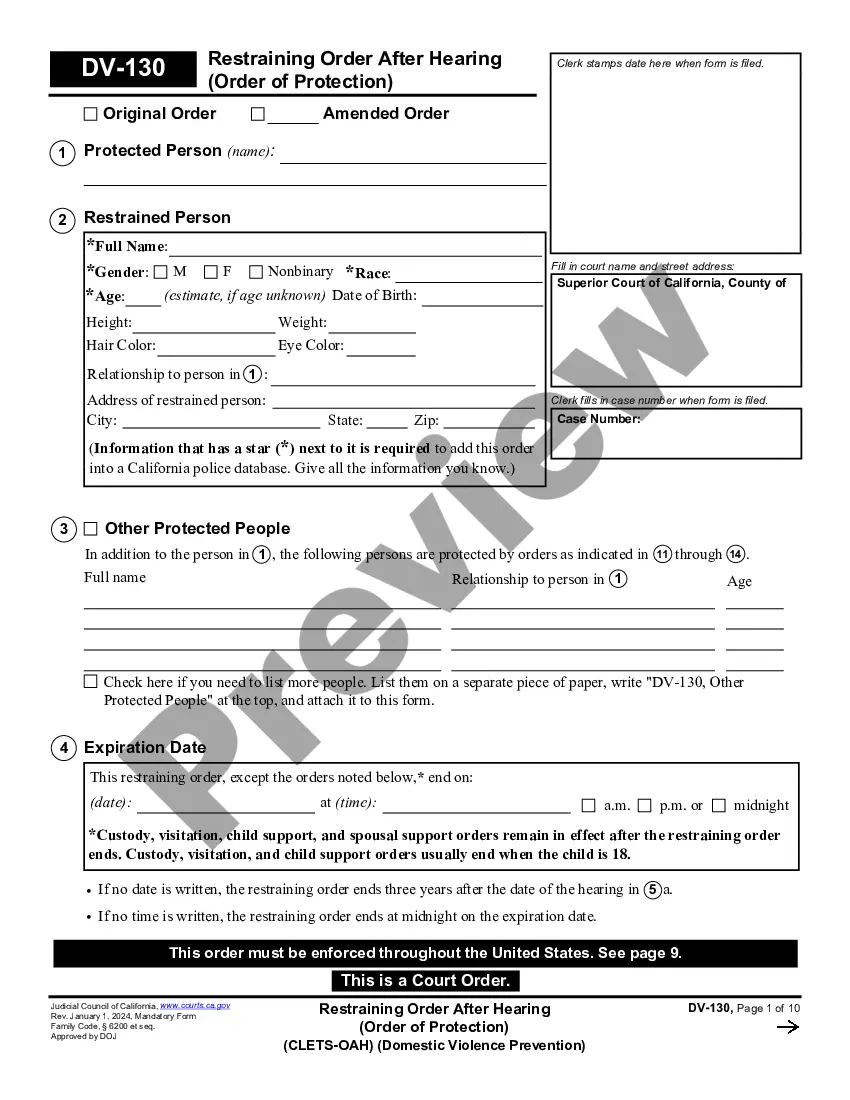

Attorneys experienced in consumer law or debt collection can help you understand your state and federal rights.

Power of attorney forms are available from many sources. Many state government websites and financial institutions make power of attorney forms available to residents and customers. Also, hospitals often offer health care power of attorney or other health care directive forms to their patients.

A skilled credit report dispute attorney has the legal background and experience to understand and navigate a variety of credit dispute challenges. They understand the details of the Fair Credit Reporting Act, including your rights under the law.

Hiring an attorney for debt settlement can be helpful, especially if you're dealing with large debts or complex legal matters. An attorney can negotiate with creditors, ensure agreements are legally sound, and protect you from lawsuits or unfair practices.

Four Steps to Take if You Received a Debt Collection Letter From a Lawyer Carefully Review the Letter to Determine the Claim. Consider Sending a Debt Validation Request. Gather and Organize All Relevant Financial Documents and Records. Be Proactive: Debt Does Not Go Away on its Own.

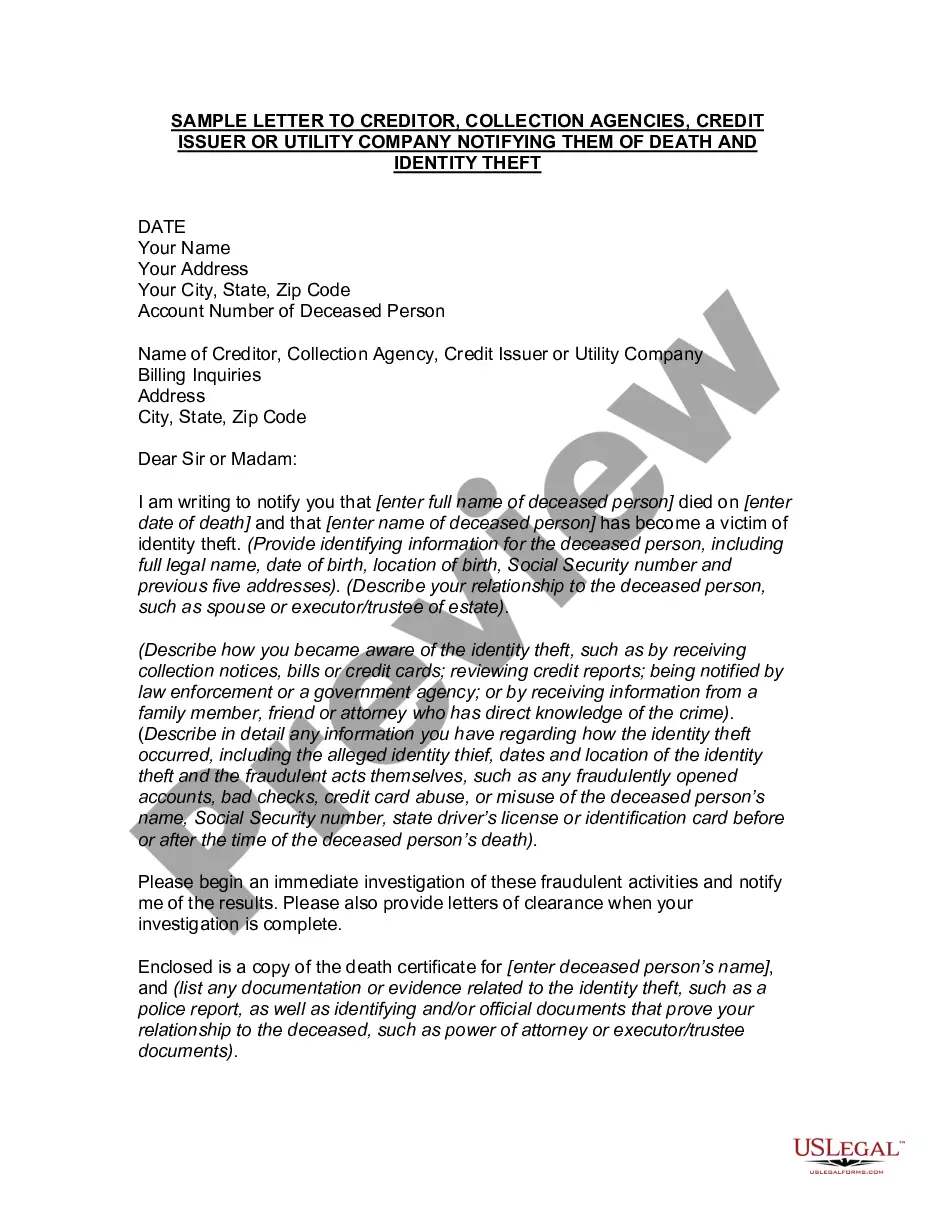

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

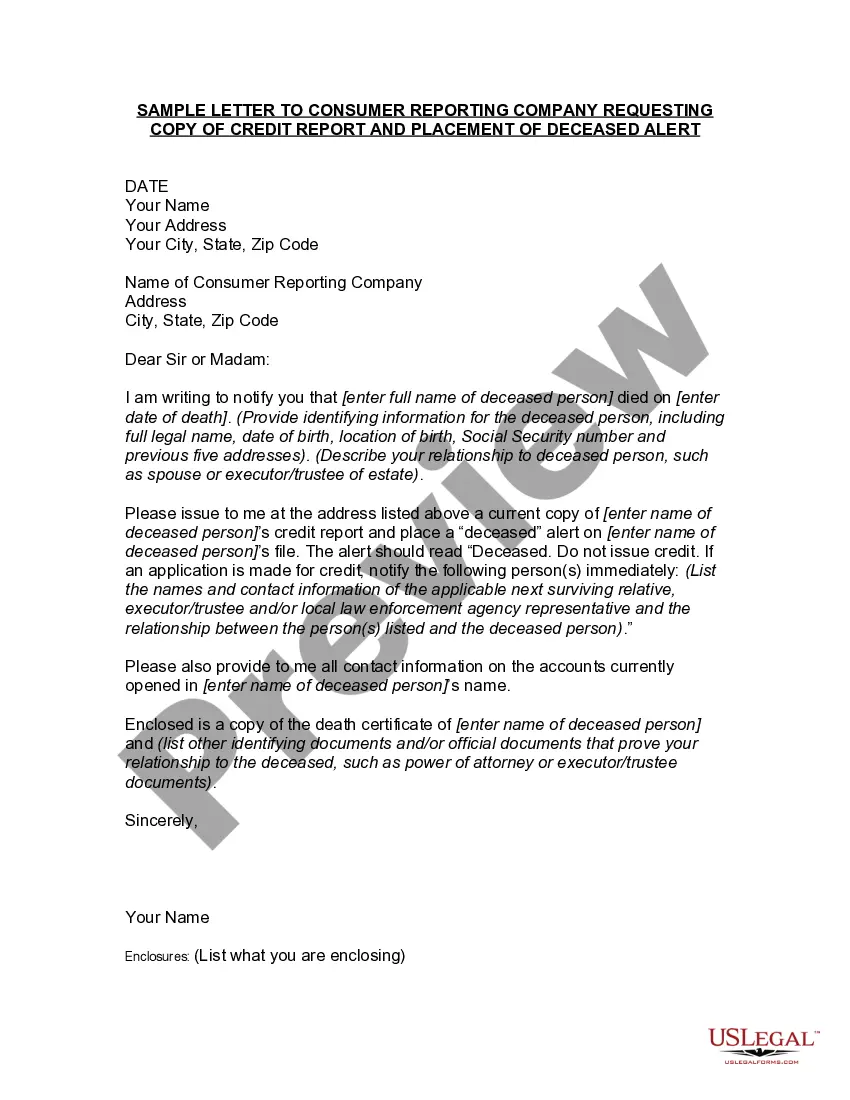

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

A 609 dispute letter is a formal way to request more information about the accounts on your credit report. Sending a 609 dispute letter may help you remove errors from your credit report. Legitimate accounts should stay on your credit report even if you send a dispute letter.