Purchase Business Sale Purchase Formula In Cook

Category:

State:

Multi-State

County:

Cook

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

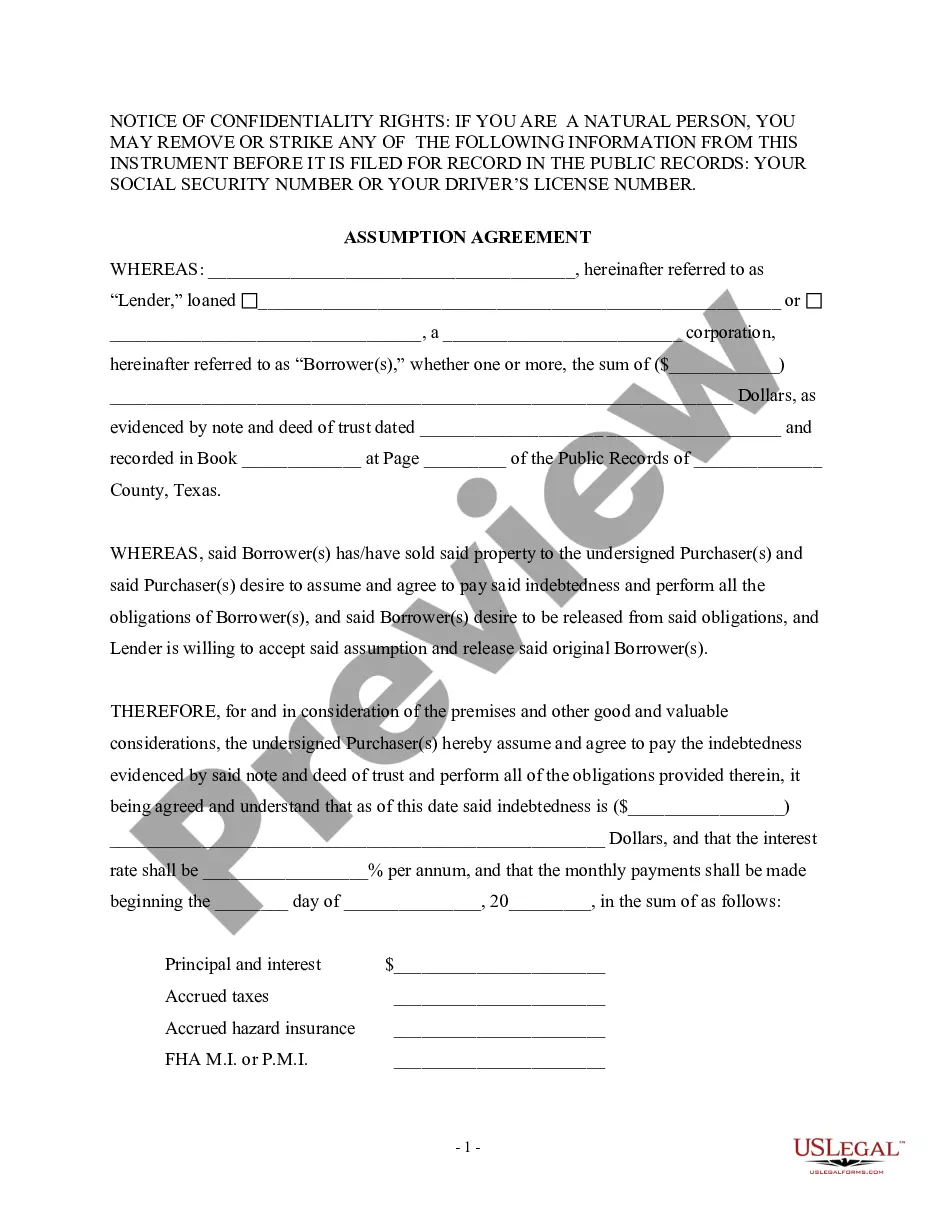

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Now it's time to agree on a purchase price. Here's how to calculate a company valuation so you can negotiate with confidence.A taxable asset purchase allows the buyer to "step up," or increase, the tax basis of the acquired assets to reflect the purchase price. The buyer's consideration is the cost of the assets acquired. Both the buyer and seller must complete IRS Form 8594 during the sale to report the sale and purchase of business assets. Small business entrepreneurs typically have two options for structuring the purchase of a business: an asset sale or a stock sale. There are two primary ways to structure the taxable purchase and sale of an incorporated business. The parties may engage in an asset acquisition.