Solicitud De Empleo Llena Withholding Tax In Queens

Category:

State:

Multi-State

County:

Queens

Control #:

US-00413-19

Format:

Word;

Rich Text

Instant download

Description

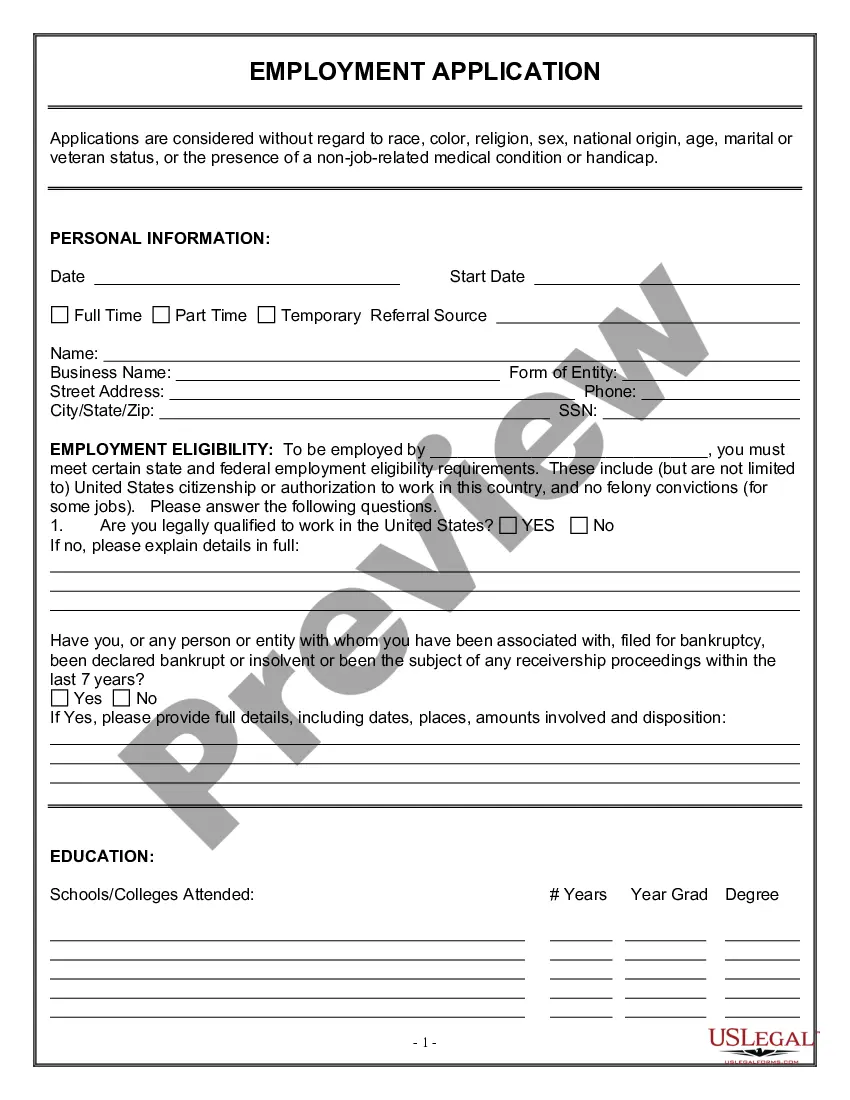

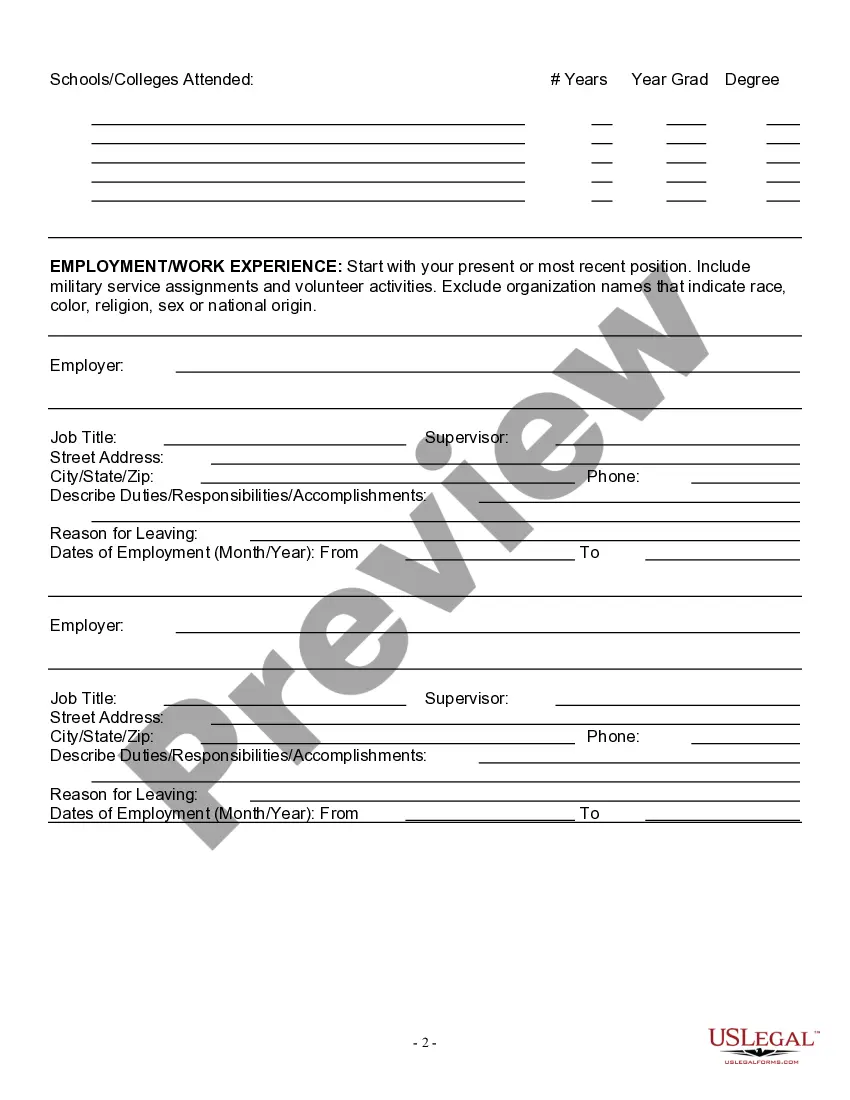

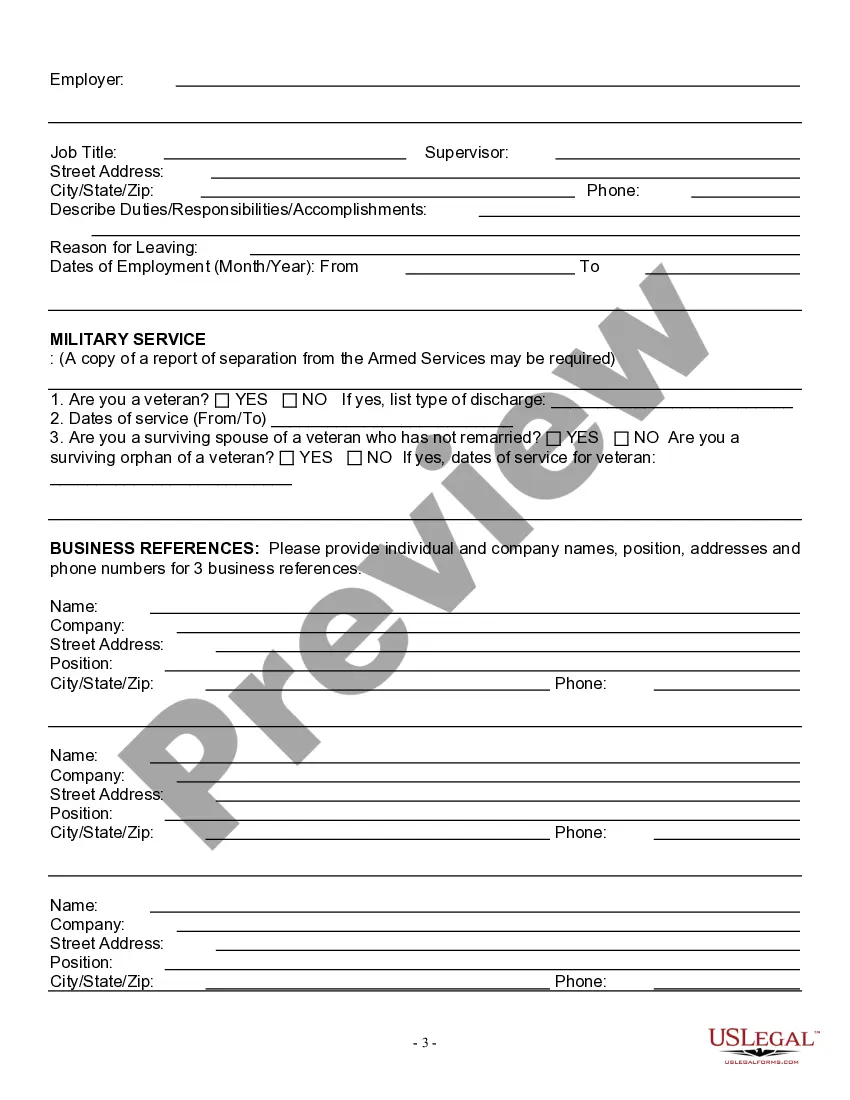

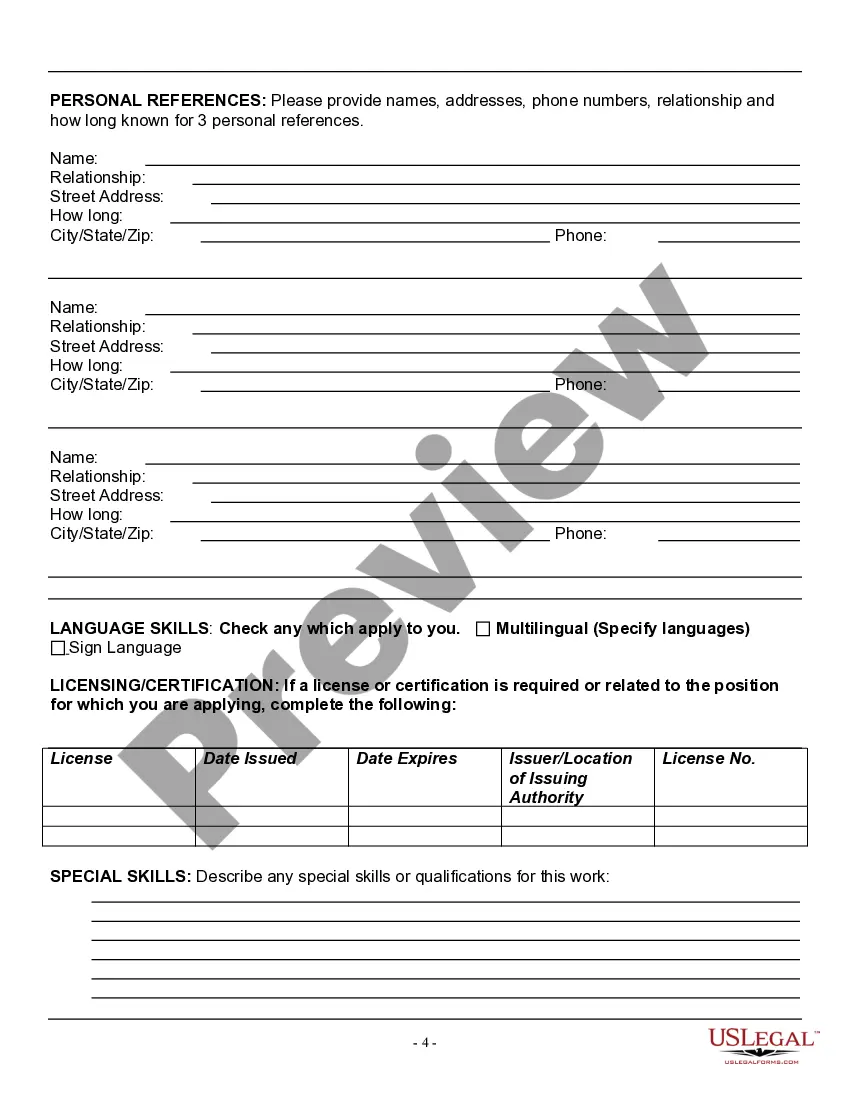

This form is an Employment Application. The form provides that applications are considered without regard to race, color, religion, or veteran status.

Free preview

Form popularity

More info

Employers are required to withhold and pay personal income taxes on wages, salaries, bonuses, commissions, and other similar income paid to employees. The Tax Department is streamlining withholding tax and wage reporting forms and Web File applications.Today we are talking all about the new york state withholding form and how to fill that out. To claim exempt status, you must meet certain conditions and submit a new Form W-4 and a notarized, unaltered Withholding Certificate Affirmation each year. Complete el Formulario W-4 para que su empleador pueda retener la cantidad correcta del impuesto federal sobre los ingresos de su paga. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. To figure out how much tax to withhold, employees on the payroll who work in the state, but live elsewhere, complete Form IT-2104.