Arbitrage Vs No Arbitrage In Orange

Category:

State:

Multi-State

County:

Orange

Control #:

US-00416-1

Format:

Word;

Rich Text

Instant download

Description

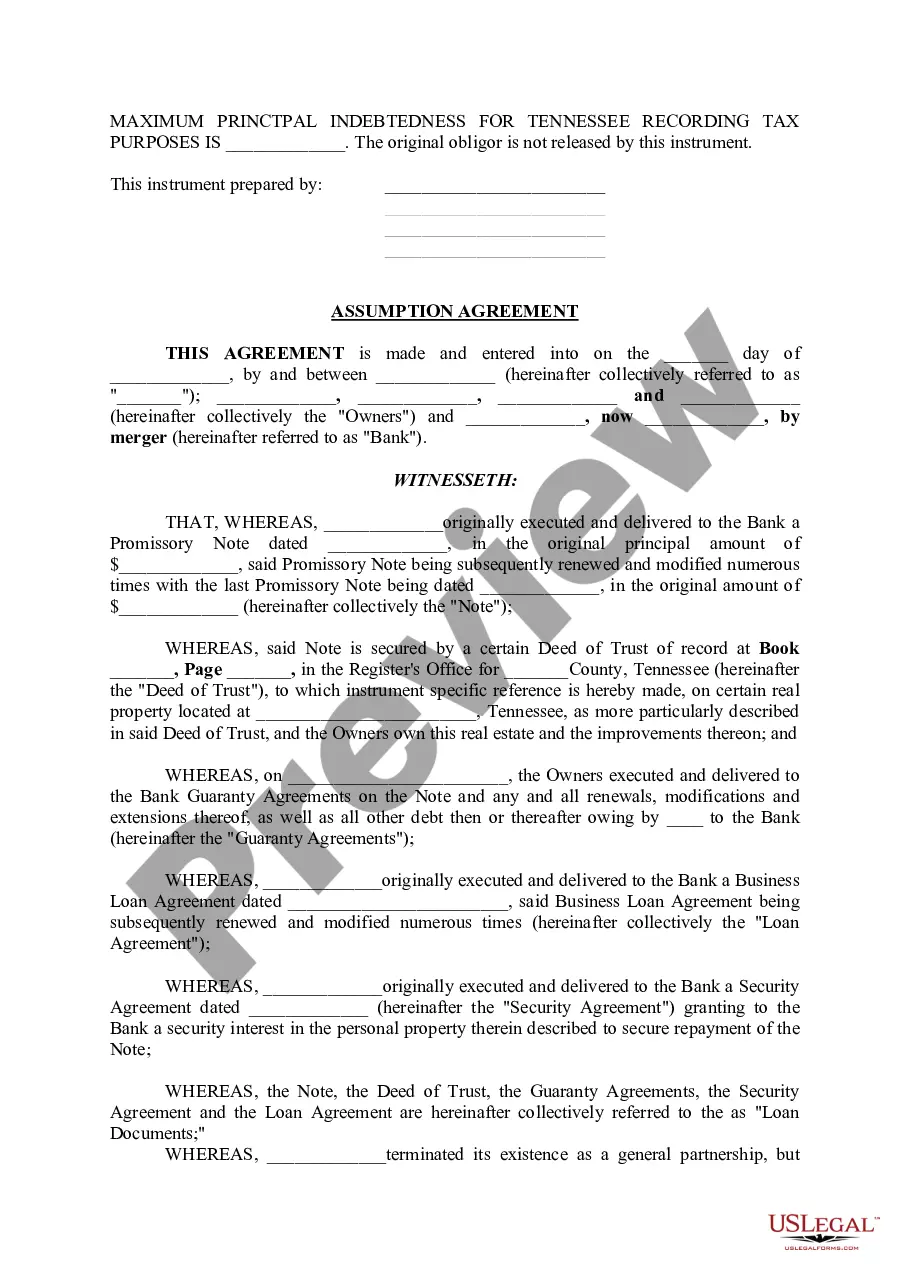

The Arbitration Agreement establishes a binding process for resolving disputes related to the sale, purchase, or occupancy of a manufactured home between the Purchaser and Retailer under federal law. It emphasizes the importance of arbitration as a means to tackle claims swiftly and effectively, thus contrasting the traditional court process. Key features include stipulations for initiating arbitration, the selection of arbitrators, and the manner in which decisions are rendered. The form requires that notices be sent to the Retailer and the AAA, containing relevant claim details. Users should be aware that arbitration may entail different rights and procedures compared to judicial actions, including the waiver of jury trial rights. This Agreement is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants involved in real estate or consumer law, as it clarifies the arbitrative process and sets explicit terms for claims under $20,000 and those above. Proper filing and adherence to the specified arbitration rules are critical for effective resolution of disputes. The Agreement underscores the significance of understanding the contrasting principles of arbitrage versus non-arbitrage scenarios in the context of dispute resolution.

Free preview