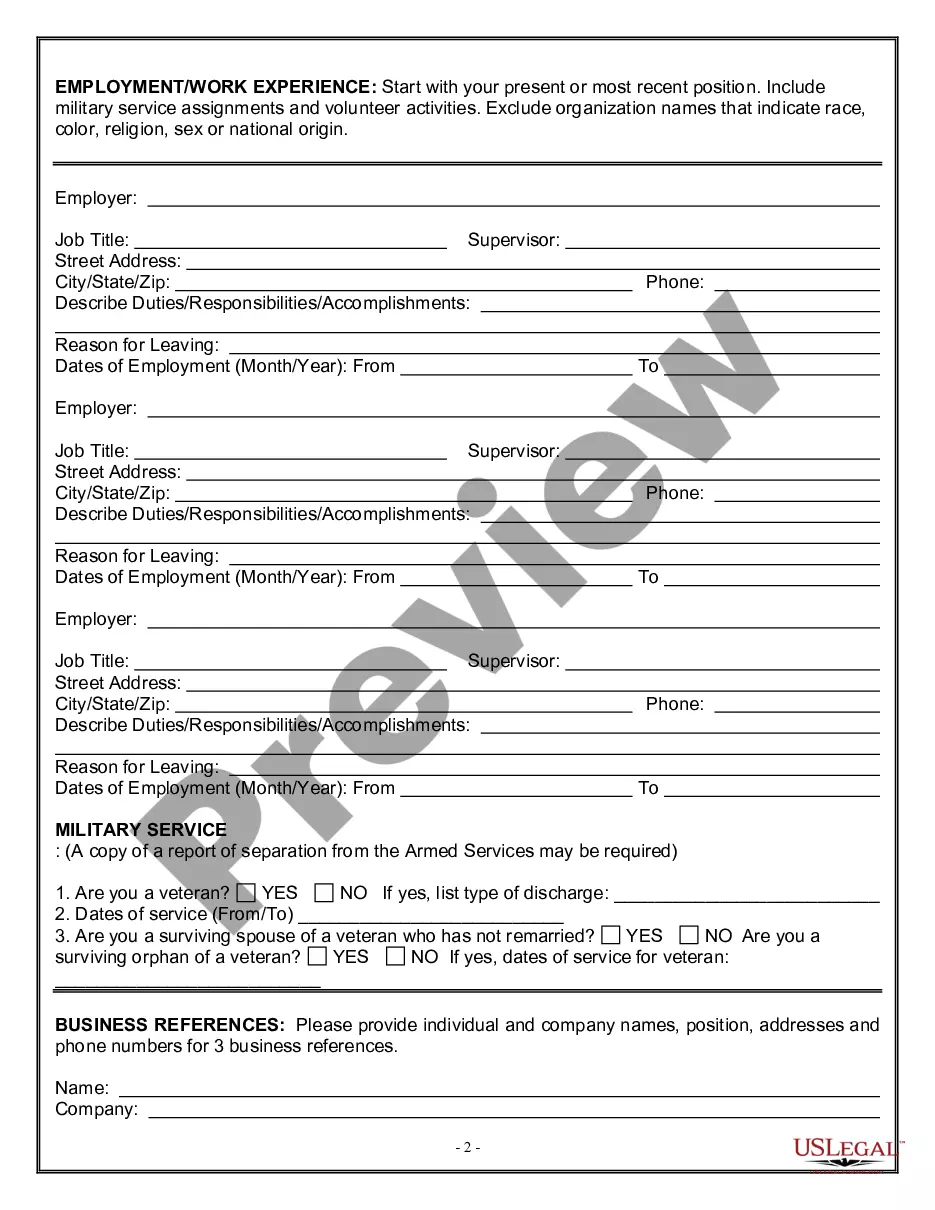

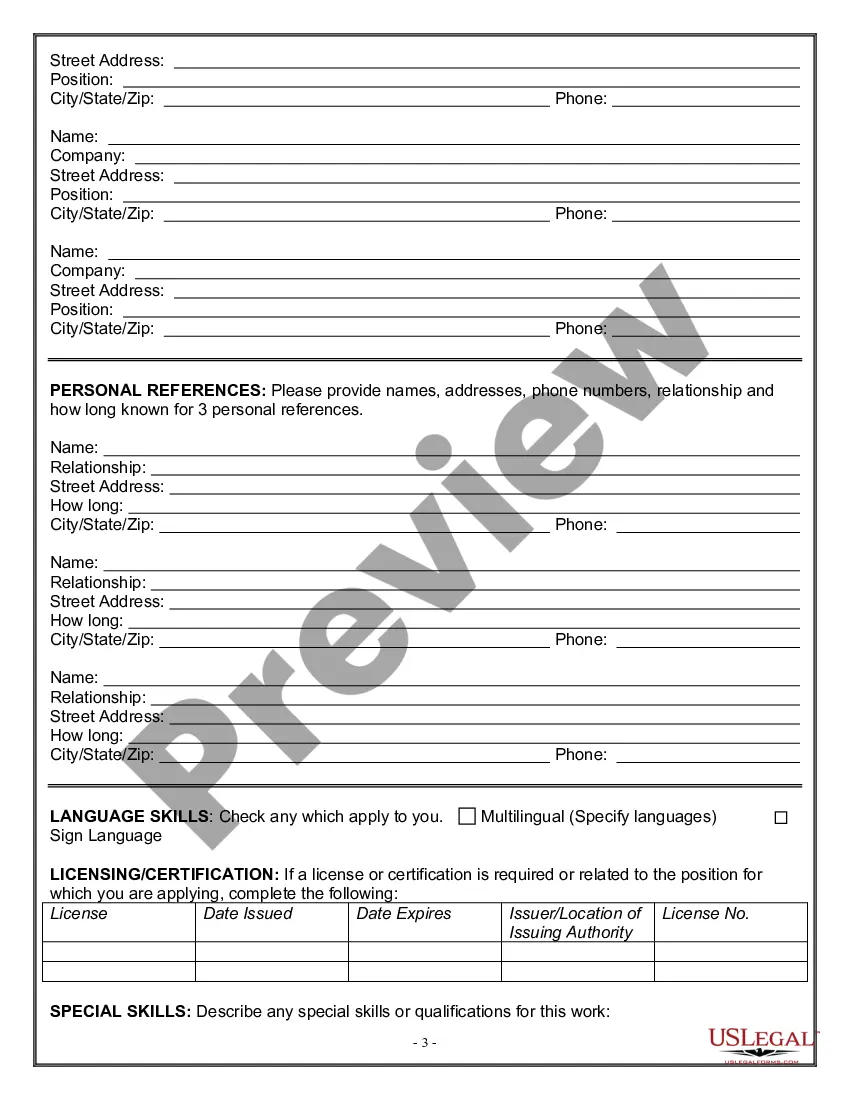

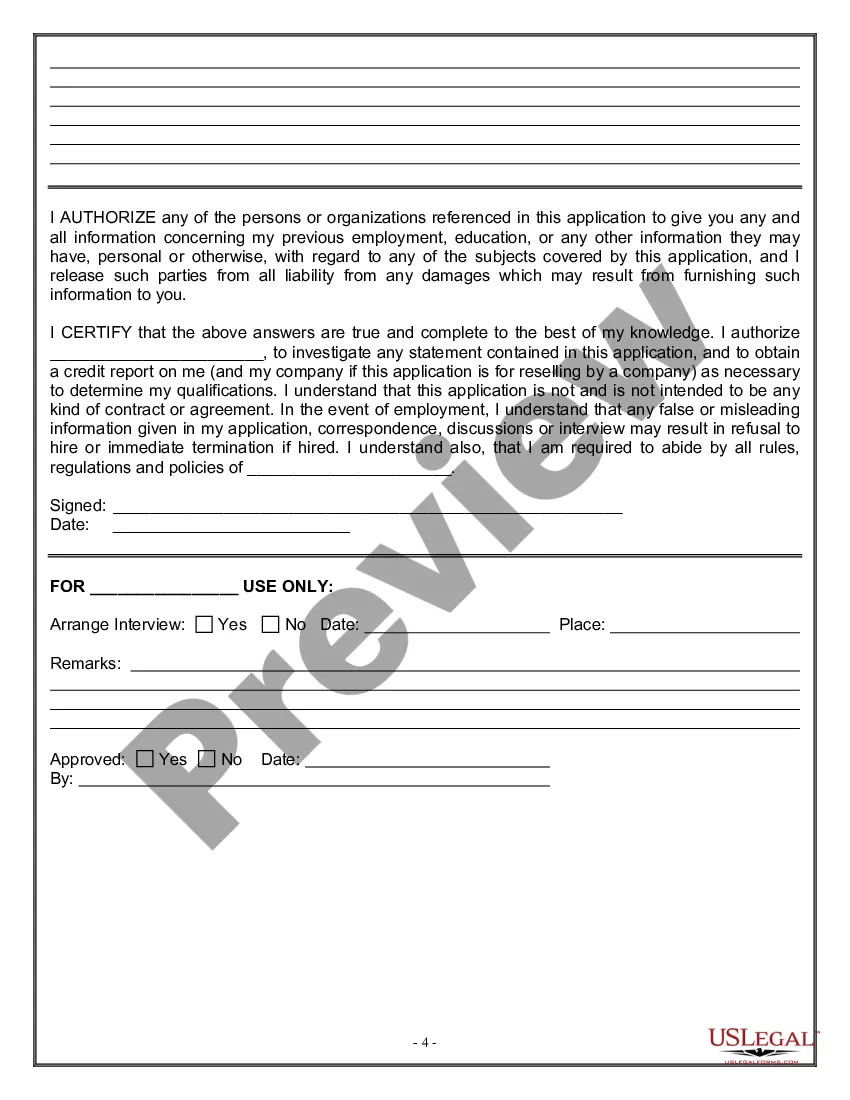

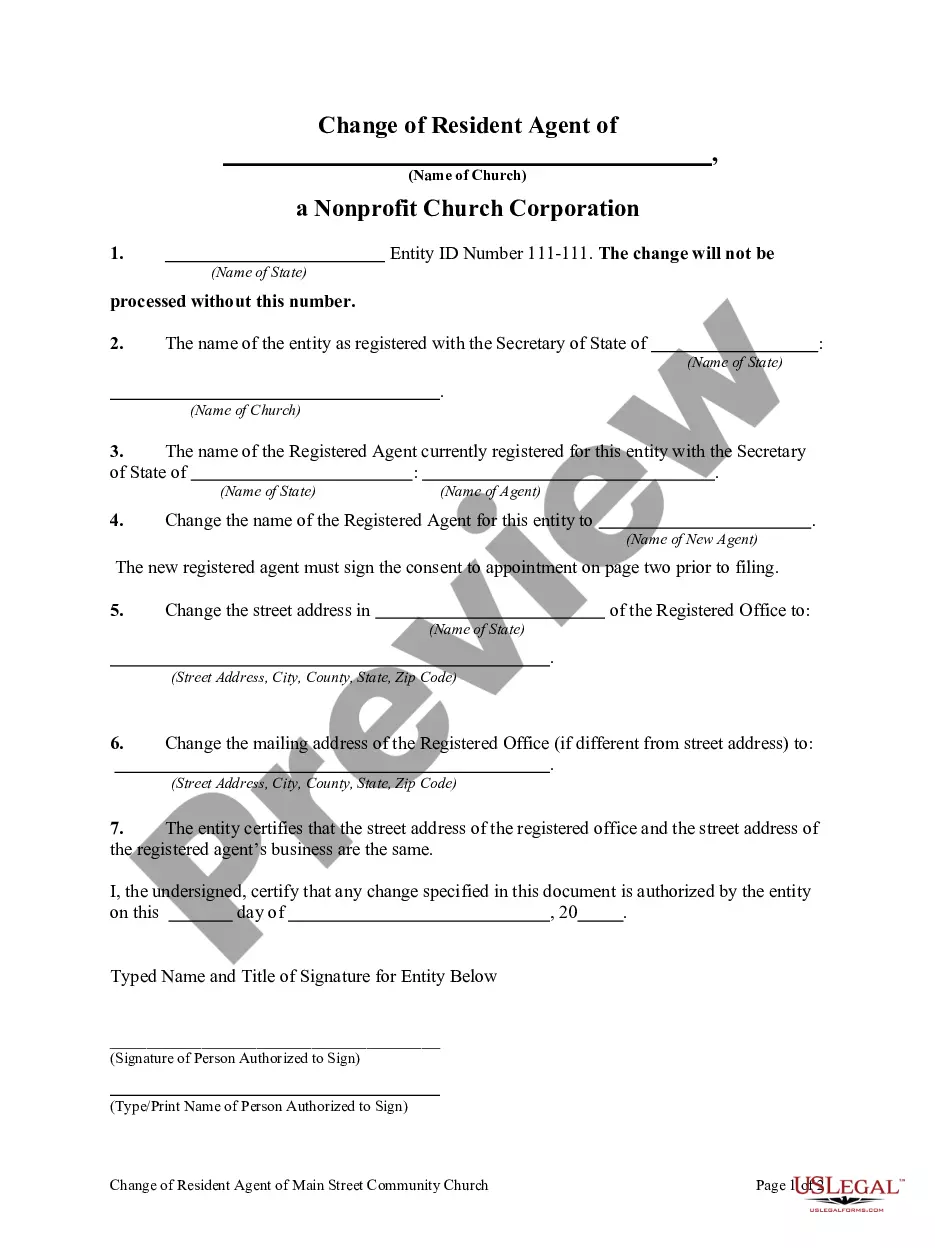

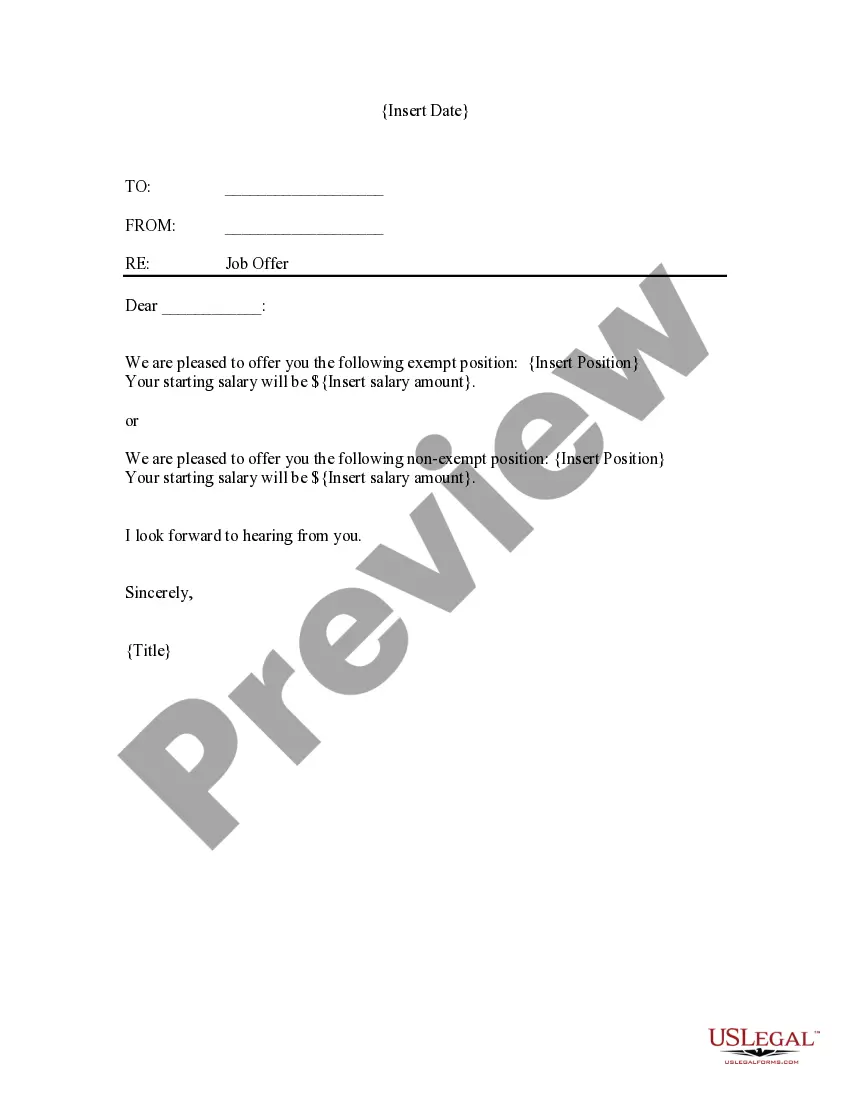

This form is an Employment Application. The form provides that applications are considered without regard to race, color, religion, or veteran status.

Employment Work Form With Social Security Number In Maryland

Instant download

Description

Free preview

Form popularity

More info

An employee's SSN can be corrected in the BEACON portal. To do so: Select "Wage Submission" from the portal's left menu.Not all forms are listed. ○ You must provide your Social Security number in the Social Security number field in Section 1. Fill out Section A and take the form to your employer. Before you start, you will need several documents that prove your identify. When you receive the worker's Social Security number, file Form W-2c (Corrected Wage and Tax Statement), to show the worker's number. The Social Security Administration (SSA) will not issue a SSN to any F-1 student who has not already been given an offer of paid employment. Employer's EIN Number. Optional: A recent pay stub may be used instead of an employment letter.