Sales Of Assets Business Advantages And Disadvantages In Fairfax

Category:

State:

Multi-State

County:

Fairfax

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

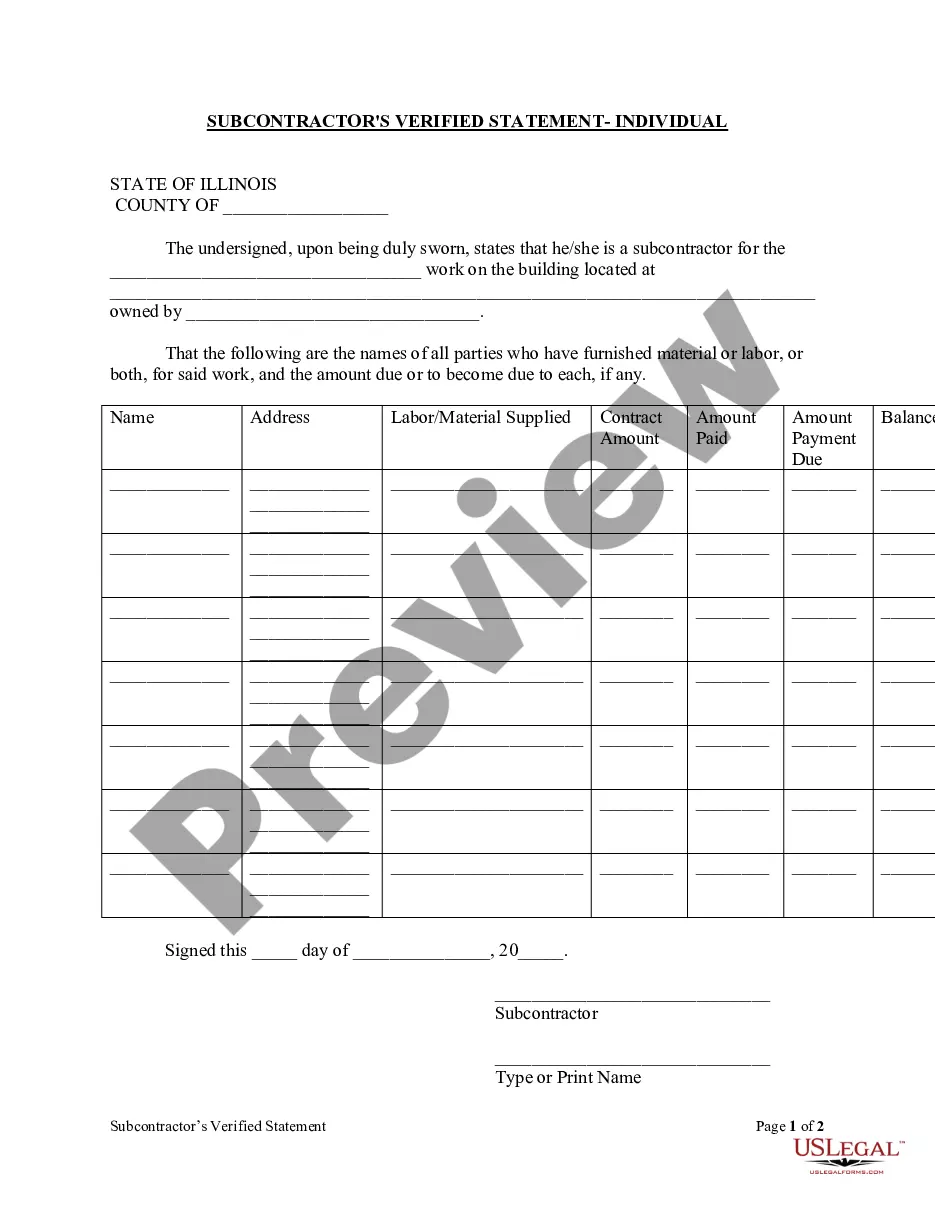

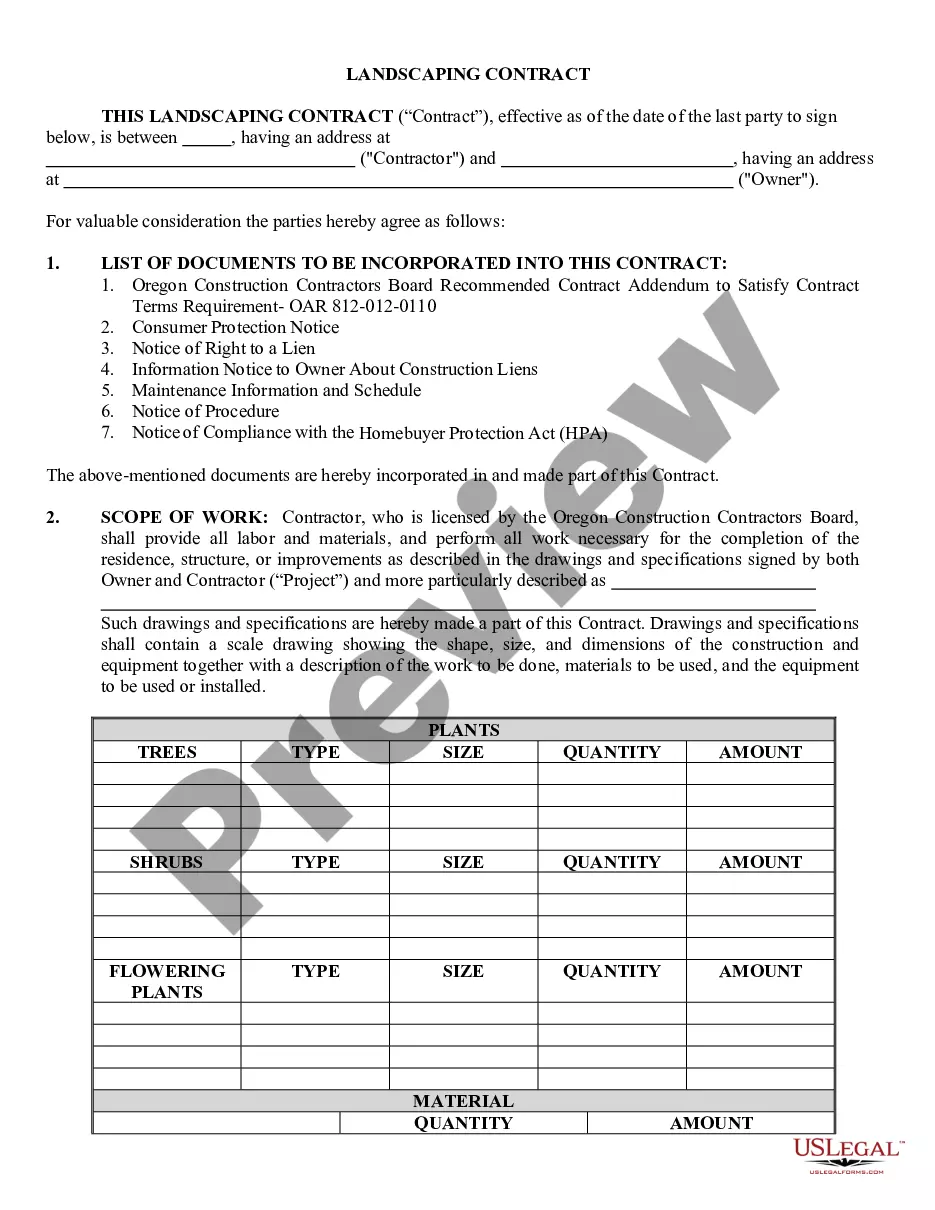

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Along with the lack of exposure to corporate liabilities, asset sales offer tax benefits to buyers. The drawbacks for a seller mainly center around taxes.You can pay your business tangible property taxes on your furniture, equipment, computers, machinery, tools, and business vehicles on the online payment portal. Advantages for the Buyer. Each year, the Real Estate Assessment Office appraises all real property in the City to determine its value for tax purposes. In an asset sale, the seller may face double taxation. Intangible assets may be subject to capital gains tax.