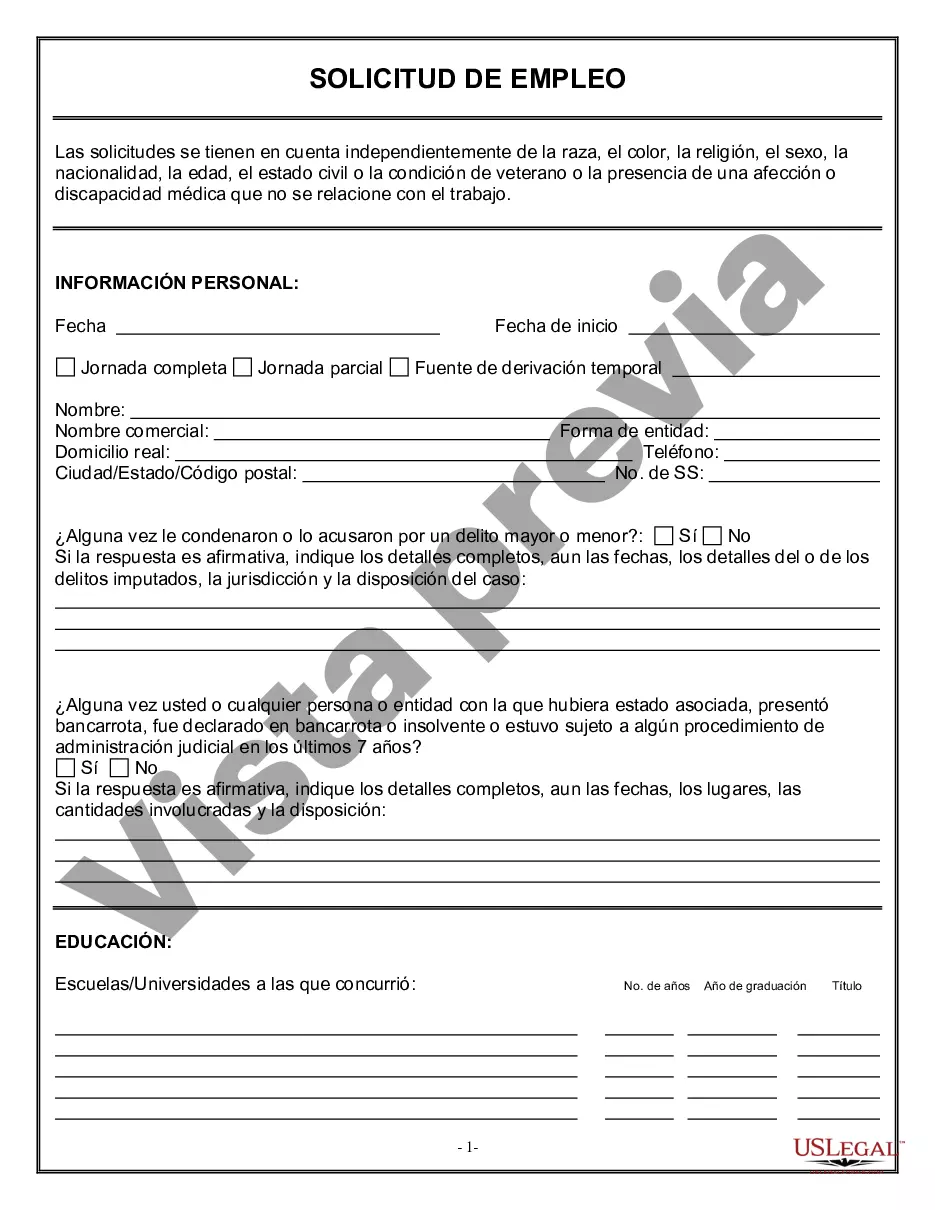

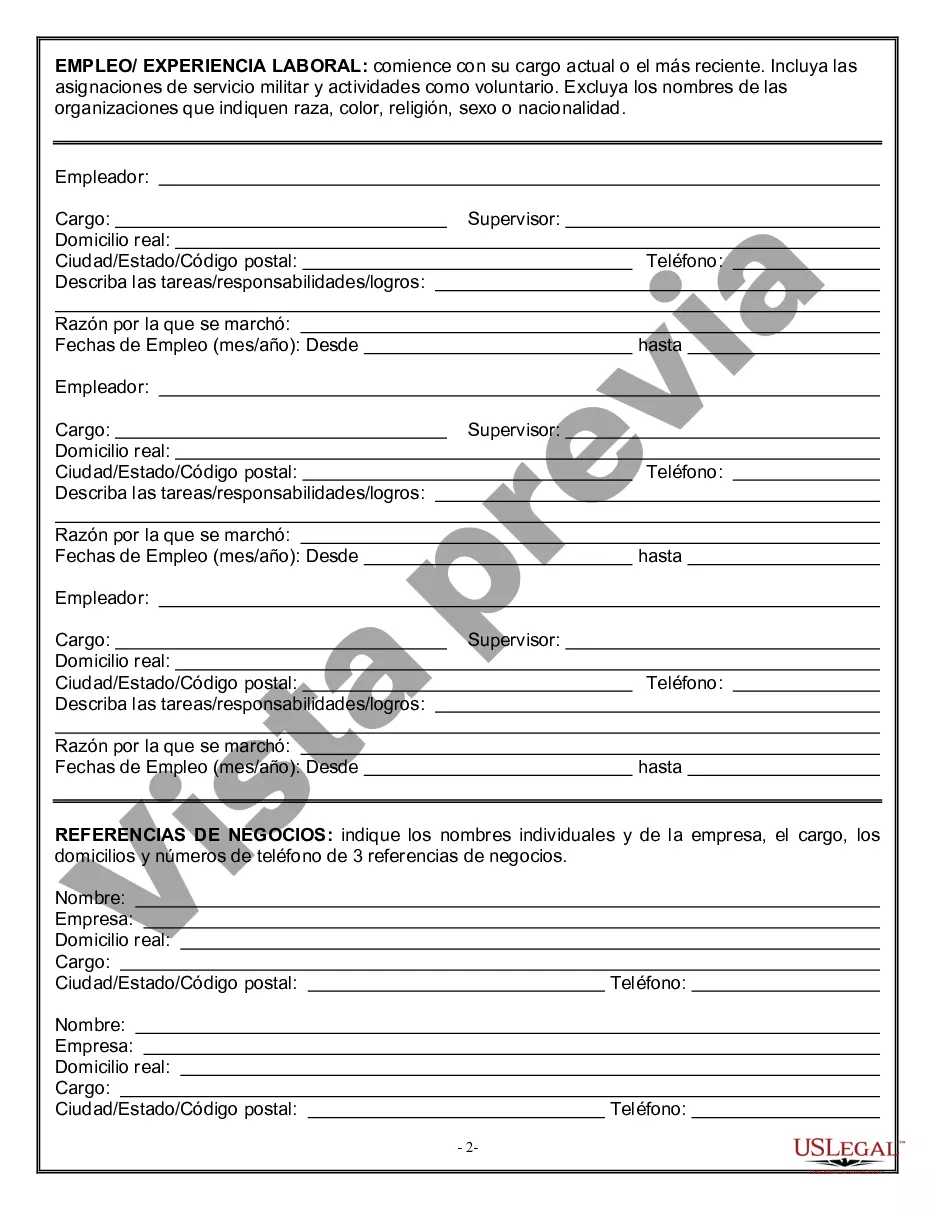

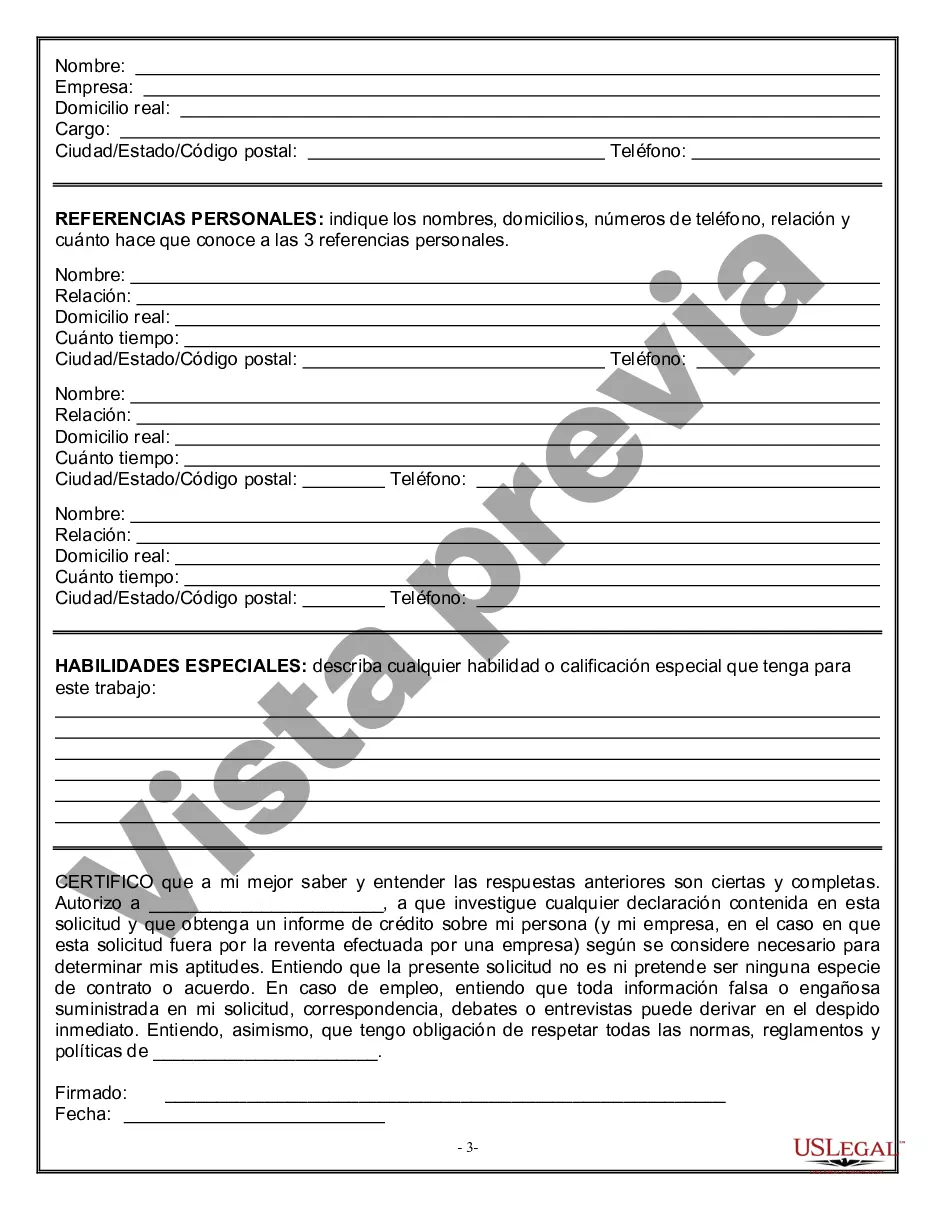

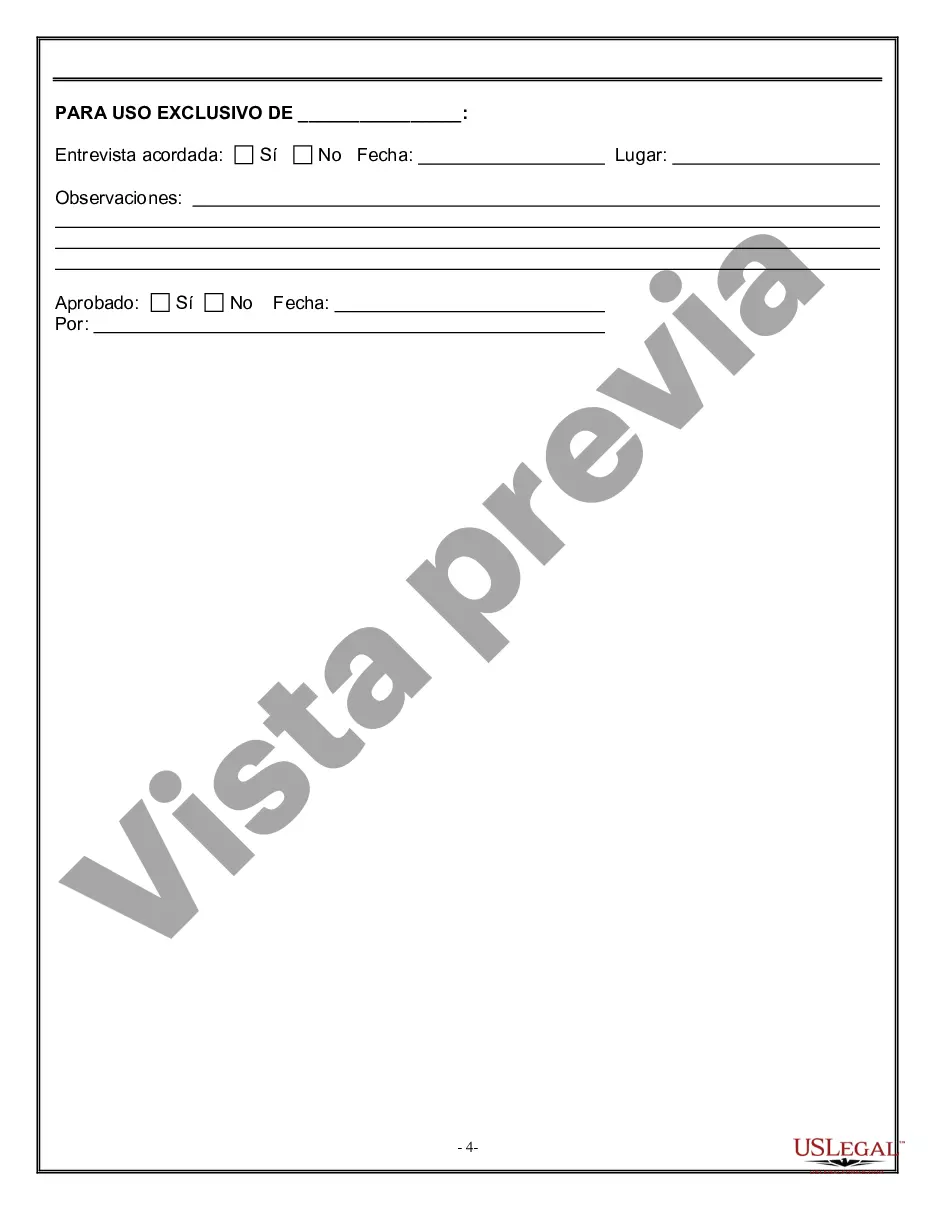

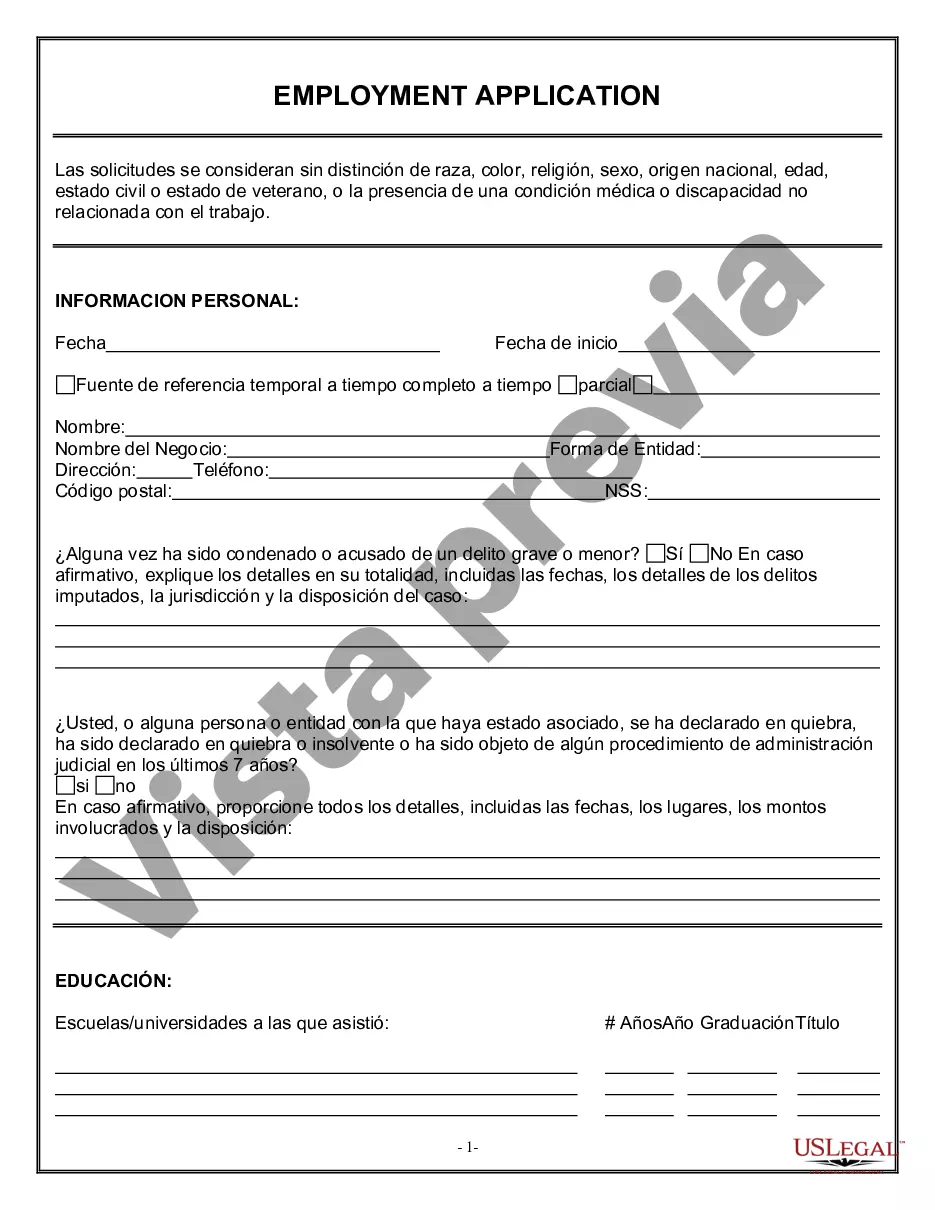

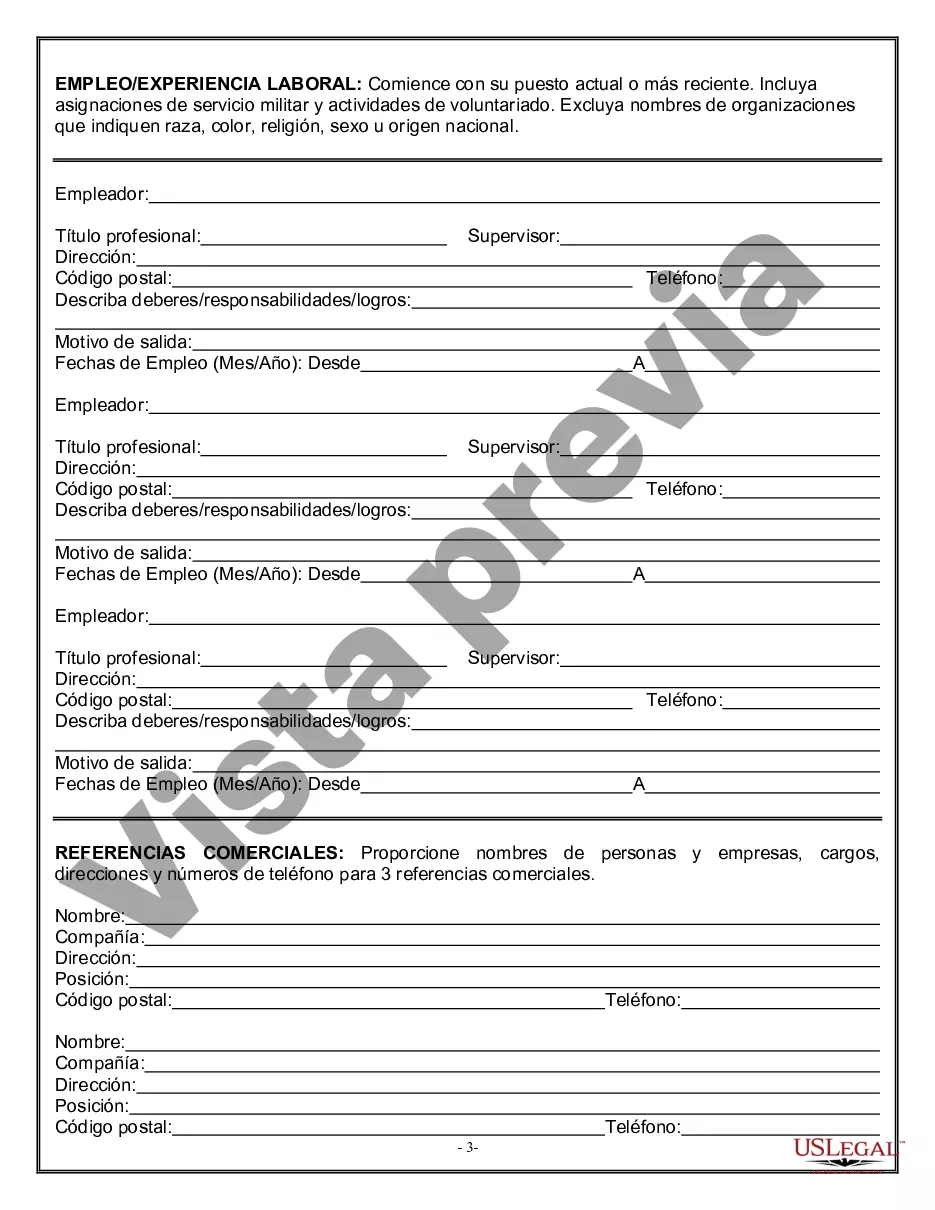

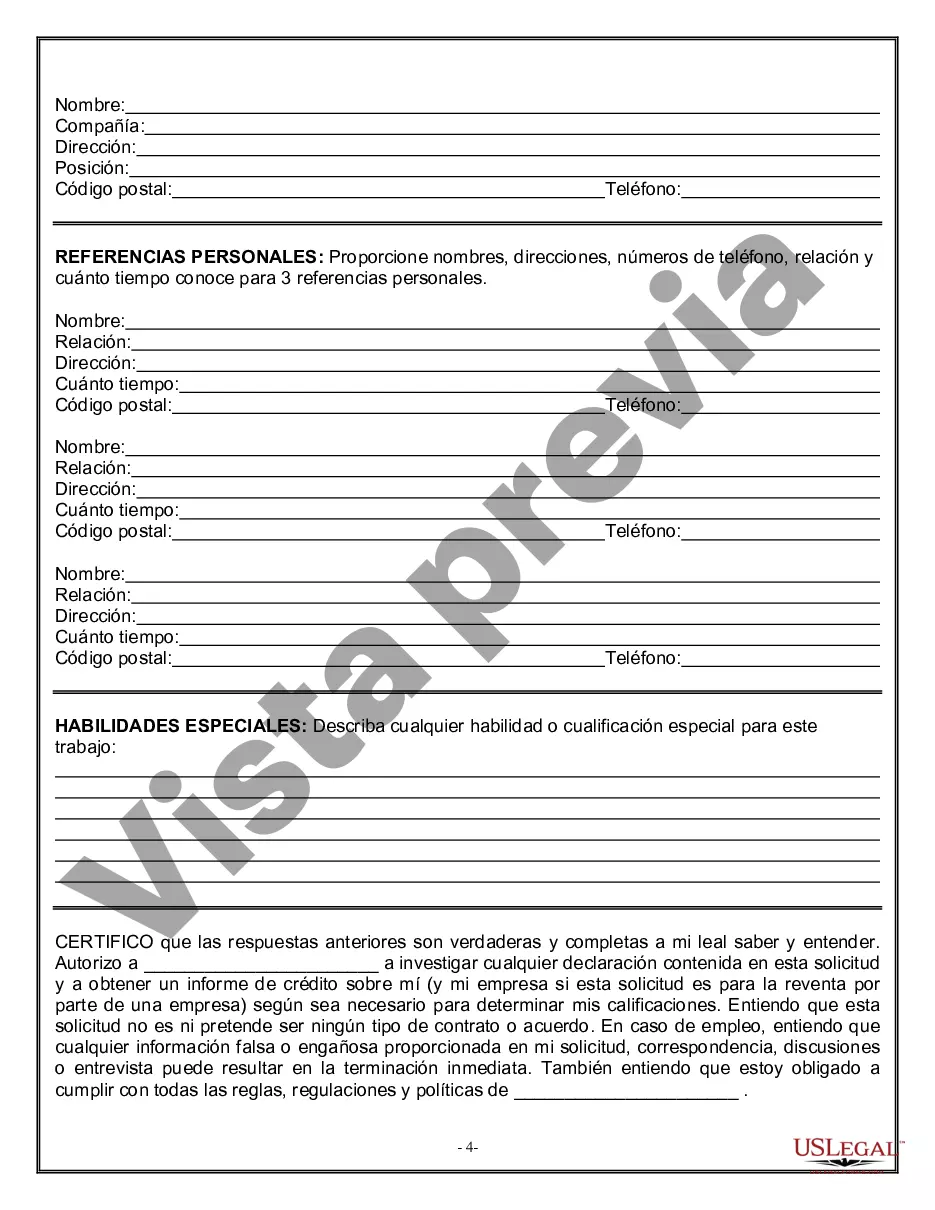

For your convenience, the complete English version of this form is attached below the Spanish version. This form is an Employment Application. The form provides that applications are considered without regard to race, color, religion, or veteran status. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Spanish Application For Employee Withholding Allowance Certificate In Georgia - Solicitud de Empleo - Employment Application

Instant download

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. Se trata de una solicitud de empleo. El mismo establece que las solicitudes se consideran independientemente de la raza, el color, la religión o su condición de veterano.

Free preview

Form popularity

More info

Employee Withholding Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Complete el Formulario W-4 para que su empleador pueda retener la cantidad correcta del impuesto federal sobre los ingresos de su paga.Georgia Form G-4, must be completed to know how much state income tax to withhold from your new employee's wages. Your employer will use the information you provide on this form—including residency, marital status, and allowances—to withhold these taxes from your pay. 4. Enter the number of dependent allowances you wish to claim, if any. 5. This application is used to apply for asylum in the United. States and for withholding of removal (formerly called. Demographic and Administrative Forms for New Employees. Form Number (if applicable), Form Description. Sales Tax Forms ; DP-1, 22917, Application for Direct Pay Authorization, fill-in pdf ; FPS-103, 52668, Fireworks Public Safety Fee Form, INTIME or fill-in-pdf.