Deferred Compensation Agreement Template For Small Business In Michigan

Category:

State:

Multi-State

Control #:

US-00417BG

Format:

Word;

Rich Text

Instant download

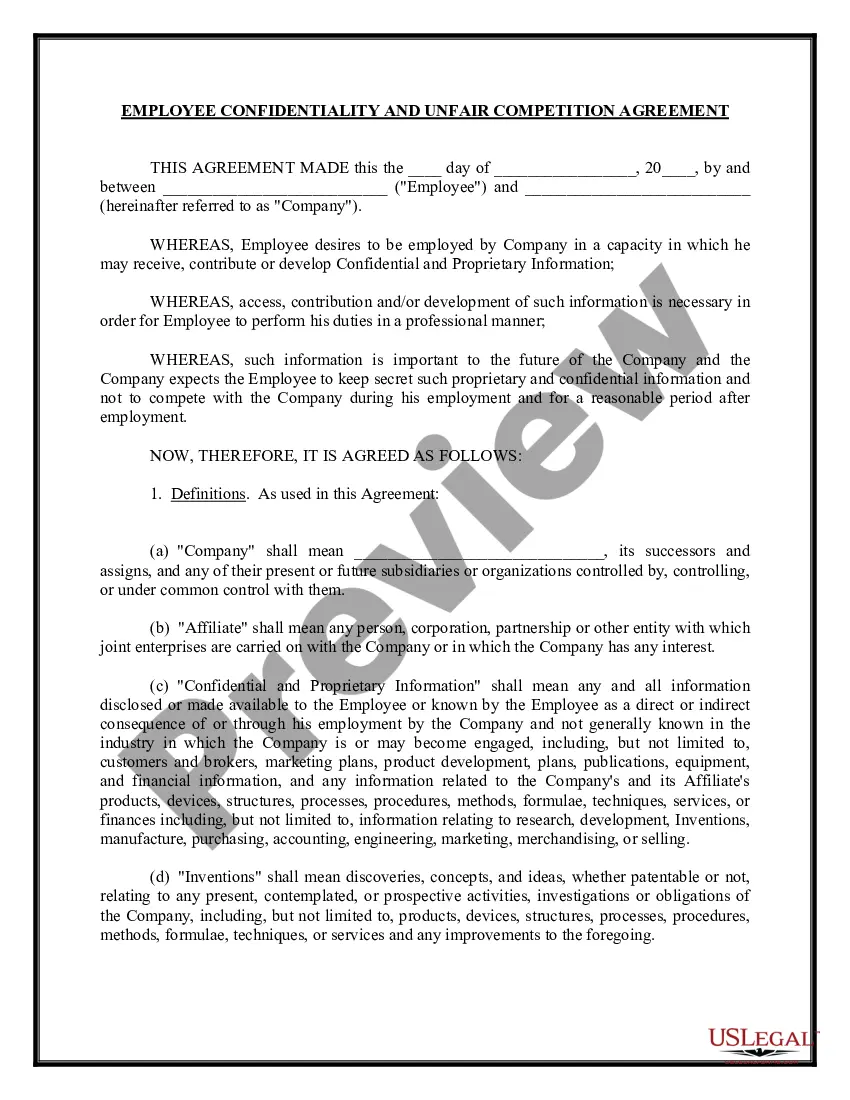

Description

The Deferred Compensation Agreement template for small business in Michigan is designed to facilitate an arrangement between employers and key employees to ensure post-retirement income, supplementing the employer’s regular pension plans. This agreement outlines the conditions under which an employee can earn additional compensation, contingent upon their continued service until retirement. Key features include details about the payment structure, specifying the amount and the installment frequency, typically executed in equal monthly payments. Additionally, provisions are included to terminate the employee's right to the deferred compensation if they engage in other business activities without the employer's consent. In cases of the employee's death prior to full payment, a lump sum payment to the surviving spouse or estate is specified. This form is particularly beneficial for attorneys, partners, owners, associates, paralegals, and legal assistants as it provides a clear, legally binding framework for compensation agreements, supports client retention strategies, and ensures compliance with legal standards. It also enables practitioners to easily fill out and customize the template, promoting efficient and effective legal document creation.

Free preview