Solicitud De Empleo Llena Withholding Tax In Suffolk

Category:

State:

Multi-State

County:

Suffolk

Control #:

US-00413-19

Format:

Word;

Rich Text

Instant download

Description

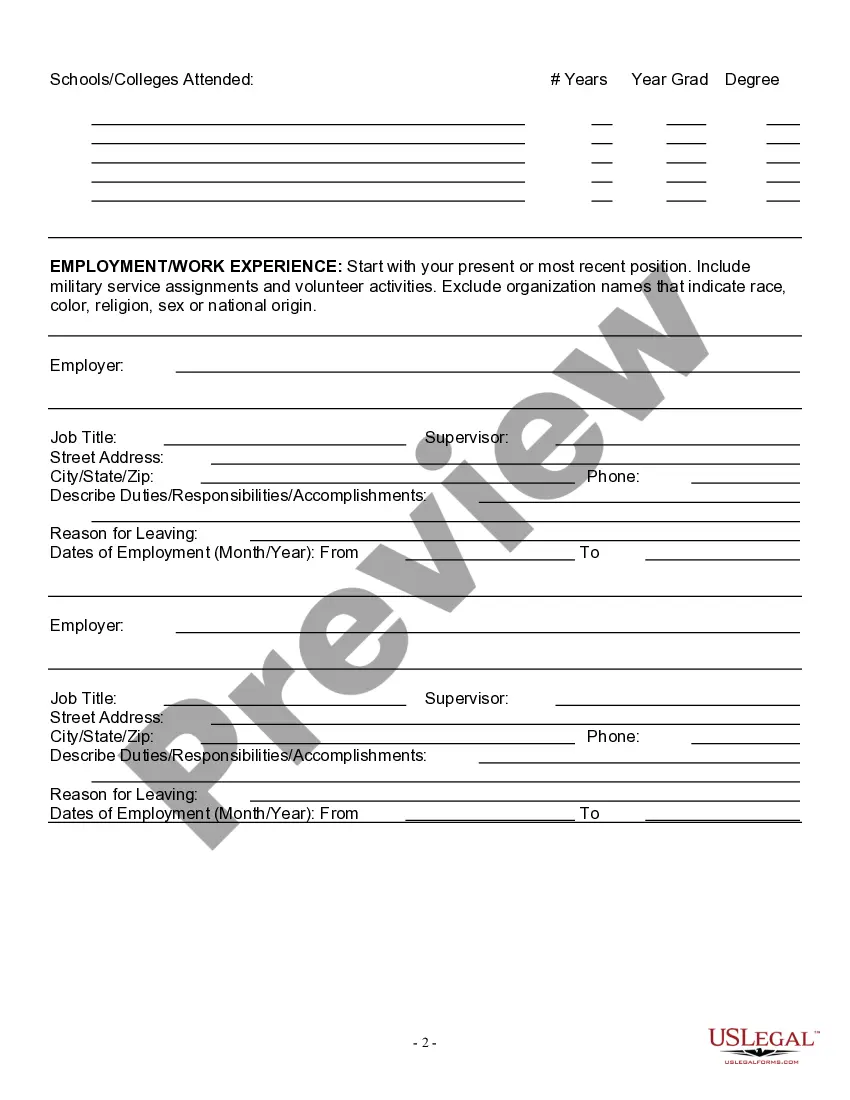

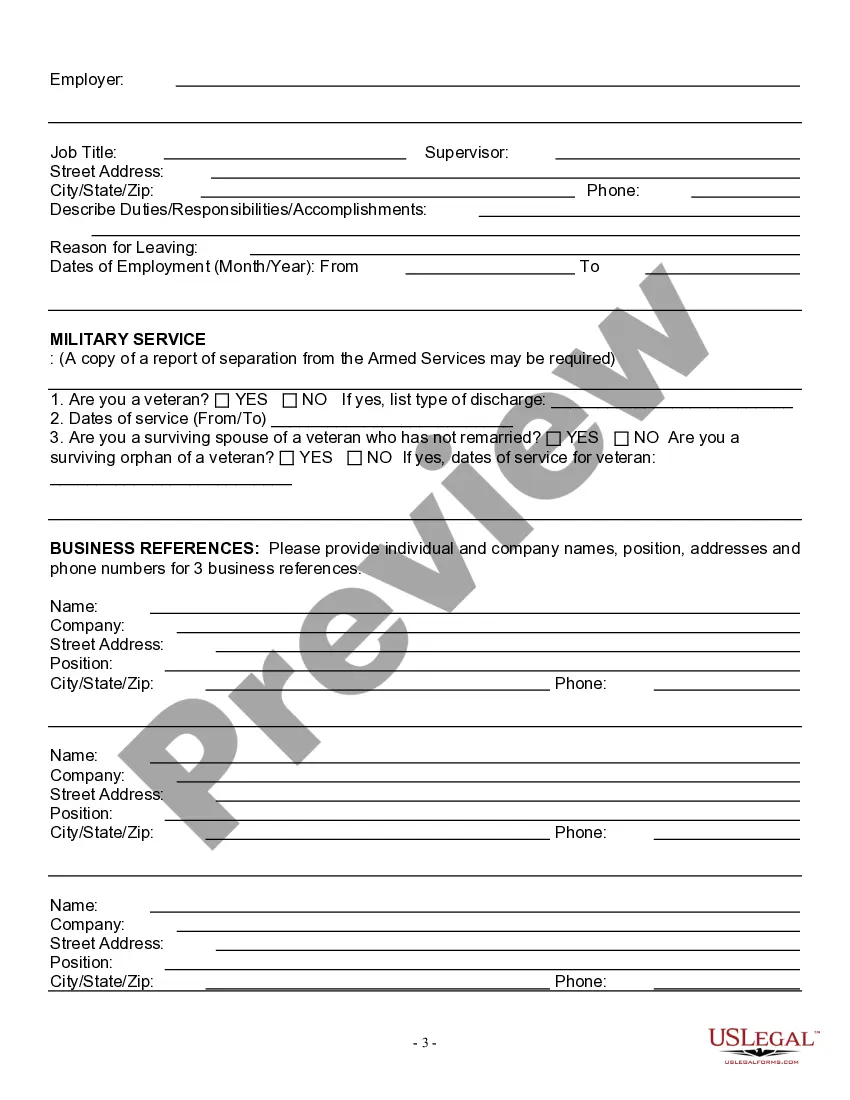

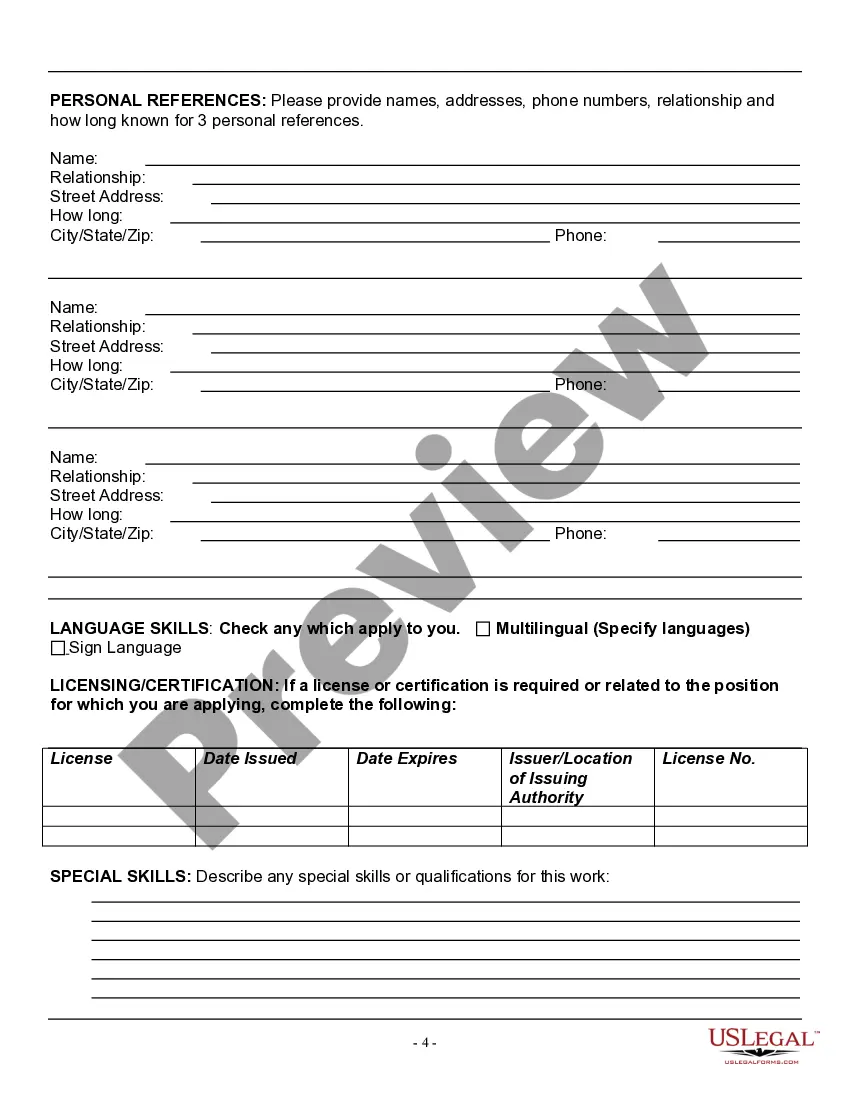

This form is an Employment Application. The form provides that applications are considered without regard to race, color, religion, or veteran status.

Free preview

Form popularity

More info

Employers are required to withhold and pay personal income taxes on wages, salaries, bonuses, commissions, and other similar income paid to employees. Your employer will use the information you provide on this form—including residency, marital status, and allowances—to withhold these taxes from your pay.Today we are talking all about the new york state withholding form and how to fill that out. The Department of Labor, Licensing and Consumer Affairs promotes the health, safety and economic well-being of both the business community and public alike. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. This video goes over how to fill out a 2021 Form W-4 if you are single and the basics behind Form W-4.