Corporate Resolution Form For Sba Loan In Georgia

Description

Form popularity

FAQ

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

Your Initial Resolutions are a legal document stating who has control over your LLC, which can be used to prove LLC ownership. This document needs to be signed by the organizer of your LLC (the person who signed the Articles of Organization).

Most LLC Resolutions include the following sections: Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.

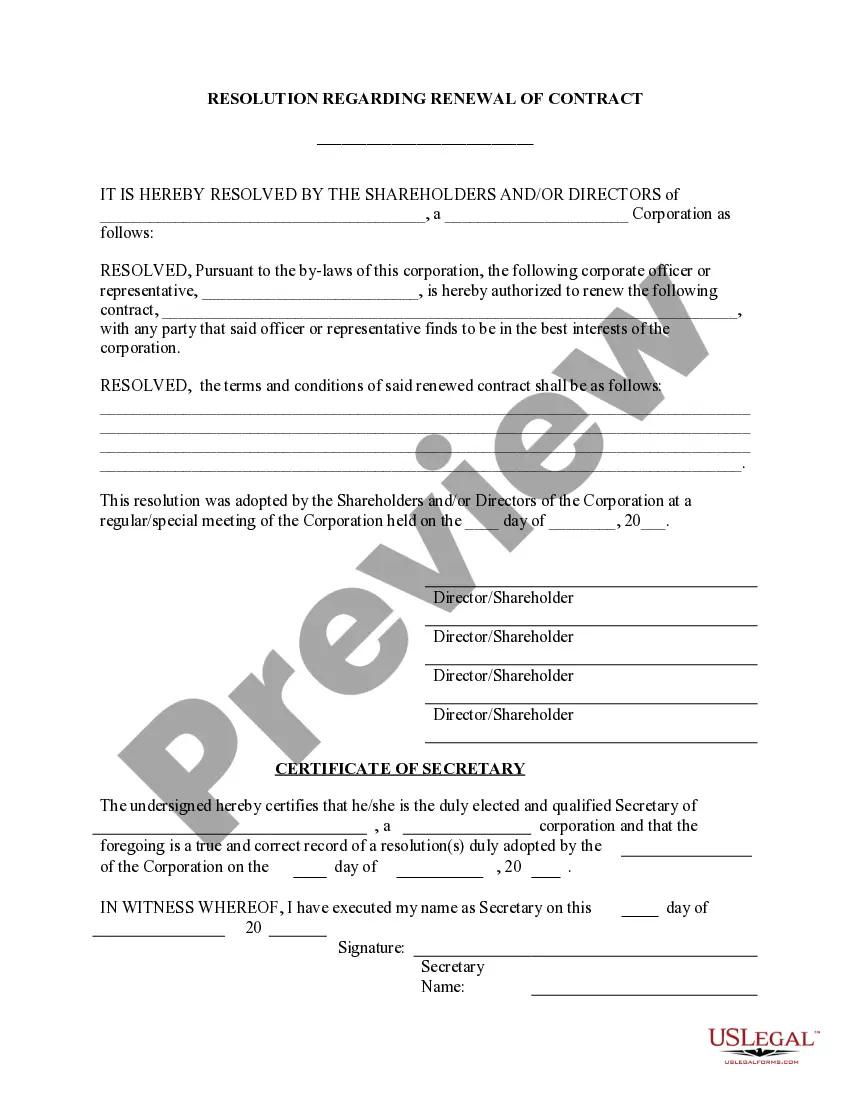

What Should a Resolution Include? the company name. the date the resolution was passed. a title that describes the action taken such as "resolution to open a checking account" details of the action taken, and. signatures of the members who agreed to pass the resolution.

A corporate resolution generally involves major decisions such as the changing of ownership structure, voting in of new board members, or the sale of company shares. A corporate resolution is also generally used to authorize people to access corporate funds, sign checks and acquire loans on behalf of the corporation.

Examples of corporate resolutions include the adoption of new bylaws, the approval of changes in the board members, determining what board members have access to certain finances, such as bank accounts, deciding upon mergers and acquisitions, and deciding executive compensation.

These resolutions are officially recorded by a corporate secretary, signed by the board of directors, and stored among a company's official records in a document repository.

What should corporate resolutions include? Your corporation's name. Date, time and location of meeting. Statement of unanimous approval of resolution. Confirmation that the resolution was adopted at a regularly called meeting. Resolution. Statement authorizing officers to carry out the resolution.

SBA Form 601 is a certificate of agreement to ensure contractors comply with EO 11246 when working on federally assisted construction projects. A borrower or contractor seeking SBA financing of more than $10,000 must complete and submit Form 601.

SBA Form 160, Resolution of Board of Directors is a form issued by the Small Business Administration (SBA) and filed with SBA Business expansion loans including direct, guaranteed or participation loans.