Form 8594 For Stock Purchase In Collin

Category:

State:

Multi-State

County:

Collin

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

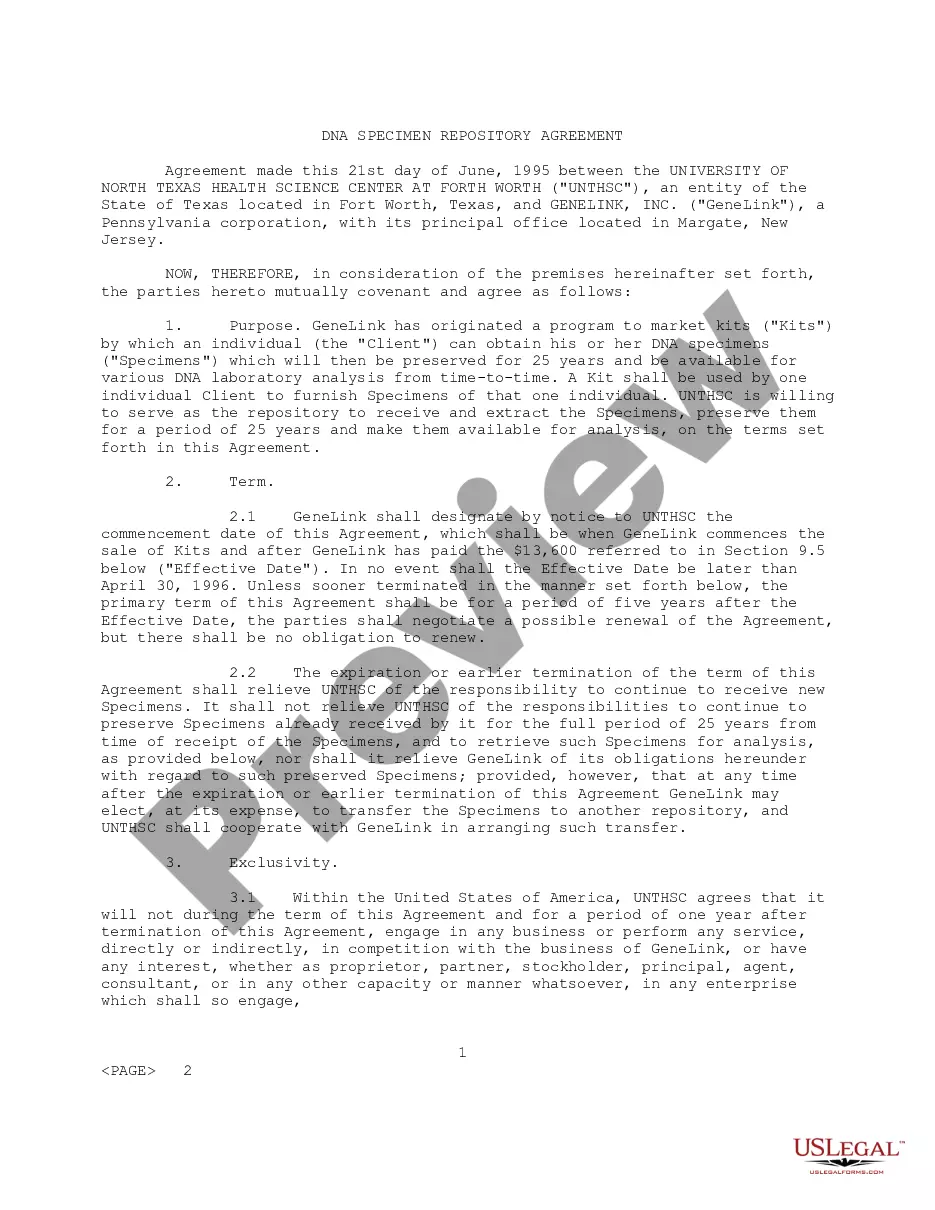

Form 8594 for stock purchase in Collin is a critical document used to report the acquisition of assets in a business transaction. This form serves to determine the allocation of purchase price among various assets, which can be crucial for tax considerations. It includes sections for detailing the assets purchased, liabilities assumed, and the purchase price allocation, ensuring clarity on what is included in the transaction. For attorneys, it aids in structuring deals, while partners and owners can utilize it to manage their investment outlines. Associates, paralegals, and legal assistants are equipped with guidelines for filling and editing the form, making it easier to comply with regulatory requirements. Key features of the form include explicit sections for asset categorization, exemptions, and tax details, streamlining both the transaction process and compliance with IRS regulations. Additionally, the form allows for modifications to suit specific transaction needs, ensuring flexibility in usage. Ultimately, Form 8594 is essential for maintaining accurate records in business acquisitions within Collin, benefiting all parties involved.

Free preview