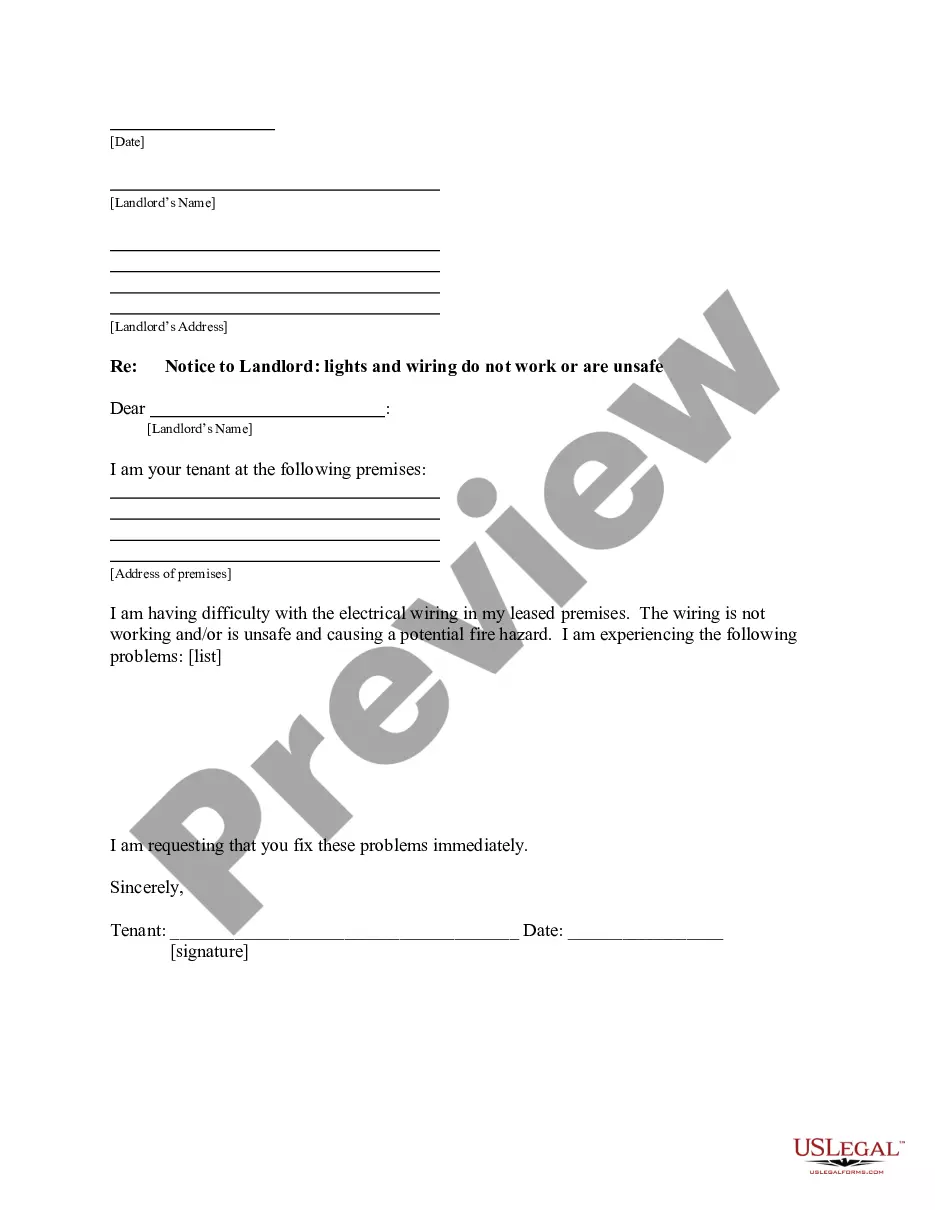

Form with which a corporation may resolve to issue additional Capital Stock in the corporation.

Capital Stock In Income Statement In Georgia

State:

Multi-State

Control #:

US-0040-CR

Format:

Word;

Rich Text

Instant download

Description

Free preview