Capital Stock Definition In Pennsylvania

State:

Multi-State

Control #:

US-0040-CR

Format:

Word;

Rich Text

Instant download

Description

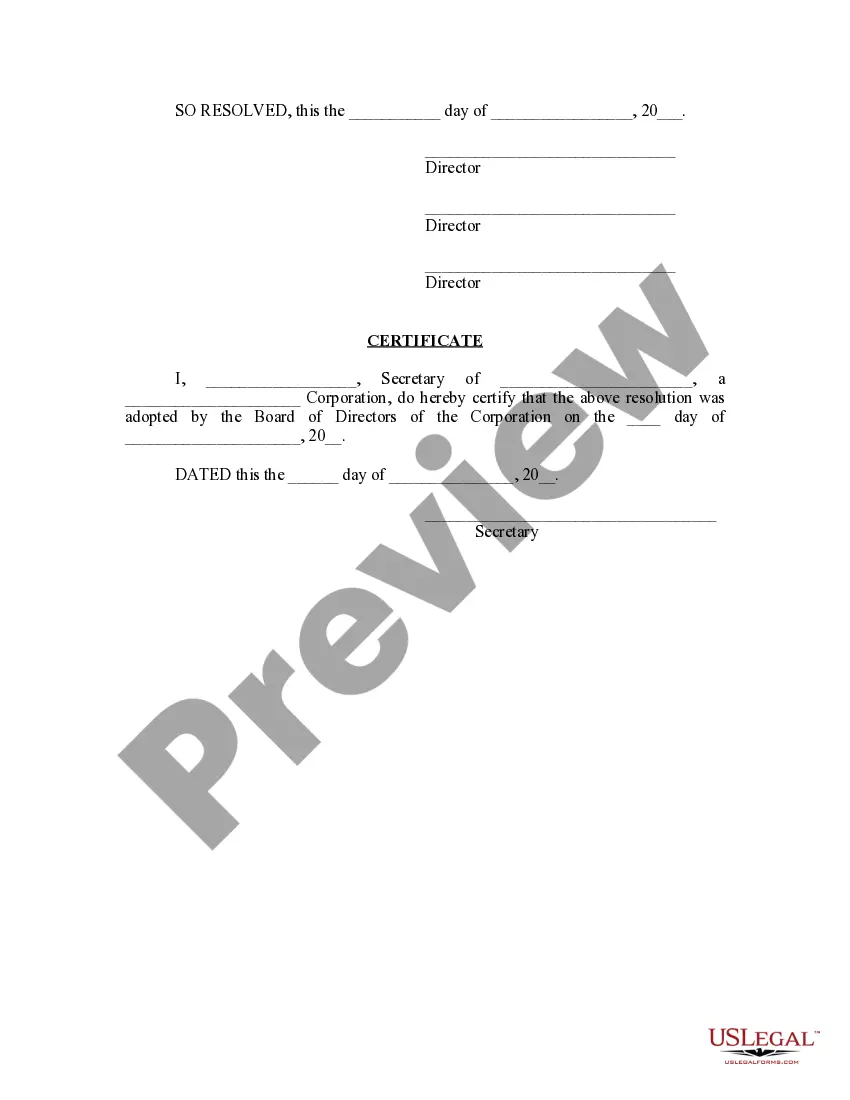

The Resolution of the Board of Directors is a key document used in Pennsylvania corporate governance that outlines the process for the issuance of capital stock. It specifically defines capital stock as fully paid and non-assessable shares of common stock valued at one dollar per share. This resolution facilitates the transfer of ownership through cash payments or asset transfers, emphasizing the sufficiency of consideration for shares issued. Key features include sections for director signatures, details of the shares issued, and a certificate of adoption. Filling out this form requires accurate entries of names, shares, and considerations. Attorneys, partners, owners, associates, paralegals, and legal assistants can efficiently use this form during corporate meetings to document stock issuance, ensuring legal compliance and clarity regarding ownership. It helps streamline the authority process for officers to act on behalf of the corporation. The form is indispensable for maintaining proper recordkeeping in a corporation's stock transactions.

Free preview