Deferred Compensation Form For Independent Contractors In Collin

Category:

State:

Multi-State

County:

Collin

Control #:

US-00417BG

Format:

Word;

Rich Text

Instant download

Description

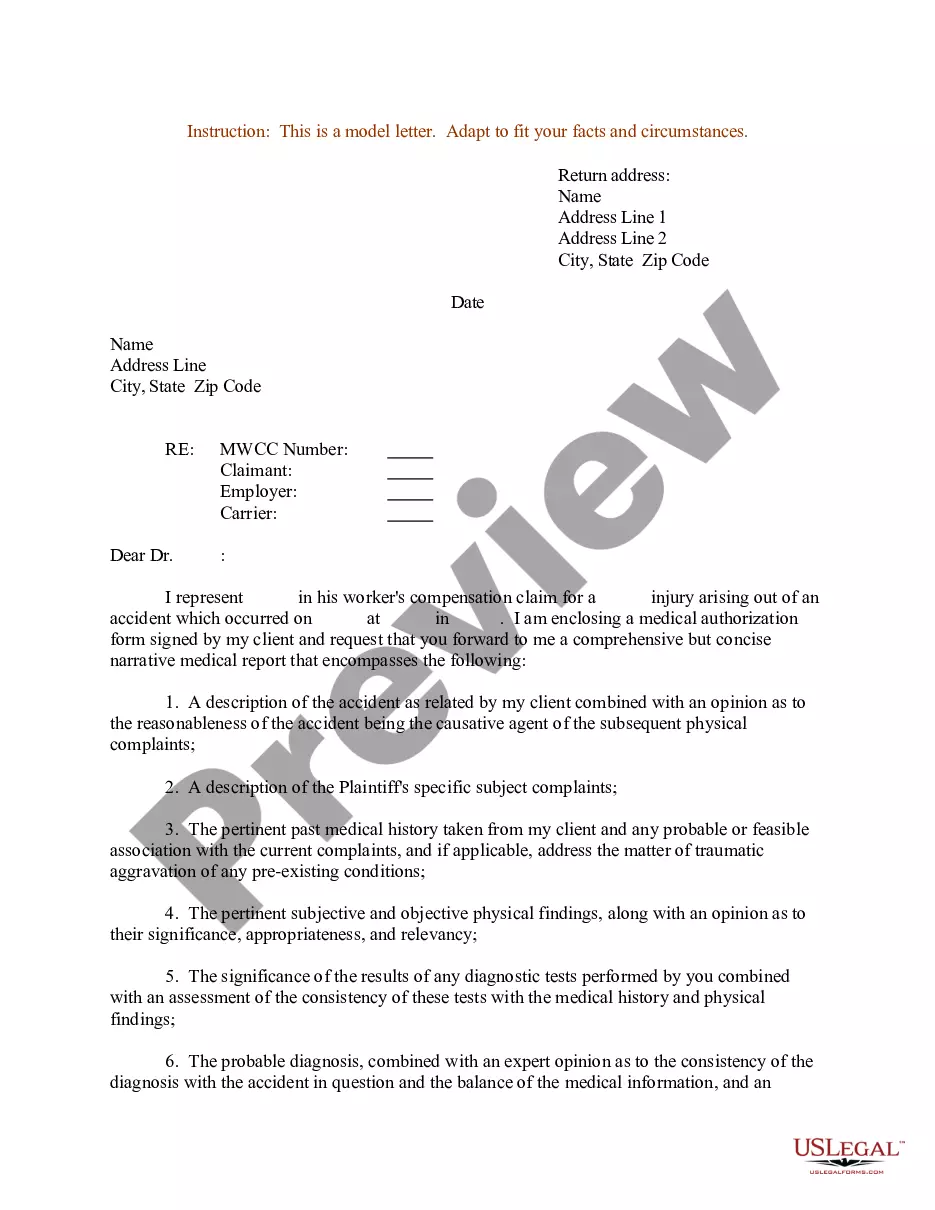

The Deferred Compensation Form for Independent Contractors in Collin serves to formalize an agreement between an employer and an independent contractor regarding additional compensation to be paid after the contractor's retirement. This form allows the employer to encourage long-term engagement by offering post-retirement income that exceeds standard pension plans. Key features include stipulations on the amount to be paid, a structured schedule for payments, and conditions that, if met, ensure the contractor remains eligible for these benefits. The form is designed for ease of use, with clear instructions on filling out personal and payment information. It is particularly relevant for attorneys, partners, owners, associates, paralegals, and legal assistants, as it aids them in structuring employment agreements that incentivize retention and encourage a dedicated workforce. They can use this form to support their clients in ensuring financial security for independent contractors post-retirement while maintaining compliance with legal standards.

Free preview