Partition And Exchange Agreement With Foreign Countries In Philadelphia

Category:

State:

Multi-State

County:

Philadelphia

Control #:

US-00410

Format:

Word;

Rich Text

Instant download

Description

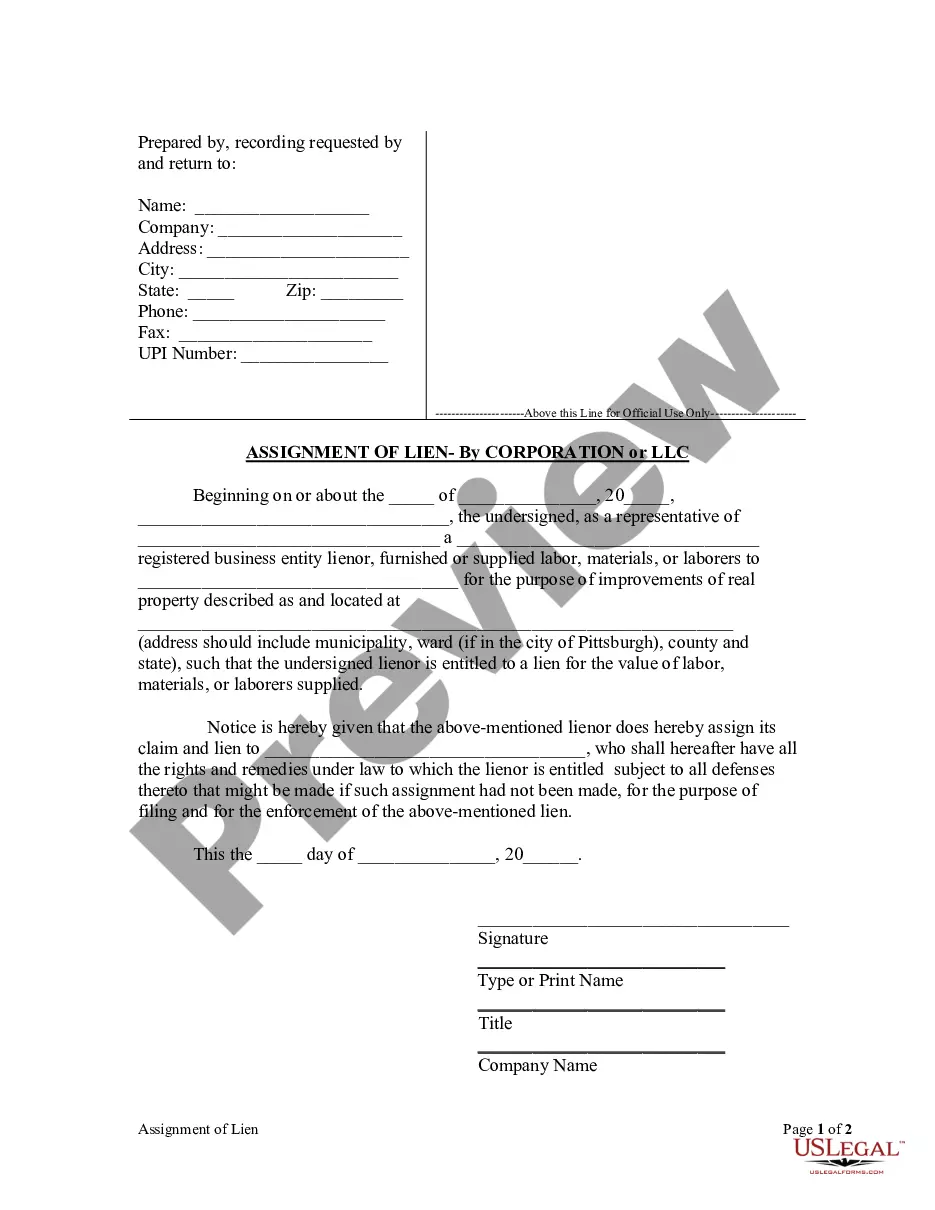

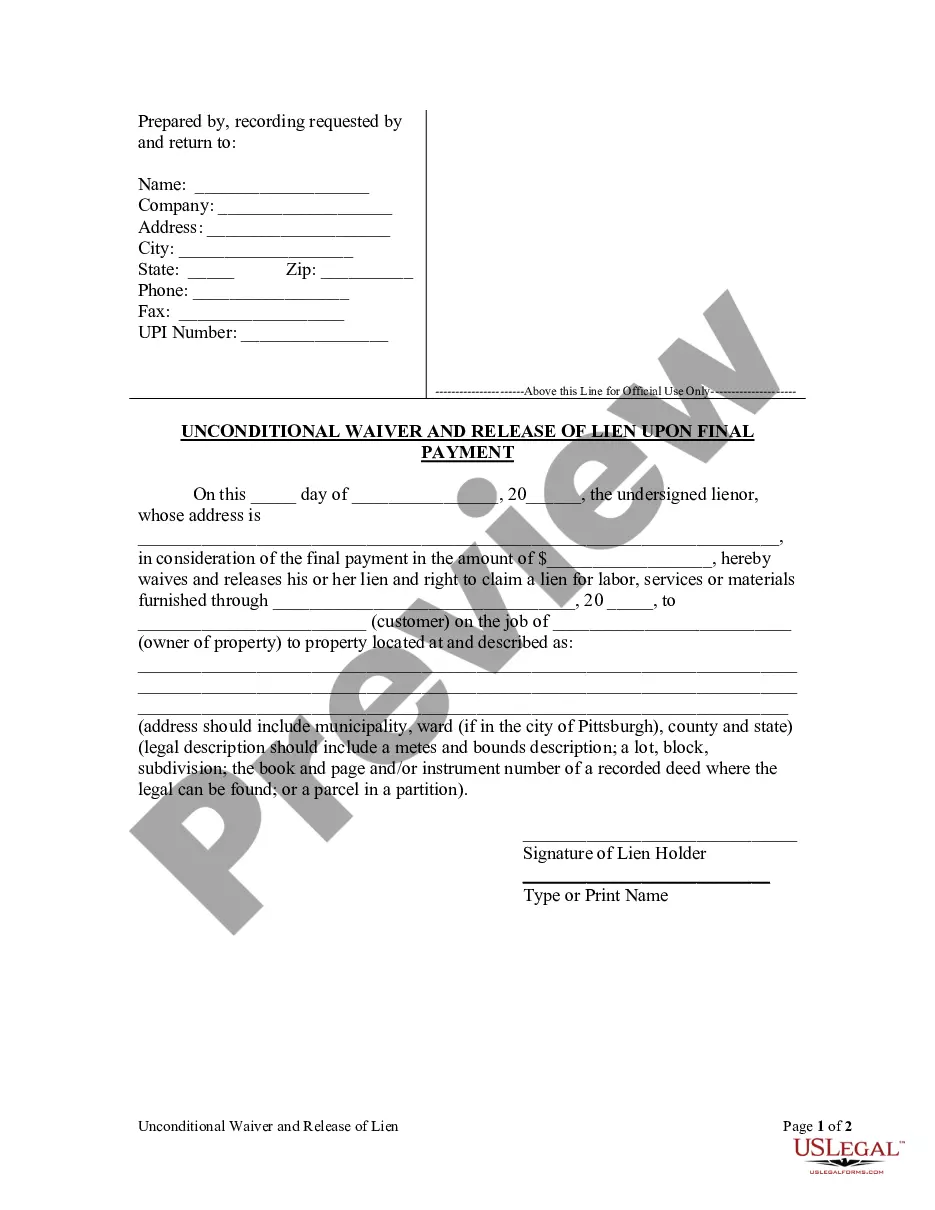

This Partition Agreement is an Agreement for the Partition and Division of Real Property. This is a Voluntary agreement to partition and divide real property. This Agreement can be used in any state. This Agreement is to be signed in front of a notary public.

Free preview