Net Receivable Sales Formula In Utah

Category:

State:

Multi-State

Control #:

US-00402

Format:

Word;

Rich Text

Instant download

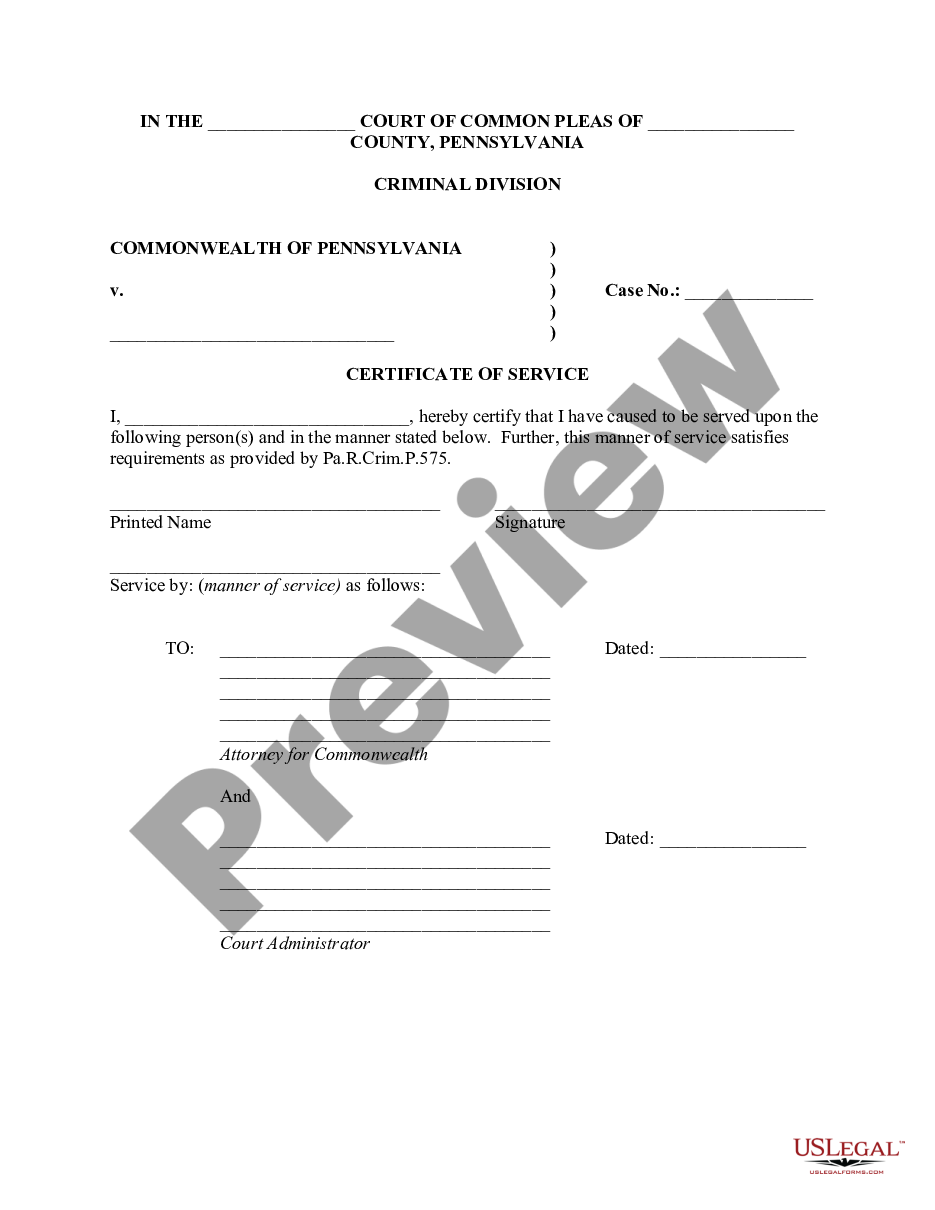

Description

Accounts Receivable -Contract to Sale is a Contract to convey all accounts to a third party at a discount. The Seller agrees to sell to the Buyer all of Seller's right title and interest in all accounts as listed on the attached Exhibit, together with all invoices representing, and all money due or to become due on the assigned accounts and all other rights in the assigned accounts of any type. This Contract can be used in any state.

Free preview

Form popularity

More info

To calculate net accounts receivable, you need: total accounts receivable, allowance for doubtful accounts, and sales returns and allowances. If you choose to use the sales factor formula, you must file using only the sales factor in the next taxable year.A company's net receivables are the total amount of money its customers owe minus what the company estimates will likely never be paid. 2023 Utah TC-65 Instructions. (Schedule J, Part 2). To calculate the net credit sales, subtract the sales returns and sales allowances from the sales you've made on credit. 4. Accounts receivable are any balances owed to the University of Texas at Dallas (University) from unaffiliated, external organizations or individuals. Sales and services, net (Note 1). 1,205,810. Use the free New Jersey Online Filing Service to file your 2024 NJ-1040 return. It's simple and easy to follow the instructions, complete your NJ tax return,.