Corporation Resolution Form Withdrawal In Michigan

Description

Form popularity

FAQ

If you fail to properly dissolve your Michigan business, you might also be subject to fines or financial penalties depending what the issues are. Problems with dissolving your Michigan corporation or LLC could also negatively impact business owners' or members' credit and future business ventures.

To start a corporation in Michigan, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Department of Licensing and Regulatory Affairs (LARA). You can file this document online, by mail or in person.

Reinstating a dissolved LLC is a process that requires careful attention to detail and adherence to state-specific requirements. By understanding the reasons for dissolution, following the necessary steps, and addressing compliance issues, you can successfully reinstate your LLC and resume its operations.

(1) A member may withdraw from a limited liability company only as provided in an operating agreement. A member withdrawing pursuant to an operating agreement may become entitled to a withdrawal distribution as described in section 305.

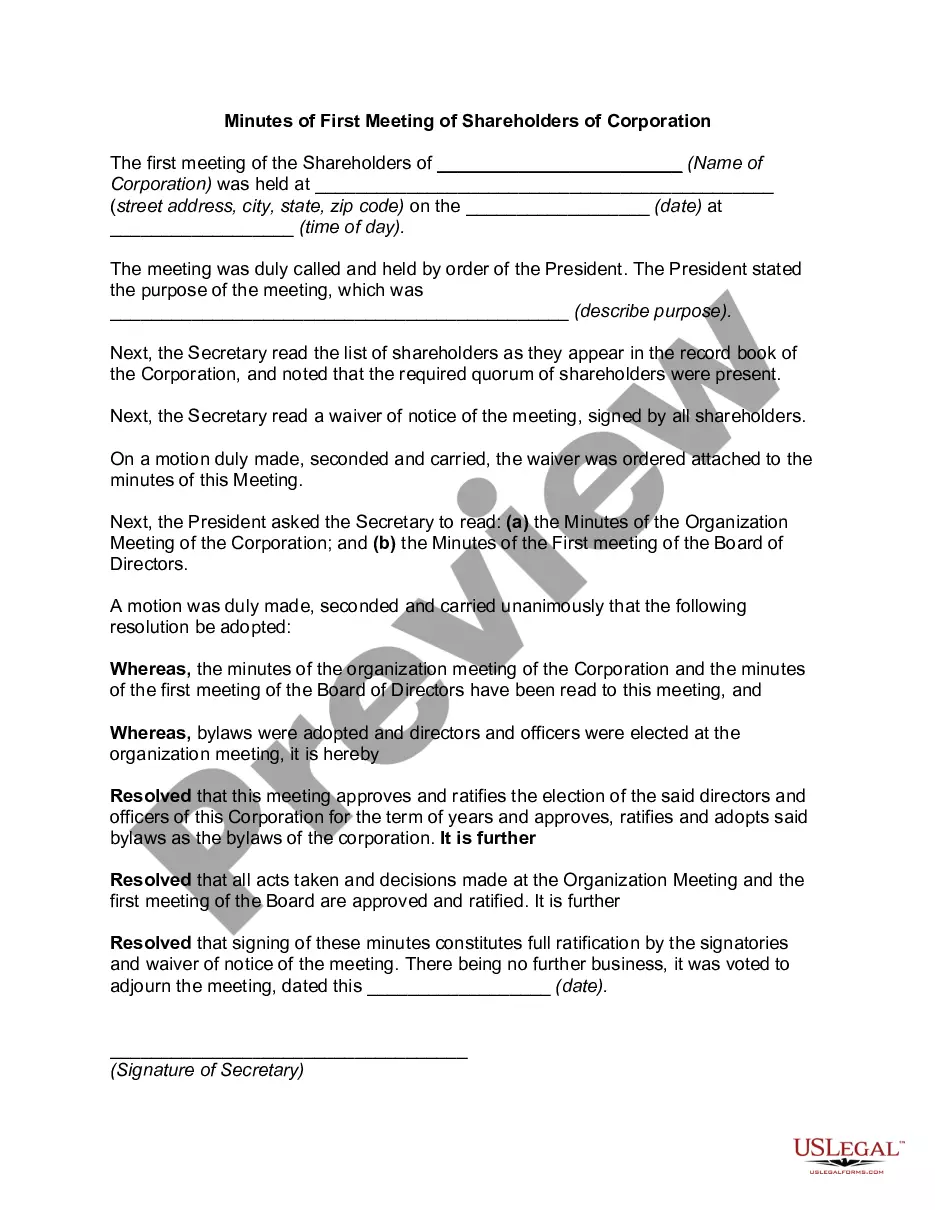

Directors vote to dissolve entity; • Send shareholders notice of a meeting to vote on proposal to dissolve; and • Shareholders approve dissolution. The certificate of dissolution is filed any time after the corporation authorizes dissolution.

In Michigan, every LLC must file an annual statement each year. The Michigan Department of Licensing and Regulatory Affairs will send you a pre-printed annual statement form approximately three months before the due date. You can either use this form or file your statement online.

Reinstate or Revive Your Michigan Entity Reinstatement is the process of restoring a delinquent entity back to good standing. Depending on the cause of delinquency, several steps may be required to reinstate your entity.