Demand For Bond Increase In Travis

Category:

State:

Multi-State

County:

Travis

Control #:

US-00415BG

Format:

Word;

Rich Text

Instant download

Description

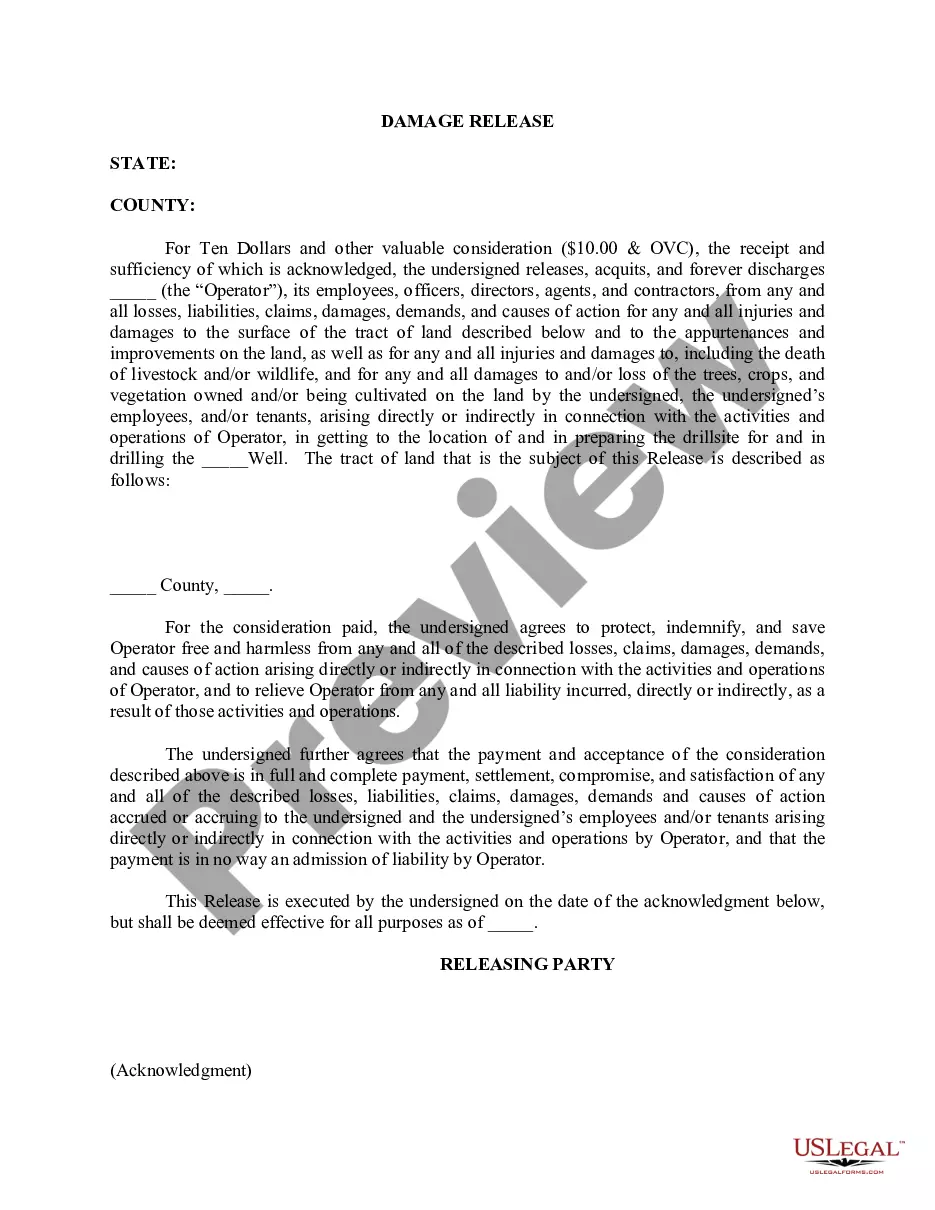

The Demand for Bond Increase in Travis is a legal form used to formalize an acknowledgment of indebtedness and set forth the terms for repayment. This form includes essential details such as the borrower’s name and address, the lender's name and address, the amount owed in dollars, and the applicable interest rate. It serves to secure the payment of a debt and bind the borrower and their legal representatives to the terms stated. Users should fill out the form carefully, ensuring that all blanks are completed accurately, and provide any necessary signatures in the designated areas. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form helpful in facilitating the documentation of debt obligations and ensuring lawful recovery processes. It can be particularly useful in cases where there is a need to increase the existing bond amount or clarify the terms of repayment, providing legal assurance to lenders. This form can also streamline communication between parties involved in business transactions or personal loans, emphasizing transparency and accountability. Legal professionals are advised to keep copies of the completed form for their records and to ensure compliance with any local or federal regulations regarding debt documentation.