Solicitud De Empleo Llena Withholding Tax In Ohio

Category:

State:

Multi-State

Control #:

US-00413-19

Format:

Word;

Rich Text

Instant download

Description

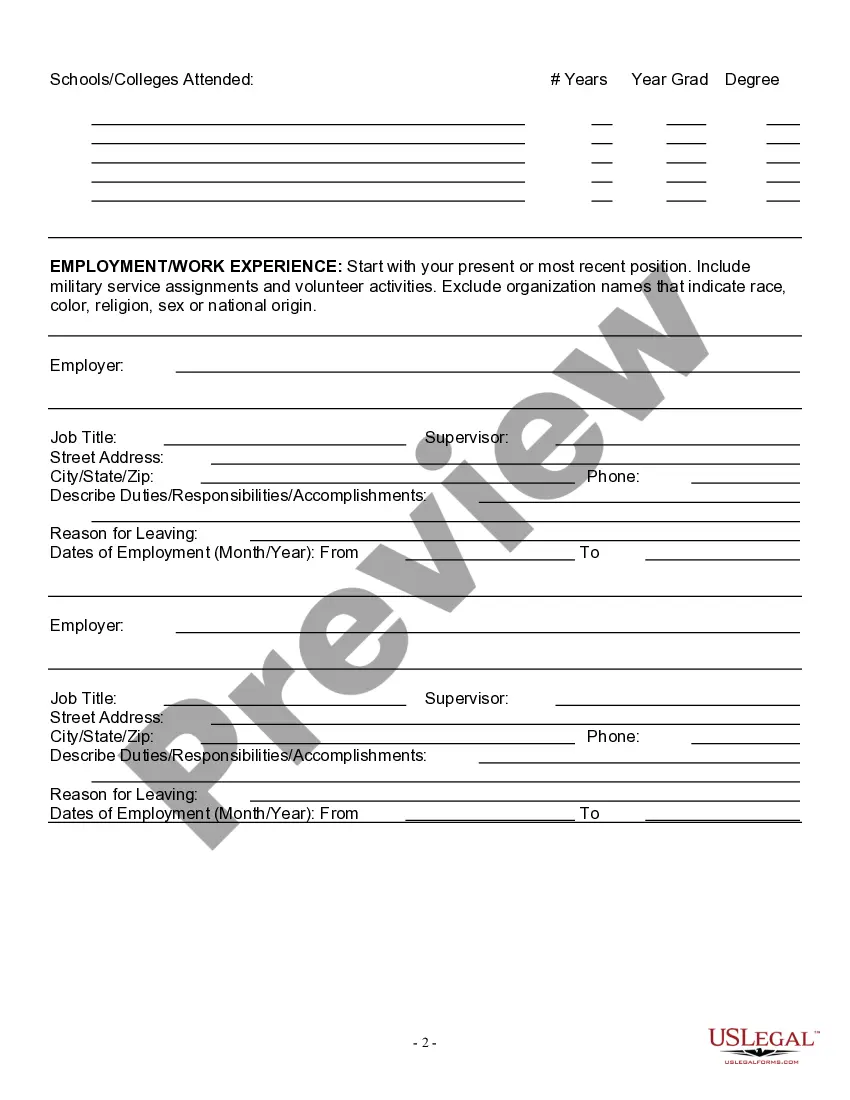

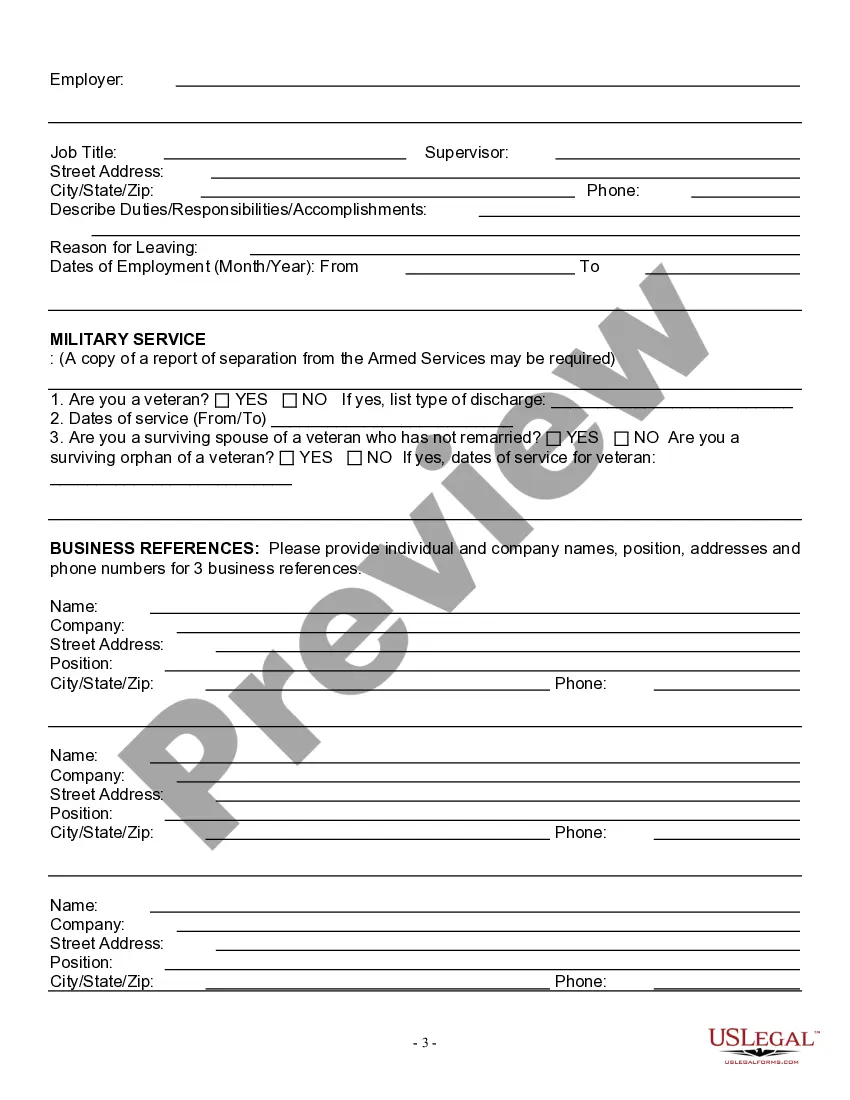

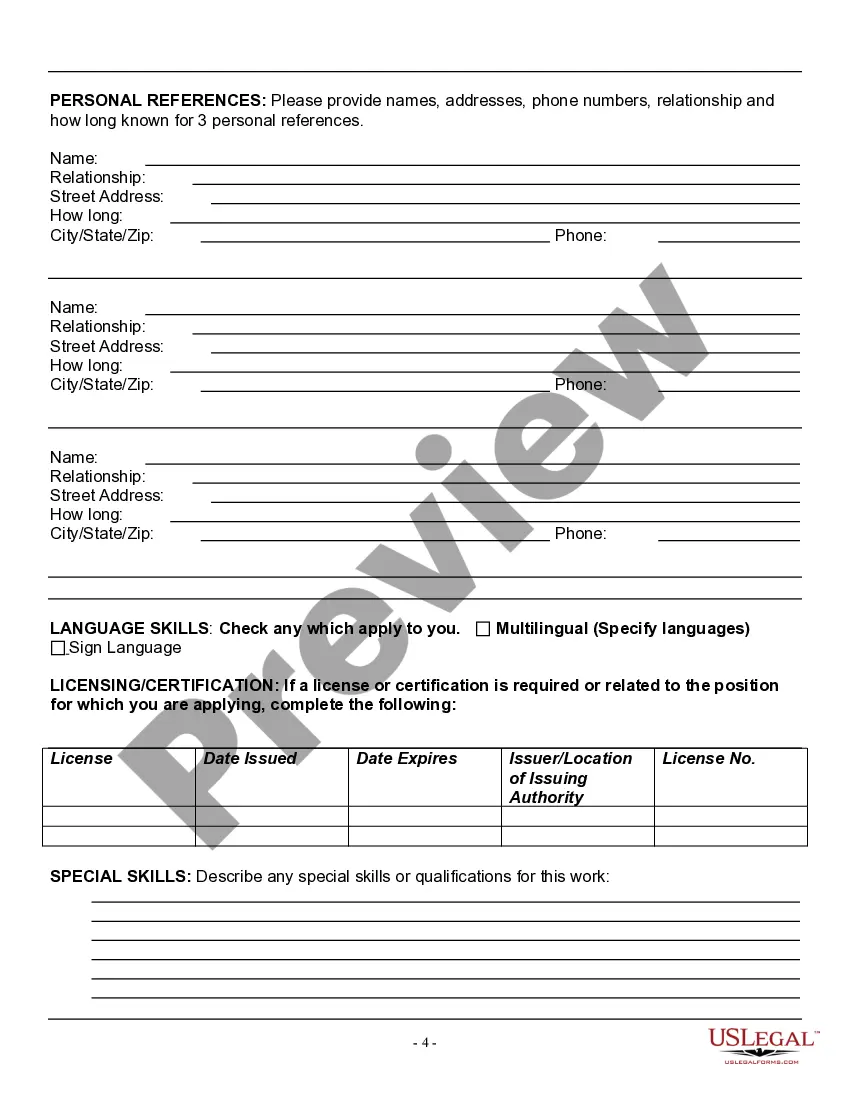

This form is an Employment Application. The form provides that applications are considered without regard to race, color, religion, or veteran status.

Free preview