Employment Work Form Withholding In Orange

Category:

State:

Multi-State

County:

Orange

Control #:

US-00413

Format:

Word;

Rich Text

Instant download

Description

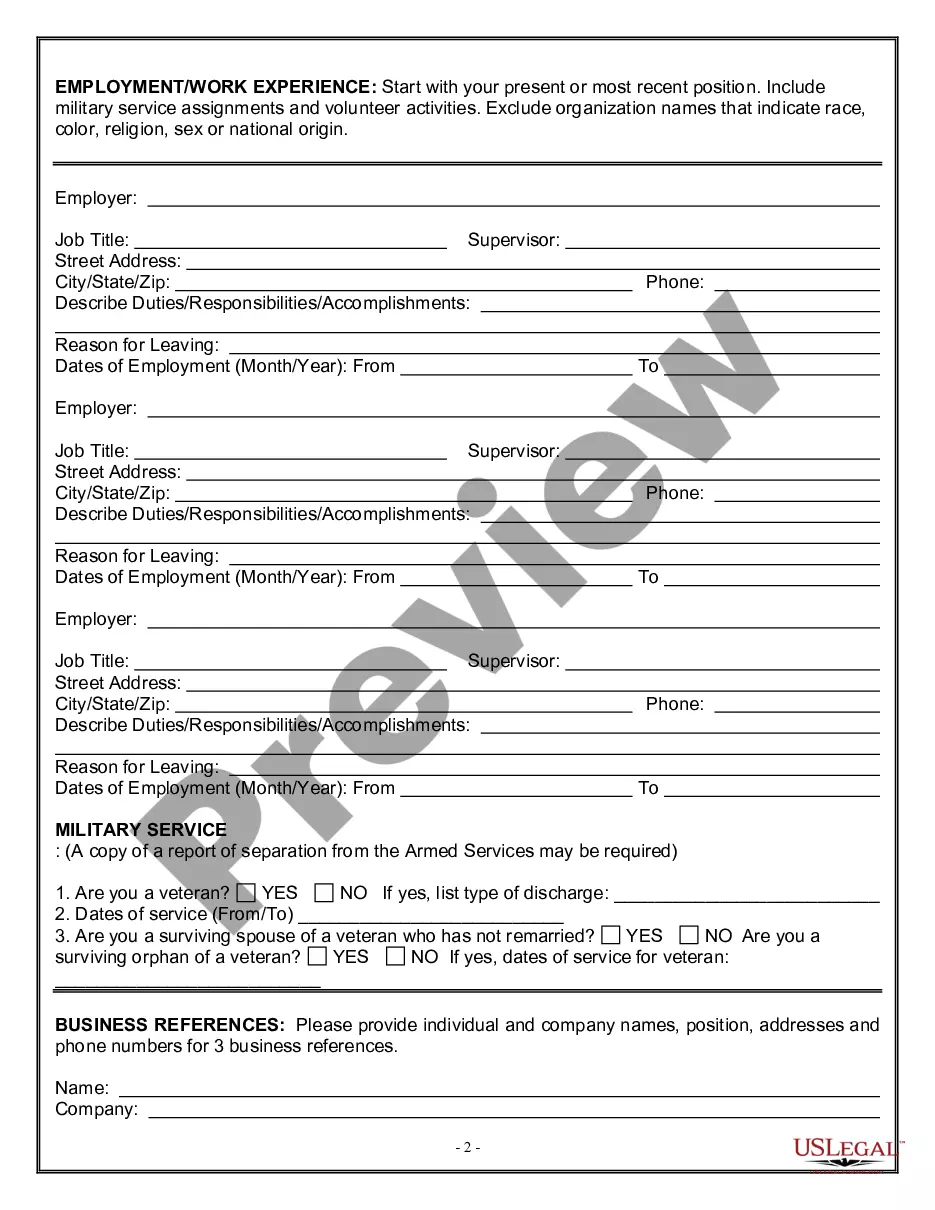

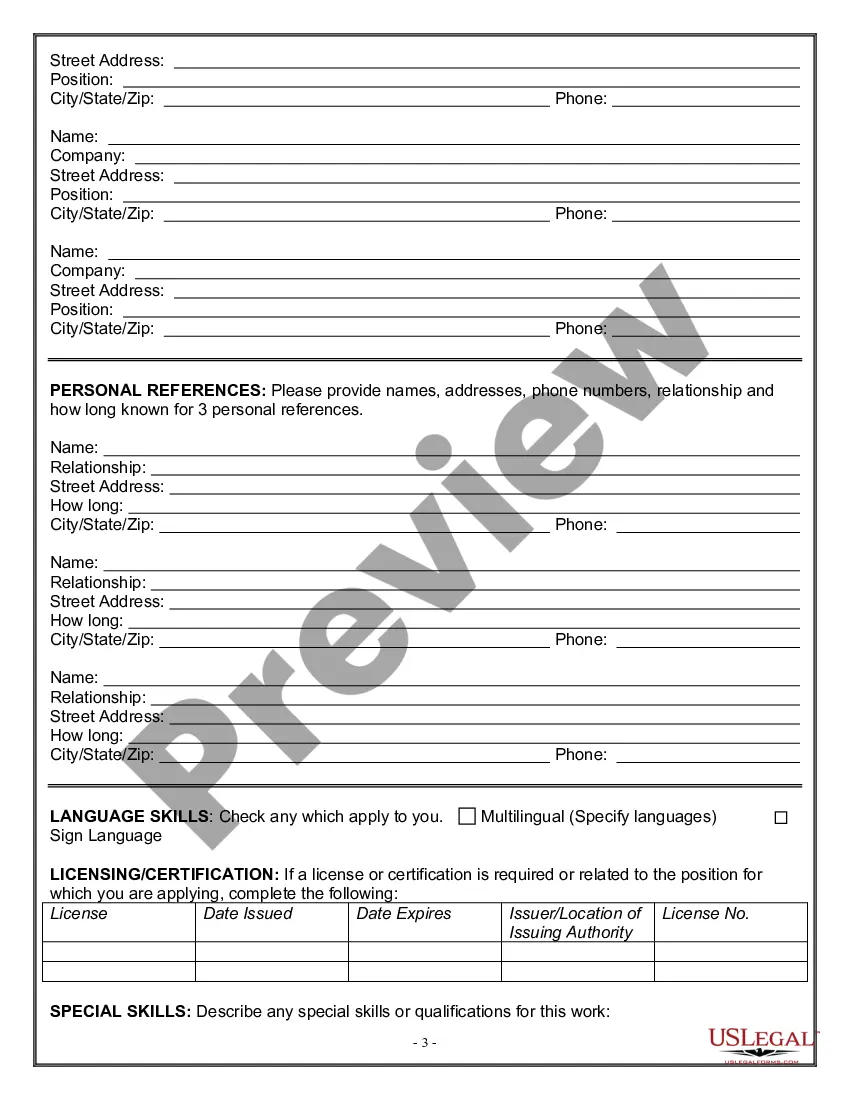

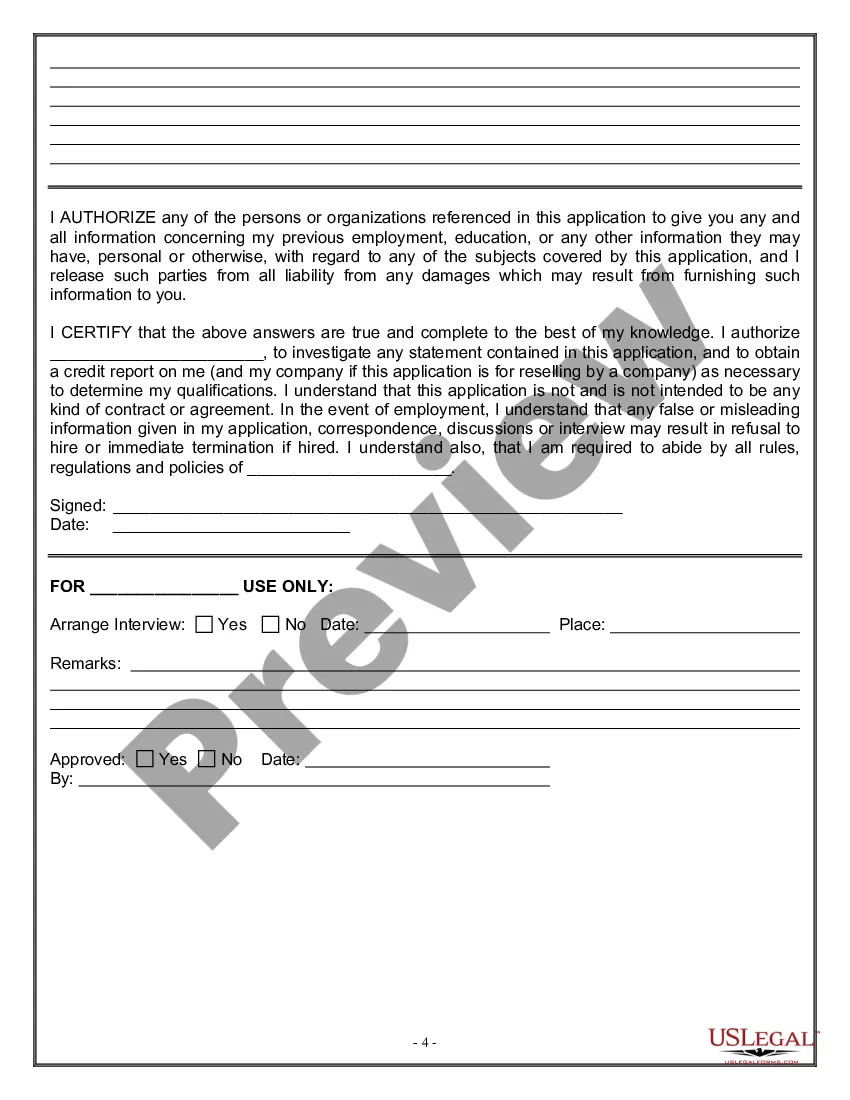

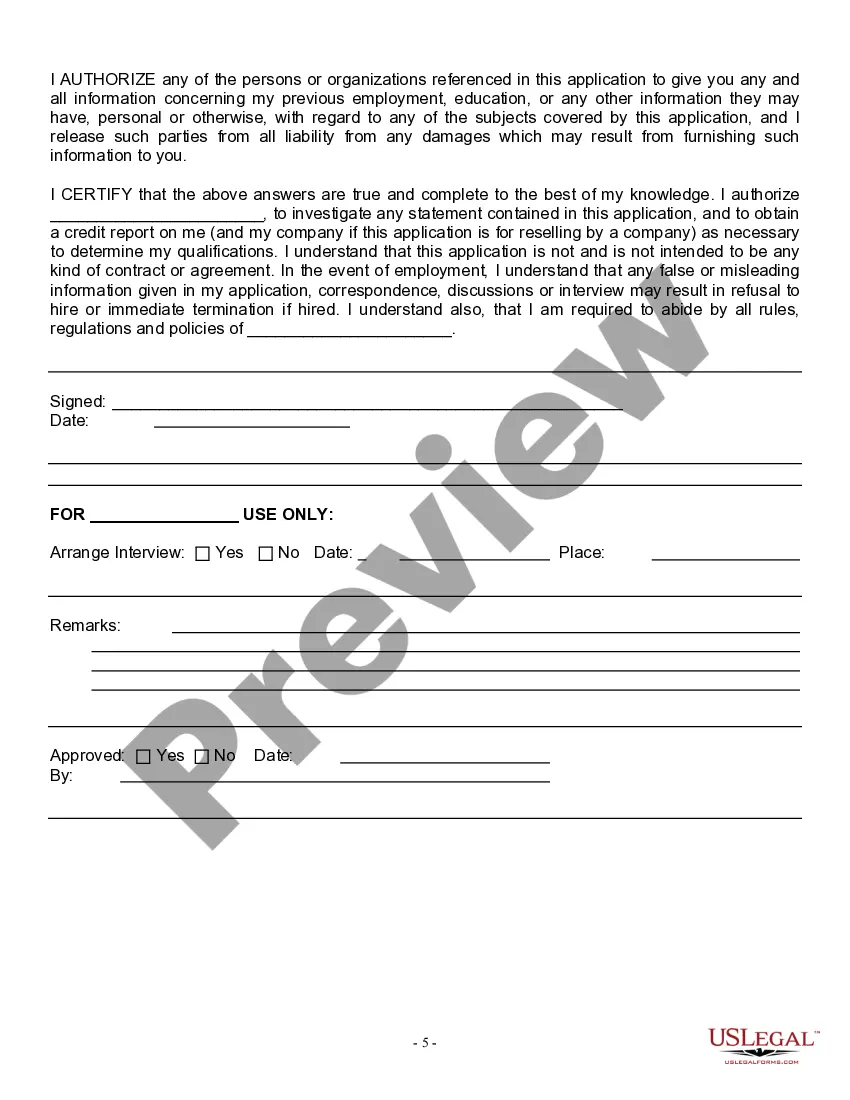

The Employment Work Form Withholding in Orange is designed for employers to gather essential information from job applicants. This form includes sections for personal information, employment eligibility, education, work experience, military service, business references, personal references, language skills, licenses, and certifications. It is vital for ensuring compliance with state and federal employment laws by requiring details about the applicant's ability to work in the United States and any past bankruptcy history. Users are instructed to fill out the form accurately and provide true statements, understanding that any falsehoods may lead to dismissal from employment. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants as it simplifies the application process and ensures that screening aligns with legal requirements. Properly managing and storing these forms can also assist firms in avoiding potential liability issues related to employment discrimination and eligibility verification.

Free preview