Sale Of Business Asset With Personal Use In Chicago

Category:

State:

Multi-State

City:

Chicago

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

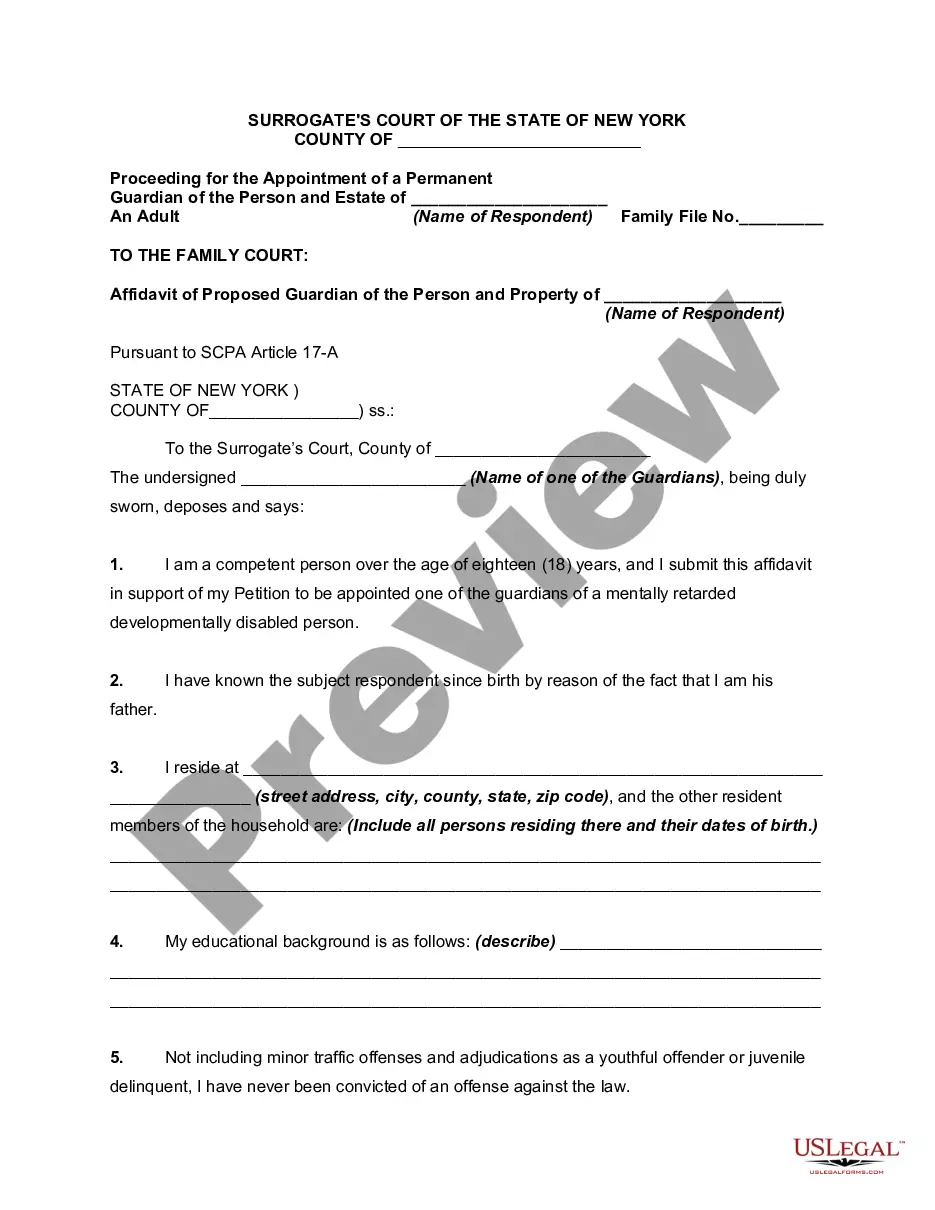

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

You (or the purchaser or transferee) must complete Form CBS-1, Notice of Sale, Purchase, or Transfer of Business Assets. In Illinois, there are two separate but complementary taxes upon the sale and use of tangible personal property.Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. To sell a business in Illinois, you'll need various legal documents, including a bill of sale, asset purchase agreement, and non-disclosure agreements. This contract sets out the key terms of the transaction, including the purchase price, payment terms, and the assets and liabilities included in the sale. Use Form 4797 to report sales of rental property, depreciable personal property, land and buildings used in a trade or business, goodwill, etc. This Drake Tax article discusses the sale of an asset used for personal and business use.