File Notice Lis Pendens Without Notice In North Carolina

Description

Form popularity

FAQ

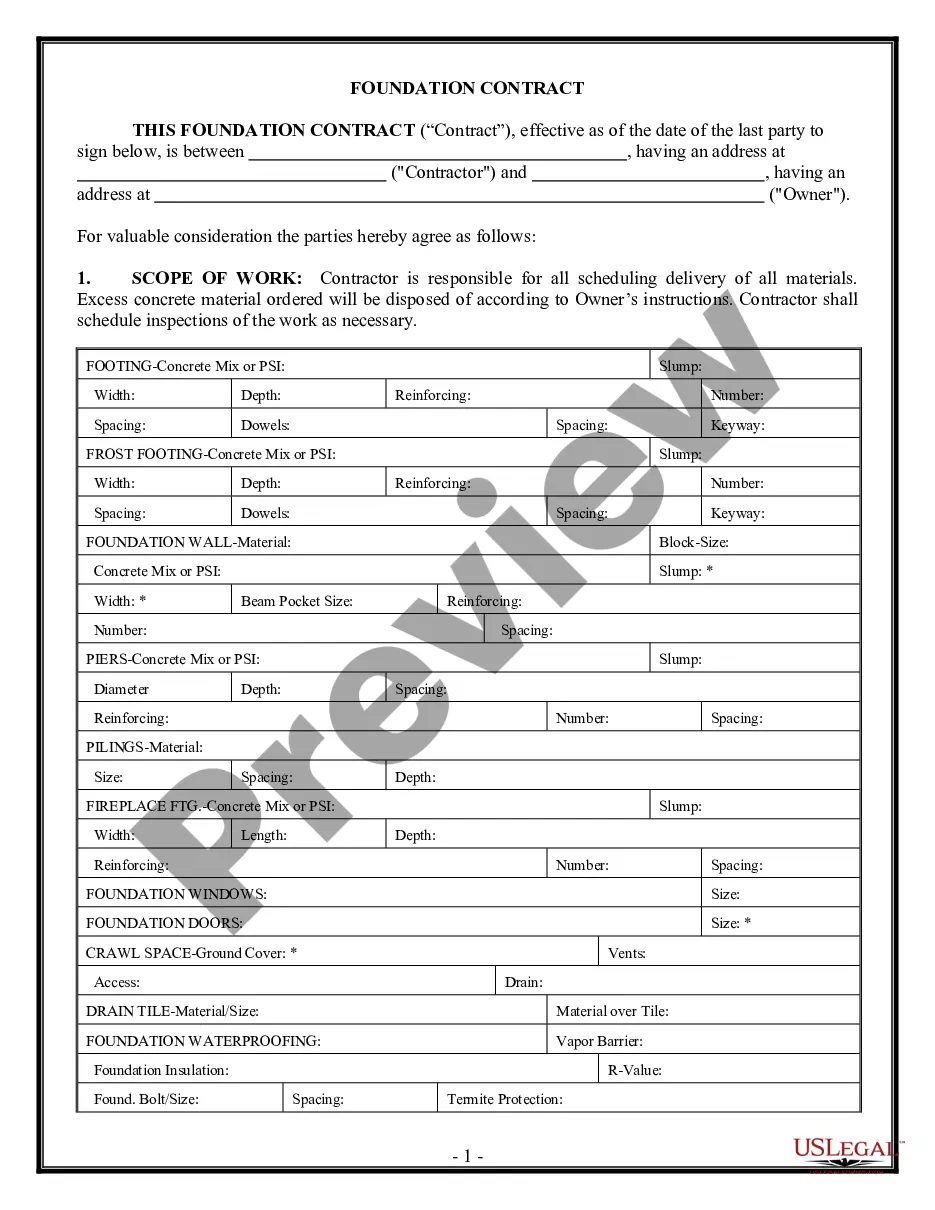

The manner of such enforcement shall be as provided by G.S. 44A-7 through 44A-16. The claim of lien on real property is perfected as of the time set forth in G.S. 44A-10 upon filing of the claim of lien on real property pursuant to G.S. 44A-12.

Interested members of the public can conduct judgement lien searches in North Carolina by querying the Clerk of Court office of any county where a debtor owns property. Queries can be made in person at the courthouse. Alternatively, inquirers can contact clerks by phone.

Under North Carolina law judgment liens expire ten years from entry of the judgement. The bankruptcy, however, can extend the statute of limitations in favor of the pre-petition lien holder in certain circumstances.

In North Carolina, a lien claimant has 120 days from the date of last furnishing to complete these 3 steps: Fill out a mechanics lien form that meets NC requirements. File the lien with the county recorder's office. Serve a copy of the lien on the property owner.

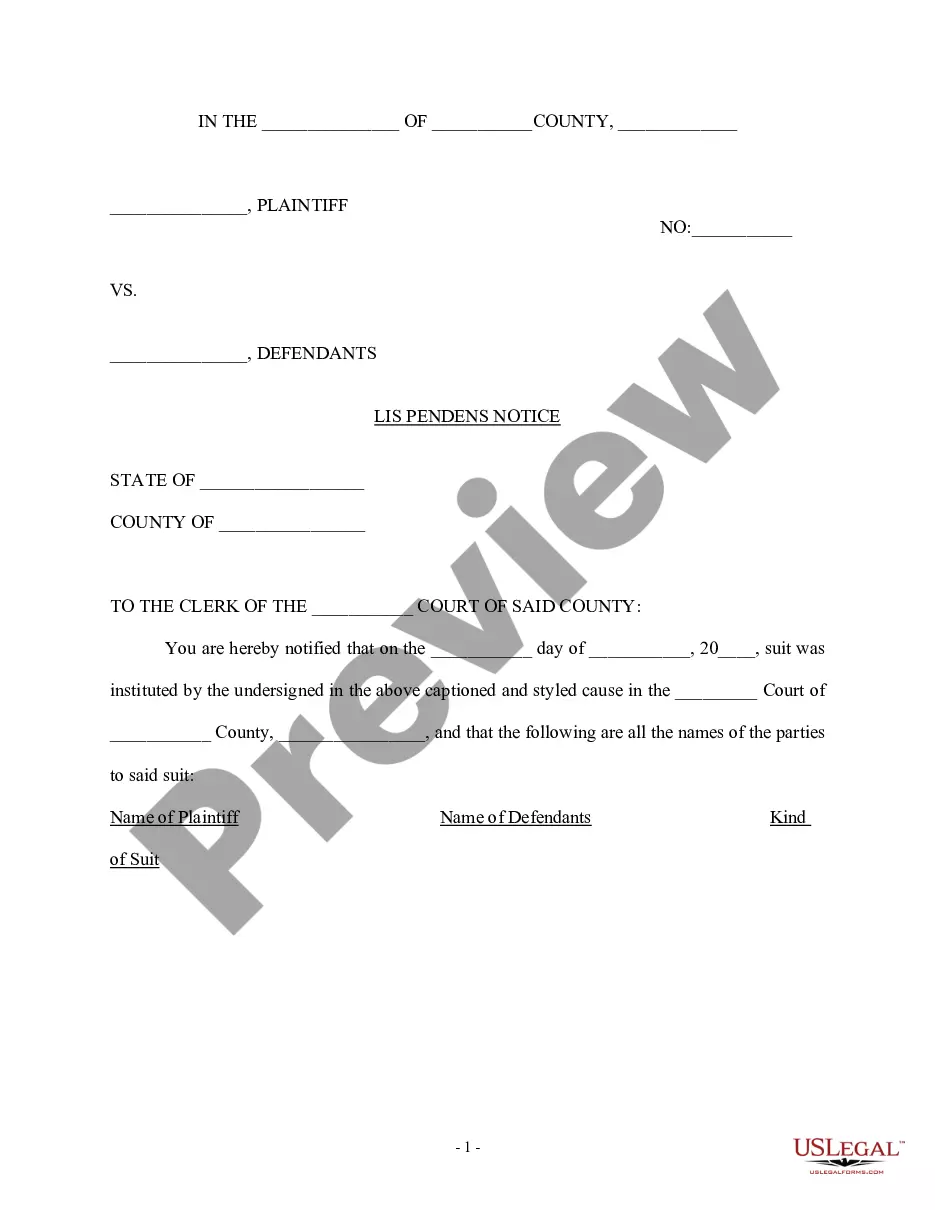

– All claims of lien on real property must be filed in the office of the clerk of superior court in each county where the real property subject to the claim of lien on real property is located.

We hope you enjoyed Ted's lesson, “Is North Carolina a Tax Lien or Tax Deed State?” North Carolina is a tax deed state. The state confiscates property for unpaid property taxes and sells it to the highest bidder at a tax defaulted auction.

Upon the issuance of a complaint and notice of hearing or order pursuant thereto, a notice of lis pendens, with a copy of the complaint and notice of hearing or order attached thereto, may be filed by the inspector in the office of the clerk of superior court for the county, as provided in G.S. 1-120.2.

North Carolina Civil Statute of Limitations Laws: At a Glance Injury to personThree years (N.C.G.S. § 1-52(16)) Collection of rent Three years (N.C.G.S. § 1-52) Libel/slander One year (N.C.G.S. § 1-54(3)) Fraud Three years (N.C.G.S. § 1-52(9)) Injury to personal property Three years (N.C.G.S. § 1-52(4))5 more rows

The Massachusetts lis pendens statute serves to protect the rights of the property owner as well. A memorandum of lis pendens associated with a parcel of real estate creates a “cloud on title” to the property, which can have harsh consequences.