Arbitration For Credit Card Debt In Florida

Category:

State:

Multi-State

Control #:

US-00416-1

Format:

Word;

Rich Text

Instant download

Description

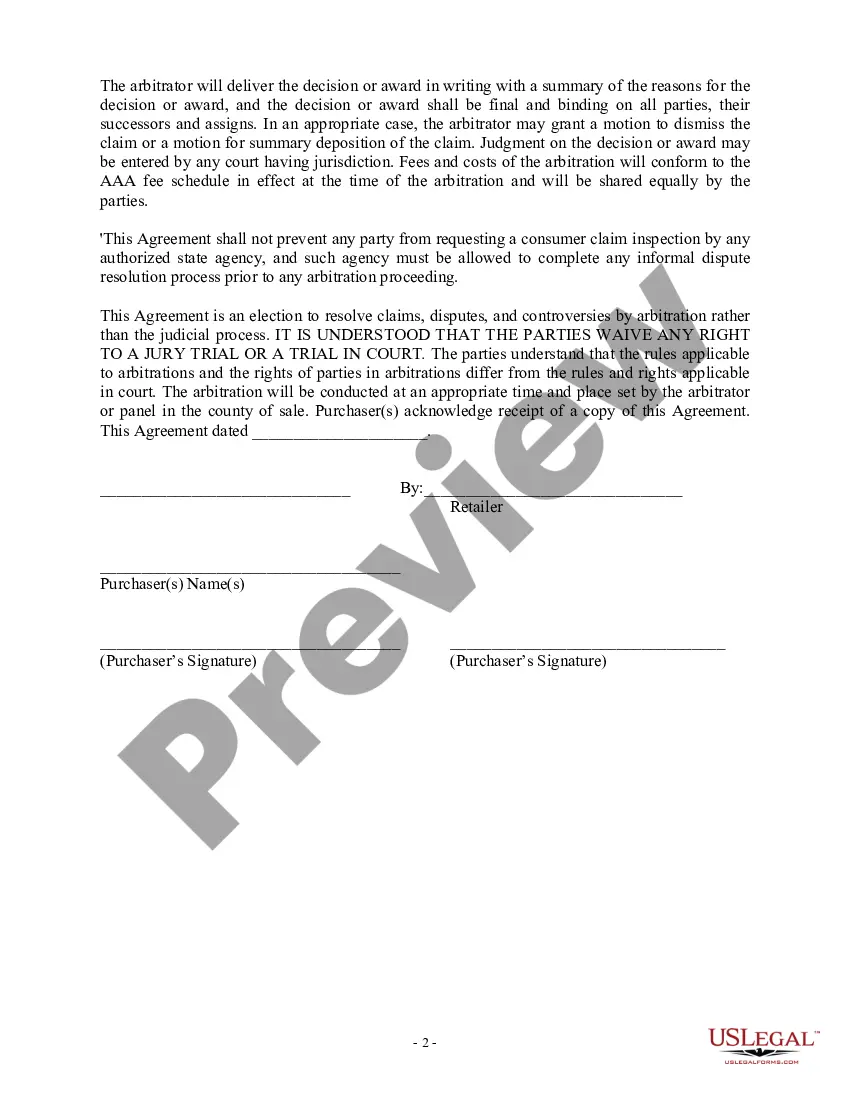

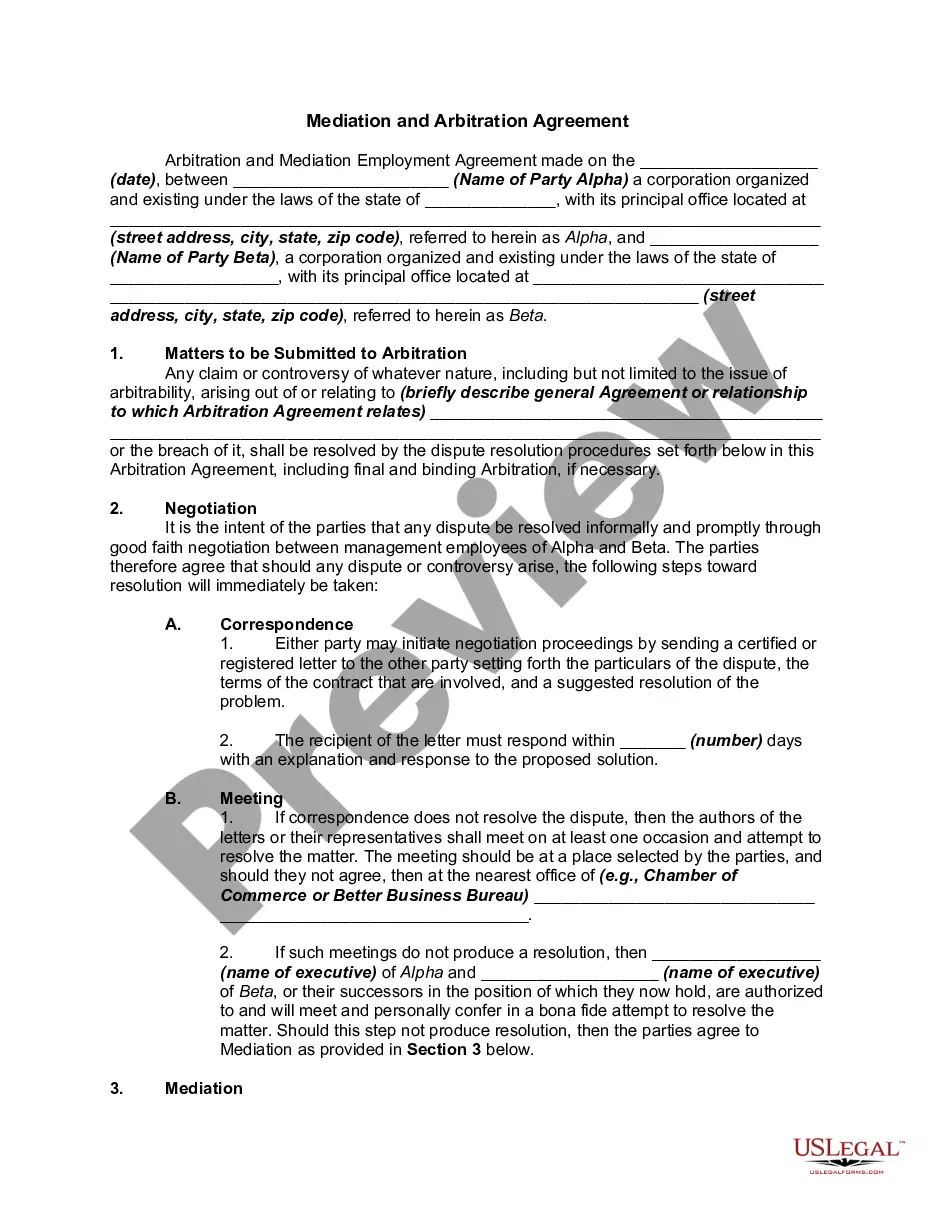

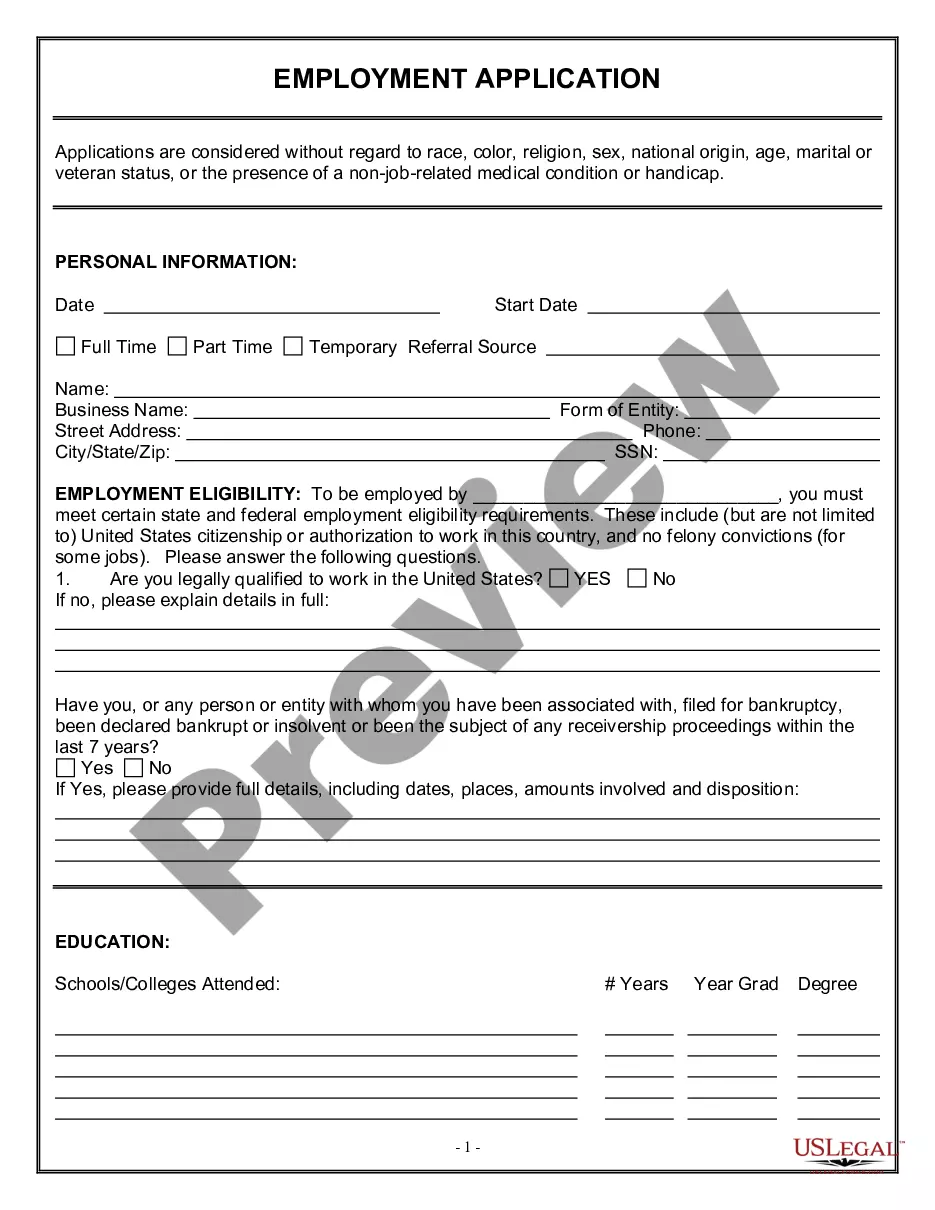

The Arbitration Agreement for credit card debt in Florida is a legally binding document designed to resolve disputes arising from the purchase of manufactured homes through binding arbitration rather than court trials. This Agreement executes concurrently with an installment or sales contract between the purchaser and retailer, acknowledging that it is governed by the Federal Arbitration Act. Key features include the requirement for all claims to be submitted to the American Arbitration Association under its Commercial Arbitration Rules, defining the arbitration process, and stipulating that costs will be shared between the parties. The form facilitates arbitration for claims under $20,000 with a single arbitrator, while claims over that amount require a panel of three arbitrators. Legal professionals can utilize this form to streamline dispute resolution processes for clients involved in consumer transactions, emphasizing the waiver of court rights and the need for notice to initiate arbitration. Filling out and editing instructions encourage clarity in defining disputes and remedies requested, making it accessible for attorneys, paralegals, and legal assistants. The Agreement is beneficial for attorneys and associates in providing clear guidelines for arbitration procedures, thereby enhancing client services.

Free preview