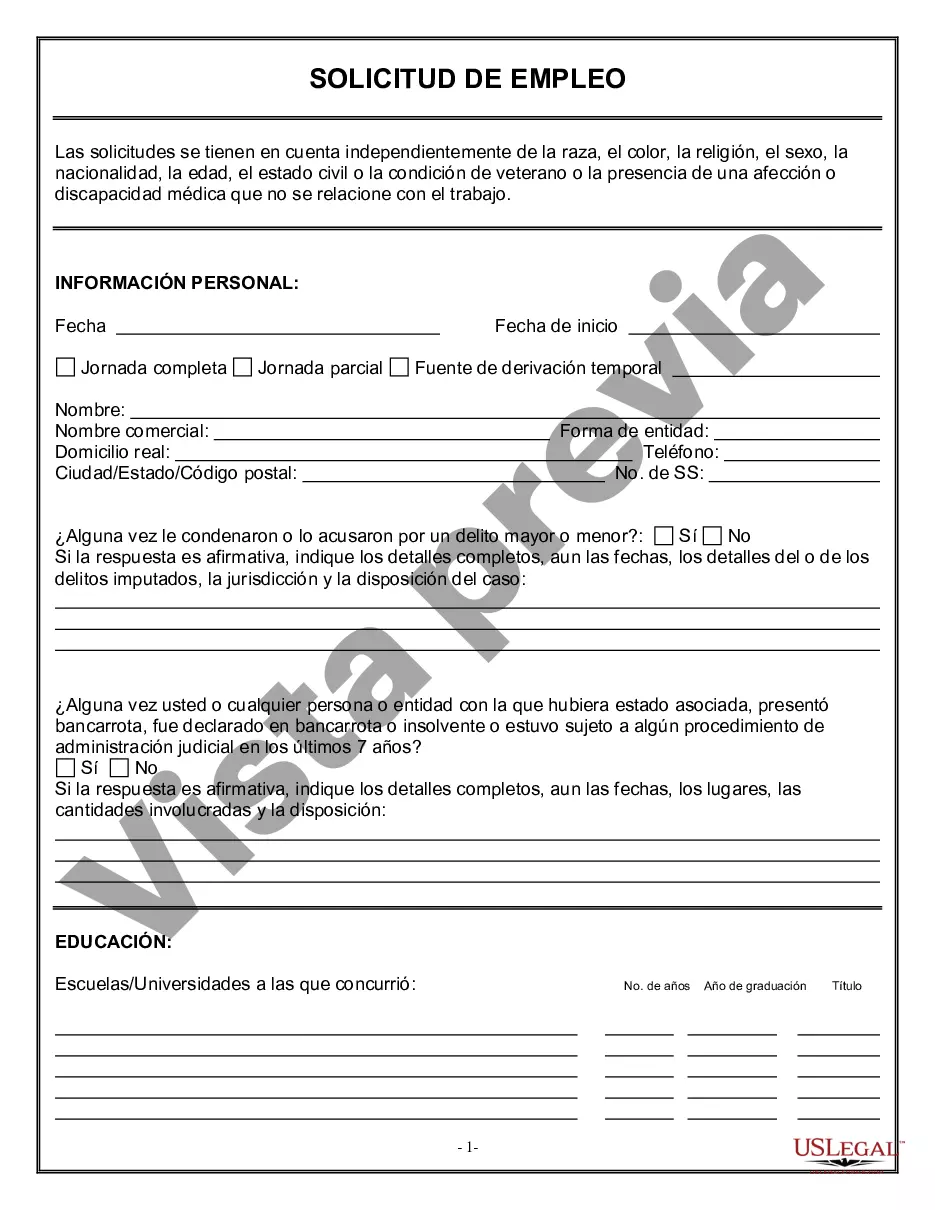

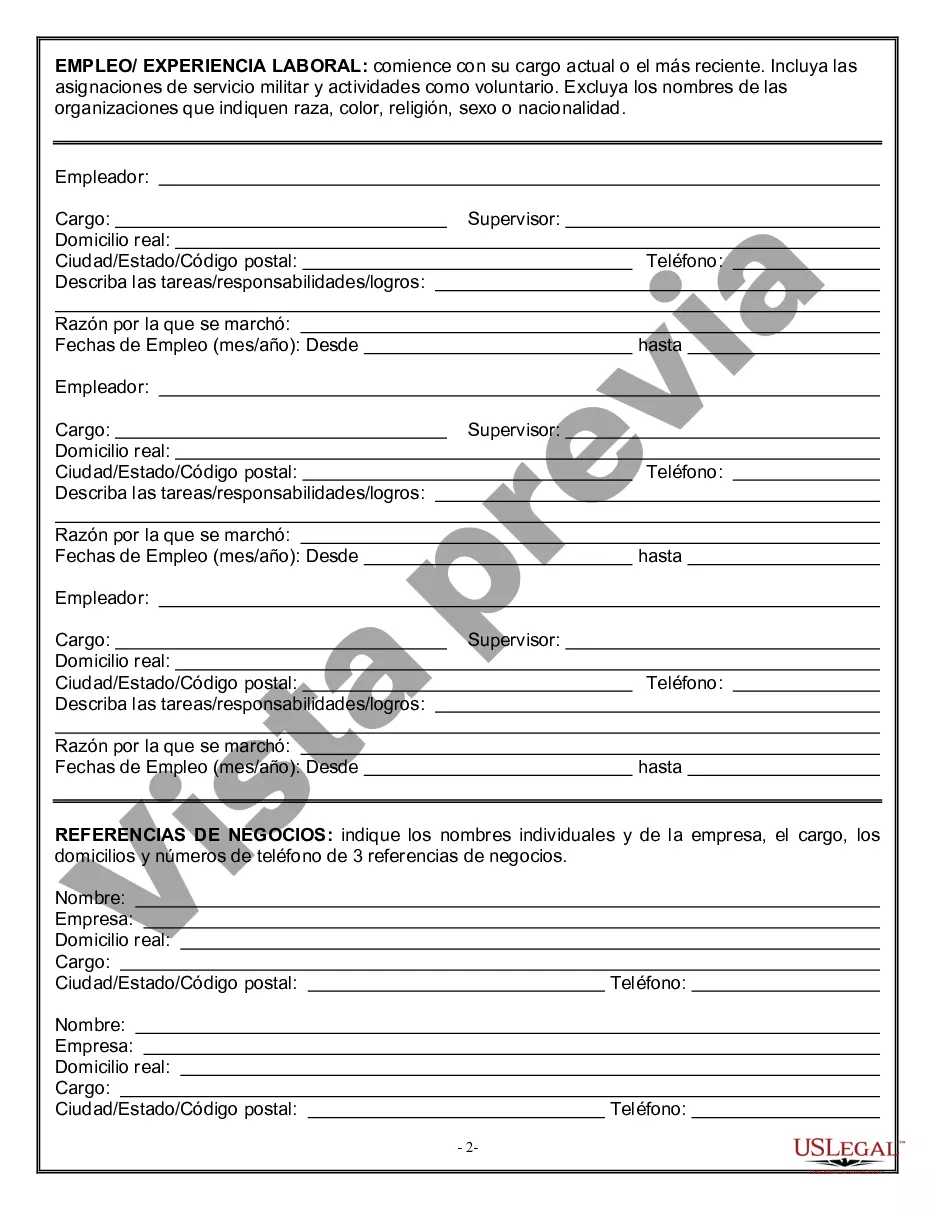

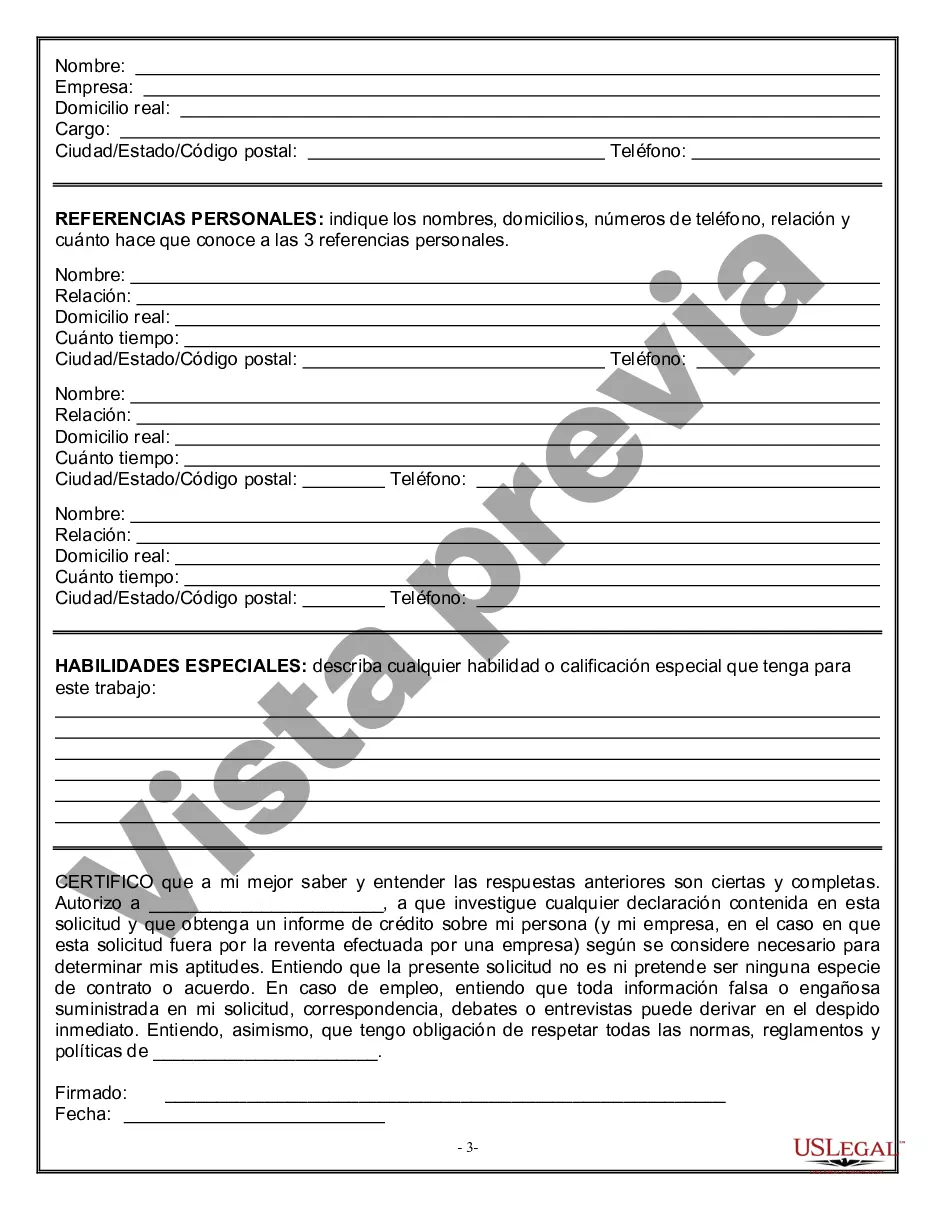

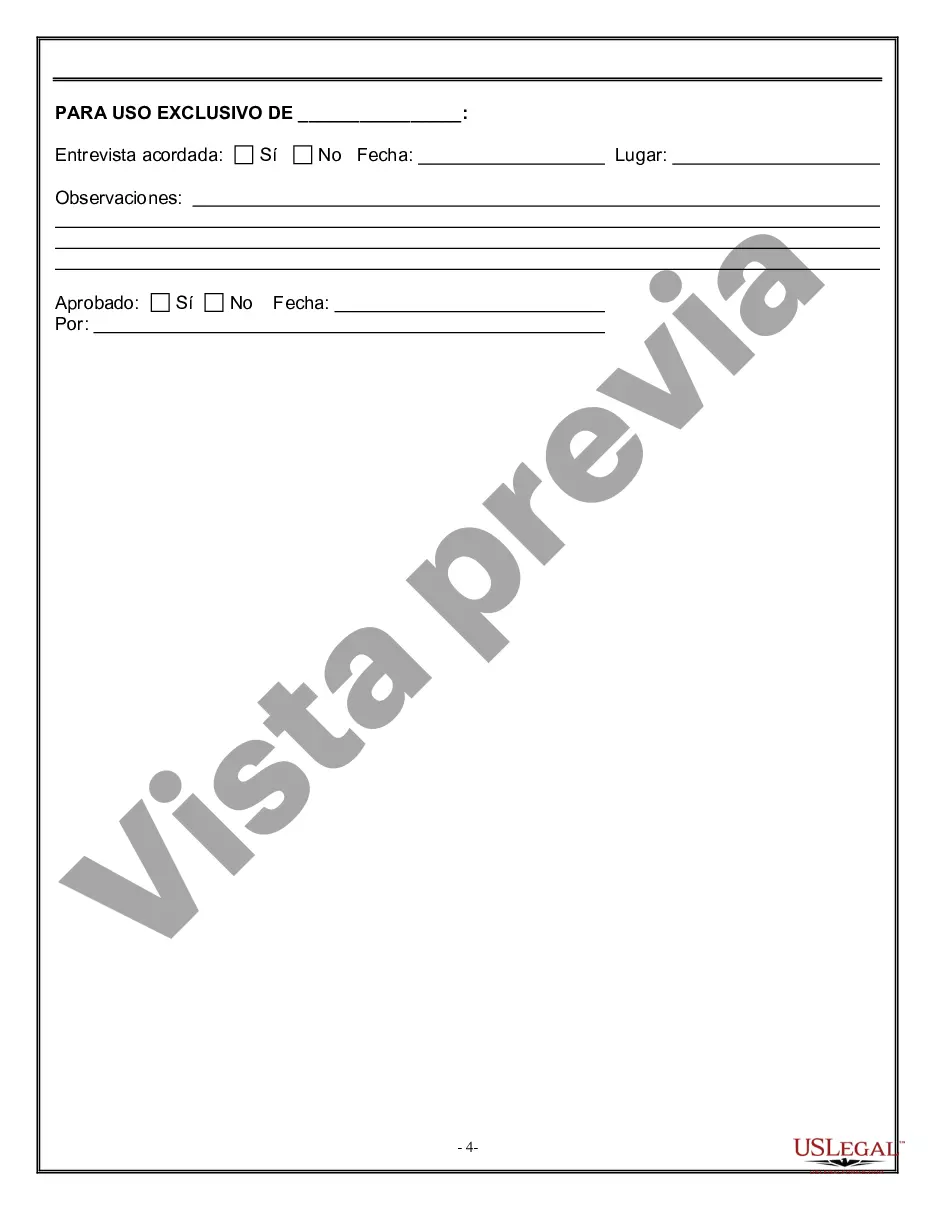

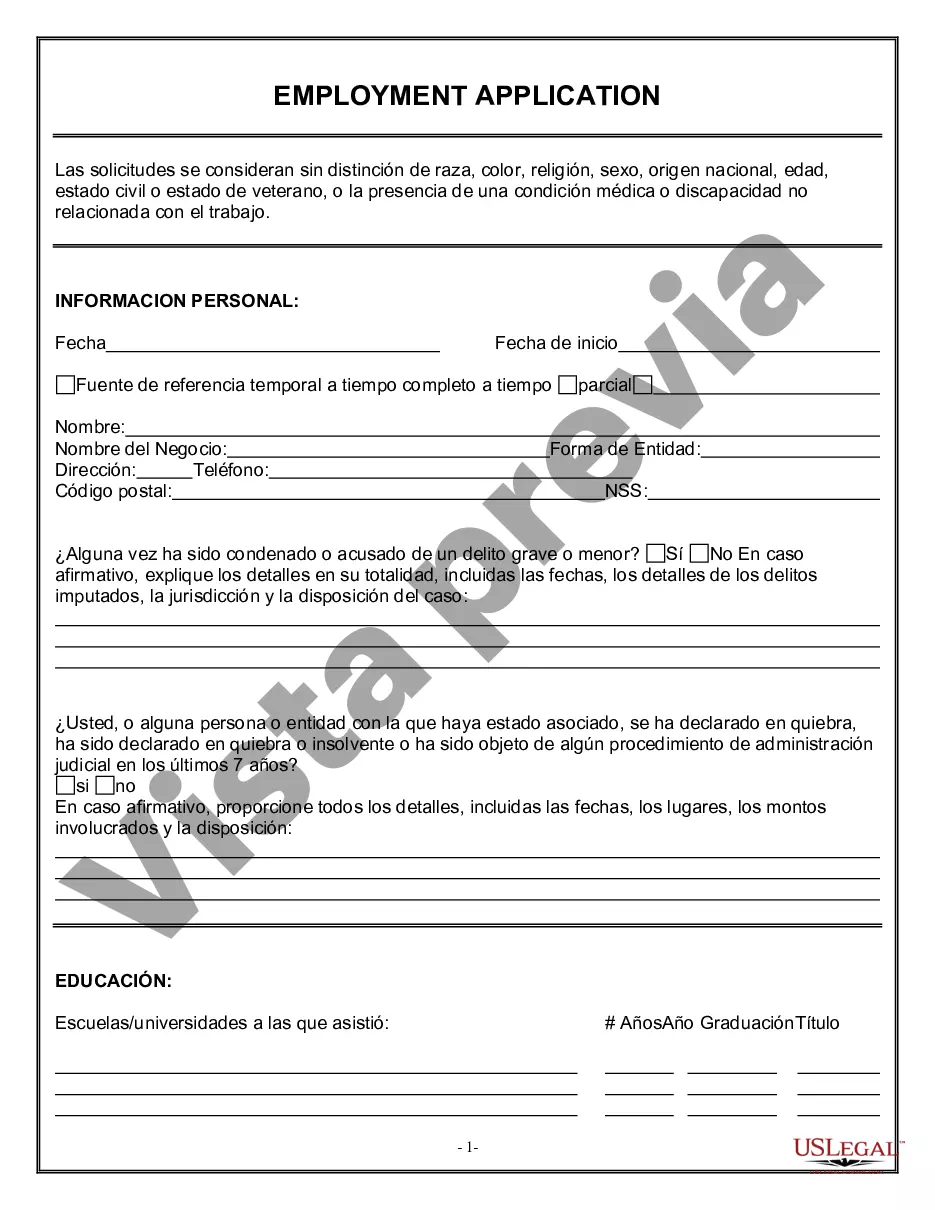

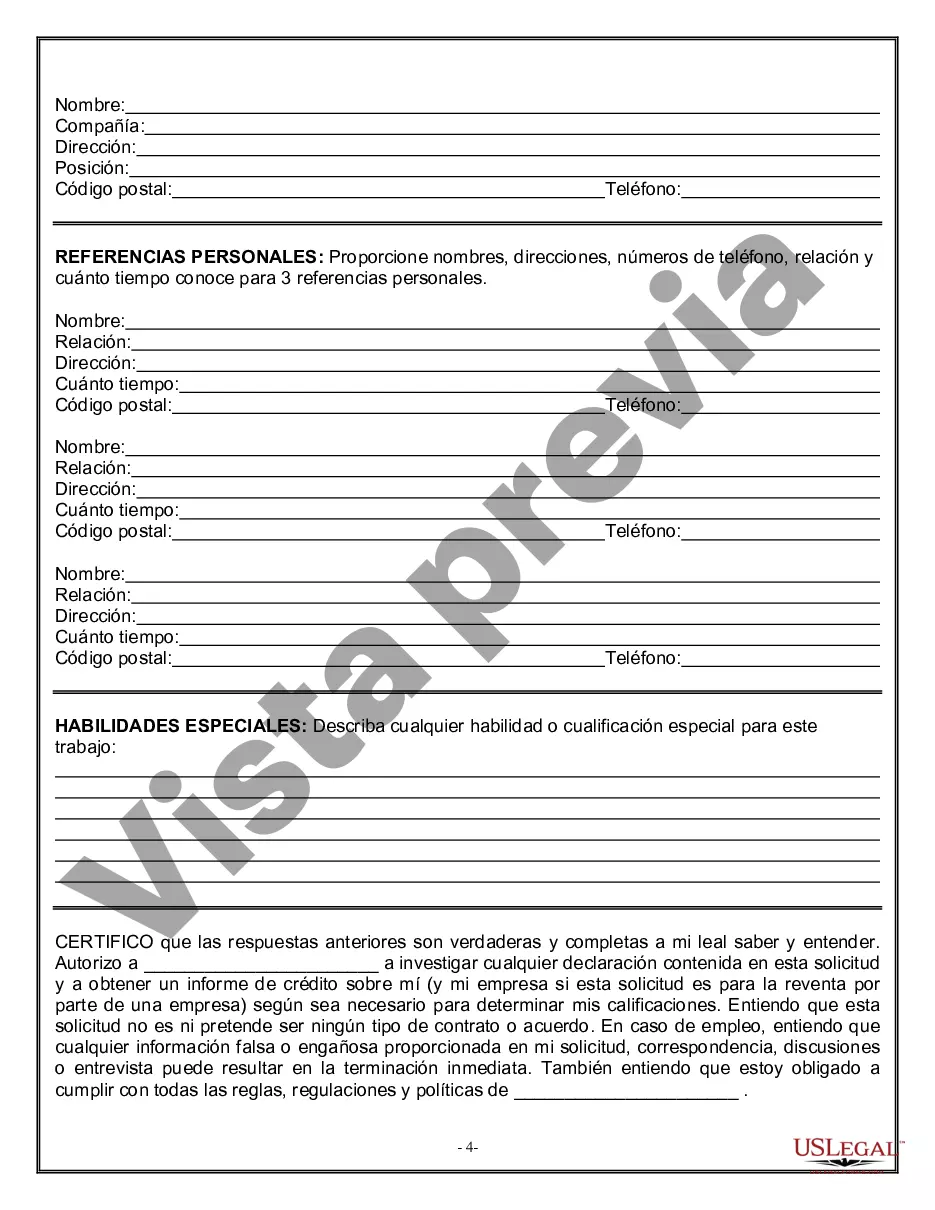

For your convenience, the complete English version of this form is attached below the Spanish version. This form is an Employment Application. The form provides that applications are considered without regard to race, color, religion, or veteran status. Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Employment Application En Español Withholding Certificate In Ohio - Solicitud de Empleo - Employment Application

Instant download

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. Se trata de una solicitud de empleo. El mismo establece que las solicitudes se consideran independientemente de la raza, el color, la religión o su condición de veterano.

Free preview