Bond Demand And Supply In Franklin

Category:

State:

Multi-State

County:

Franklin

Control #:

US-00415BG

Format:

Word;

Rich Text

Instant download

Description

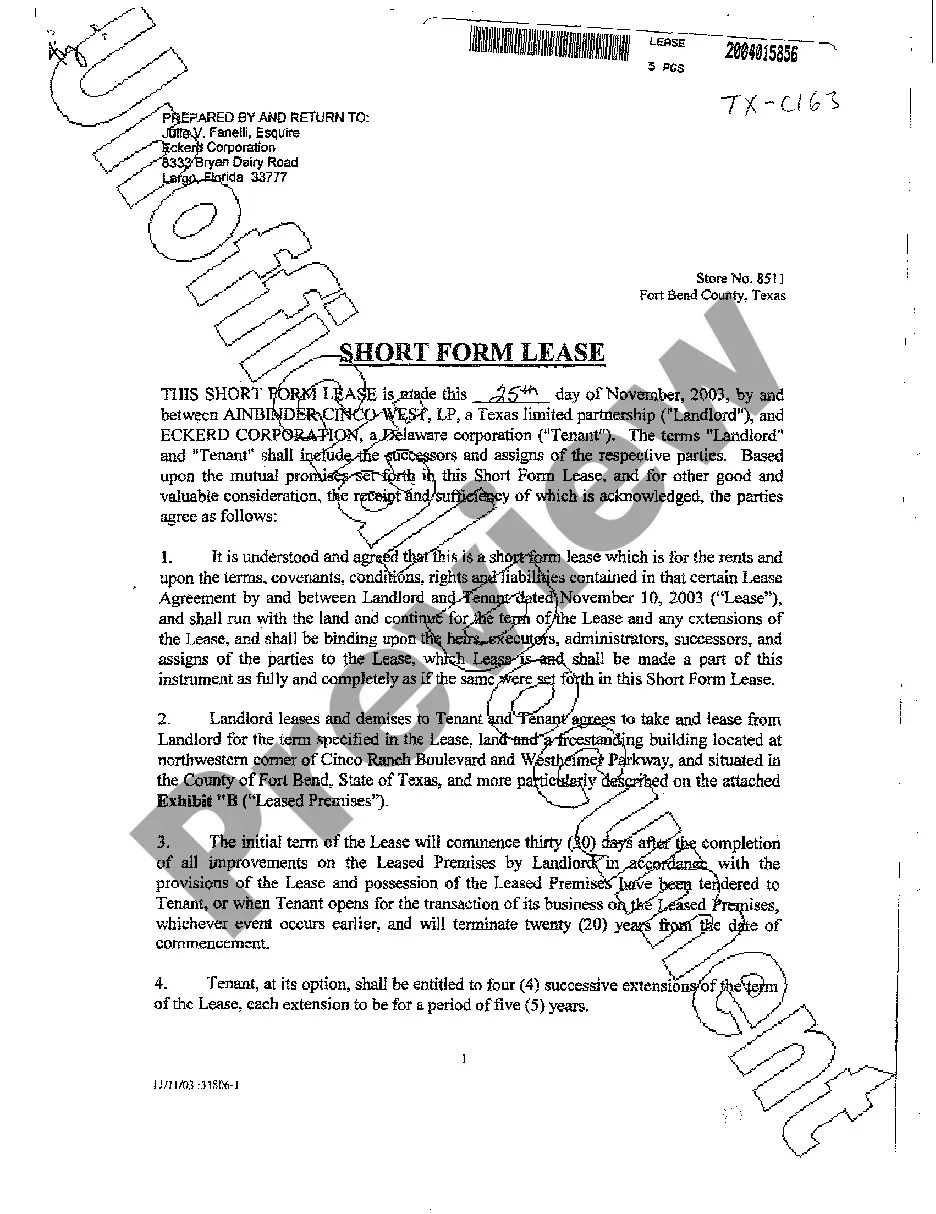

A Bond is a document with which one party promises to pay another within a specified amount of time. The term "demand" means that the principal plus any interest is due on demand by the bondholder rather than on a specific date. Bonds are used for many things, including borrowing money or guaranteeing payment of money. A bond can be given to secure performance of particular obligations, including the payment of money, or for purposes of indemnification. The validity of a "private" bond, payable upon demand, is determined by the same principles applicable to contracts generally. The purpose of the bond must not be contrary to public policy; it must be supported by a valuable consideration; and there must be a clear designation of the obligor and the obligee. A bond procured through fraud or duress may be unenforceable, but mistake on the part of the obligor as to the contents of a bond, or its legal effect, is not a defense to enforcement of the bond.

Form popularity

More info

Along with a smaller supply of munis, demand is rising. Municipal bonds tend to trade less efficiently than other fixed income instruments.Brandywine Global sees plenty to like in credit markets. But dexterity and patience are key to finding opportunities and avoiding risks. We believe the concerns over rising US deficits, growing debt burdens and decreasing demand for US Treasuries are somewhat overstated. PERFORMANCE BOND REQUIRED (May be in form of cash or certified check). Supply is usually the culprit, not demand. The combination of higher prices and lower output generally arises from an adverse supply shock.