Arbitration For Credit Card Debt In Cook

Category:

State:

Multi-State

County:

Cook

Control #:

US-00416-1

Format:

Word;

Rich Text

Instant download

Description

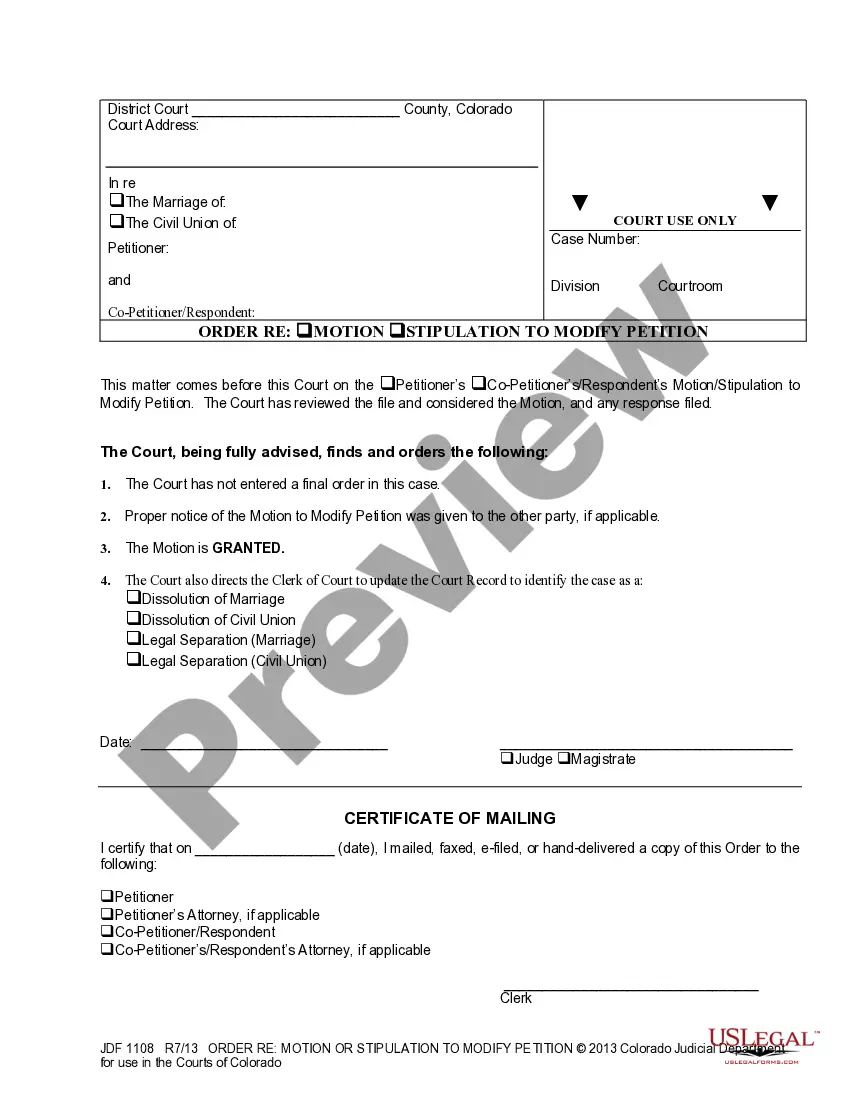

This arbitration agreement is executed contemporaneously with, and as an Inducement and consideration for, an Installment or sales contract for the purchase of a manufactured home. It provides that all claims or disputes arising out of or relating in any way to the sale, purchase, or occupancy of manufactured home resolved by binding arbitration administered by the American Arbitration Association ("AAA") under its Commercial Arbitration Rules. This Agreement is an election to resolve claims, disputes, and controversies by arbitration rather than the judicial process. The parties waive any right to a court trial.

Free preview

Form popularity

More info

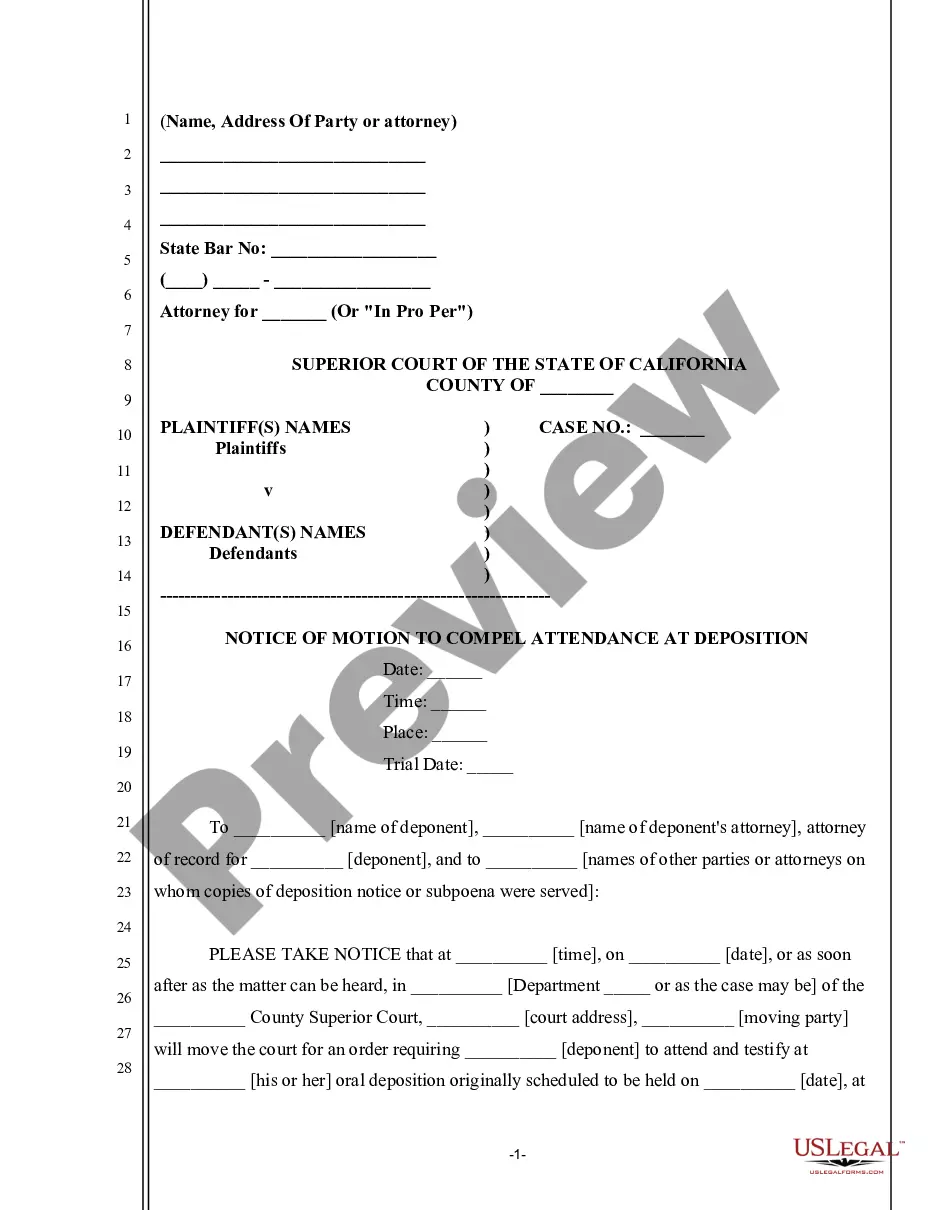

A mandatory arbitration hearing is a legal proceeding for certain types of civil cases where the plaintiff is asking for money damages only. Many credit cards have arbitration clauses, so the debt buyer should not be suing in court anyways.Rather, they should be filing arbitration. Arbitration is a mandatory but non-binding informal hearing where a neutral arbitrator, or panel of arbitrators, is selected to hear the evidence in your case. Use a sample Motion to Compel Abritration or let the SoloSuit's software draft a customized Motion to Compel Arbitration for you. If you are being sued for credit card debt, check your credit card agreement. The goal of the Protocol, in concert with the AAA Consumer Arbitration Rules, is to ensure evenhandedness in the administration of consumer-disputes resolution. Certain civil cases pending in the Circuit Court of Cook County must complete the mandatory arbitration process. Equifax: Court Finds Arbitration Clause in Credit Card Contract Unenforceable in Consumer Fraud Claim.