Form 8594 Requirements In Broward

Category:

State:

Multi-State

County:

Broward

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

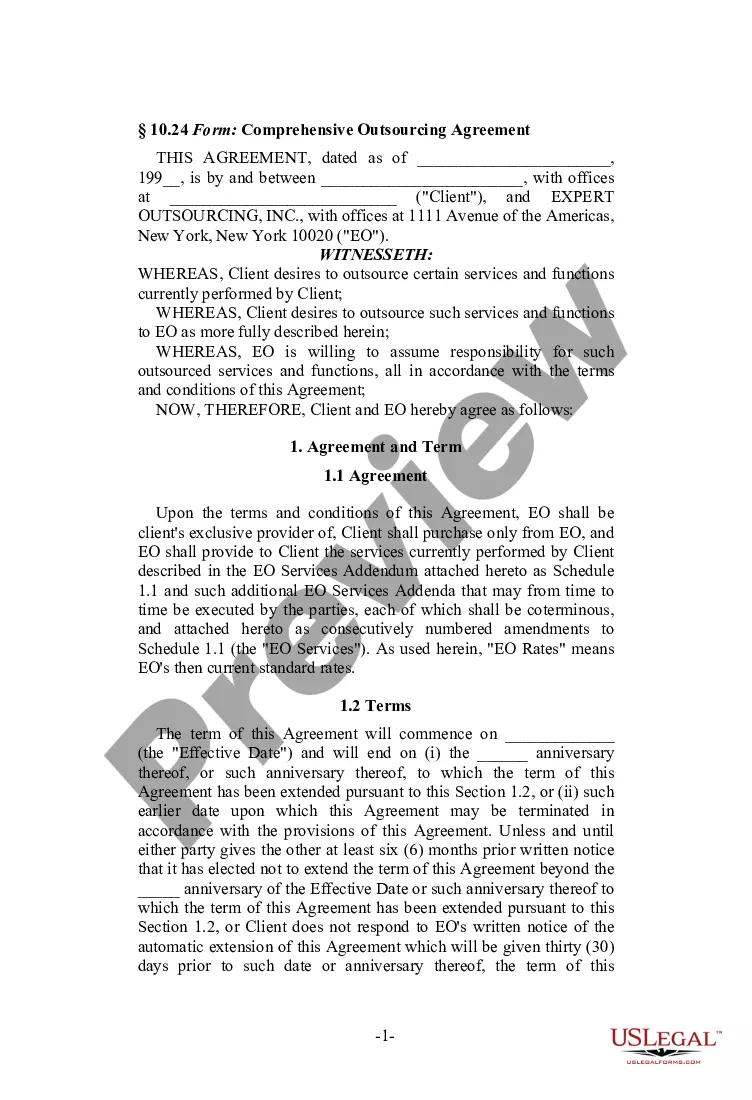

Form 8594 requirements in Broward pertain to the allocation of purchase price when a business is sold. This form is vital for properly documenting the sale of assets in business transactions. It specifies how the seller and buyer will allocate the purchase price among the various assets involved in the sale, which is important for tax purposes. Users should fill out the form with care, ensuring every asset is listed and accurately valued. Key features include sections for detailing assets, liabilities, purchase price, and terms of payment. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form useful for structuring asset transactions, ensuring compliance with tax regulations, and protecting their clients’ interests. It is imperative to review the form for any necessary edits based on the specific transaction and to delete any non-applicable provisions. The completed Form 8594 not only facilitates a smoother transaction but also provides legal clarity for all parties involved.

Free preview