Sales Of Assets Business Advantages And Disadvantages In Bronx

Category:

State:

Multi-State

County:

Bronx

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

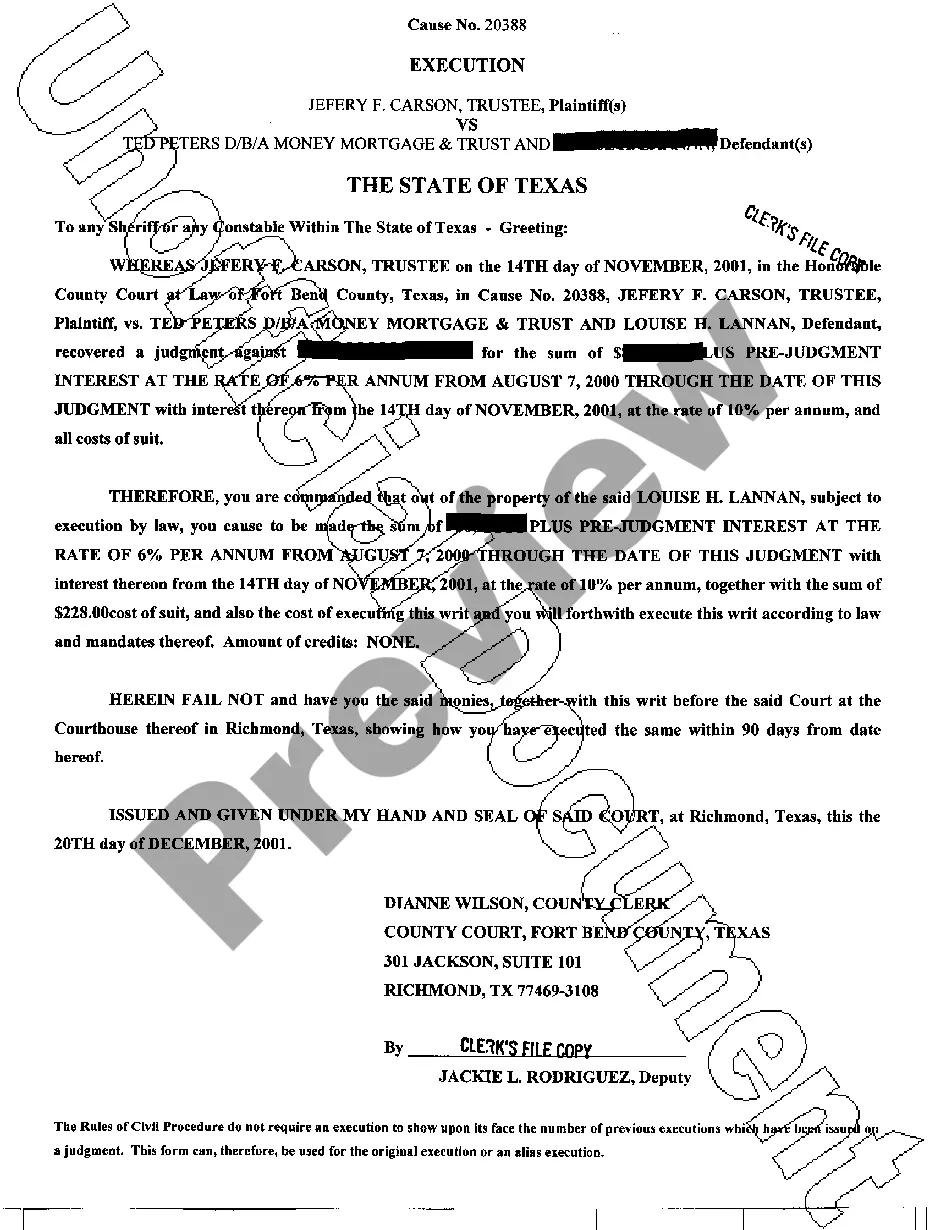

The Asset Purchase Agreement is a crucial legal document utilized in the sale of business assets, specifically outlining the terms between the seller and buyer. For the Bronx area, understanding the sales of assets business advantages and disadvantages is essential for potential buyers and sellers. The key advantages of such sales include the potential for streamlined transactions and the ability to acquire specific assets without assuming business liabilities. However, disadvantages may encompass challenges related to valuation and potential hidden liabilities. This form includes features such as clearly delineated sections for assets purchased and liabilities assumed, which helps mitigate risks. Additionally, filling instructions are straightforward: parties must modify sections as relevant to their situation, ensuring clarity and compliance. Use cases for attorneys, partners, owners, associates, paralegals, and legal assistants in the Bronx include assisting clients in navigating asset sales, structuring agreements to protect interests, and ensuring compliance with local regulations.

Free preview