Form 8594 And Contingent Consideration In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

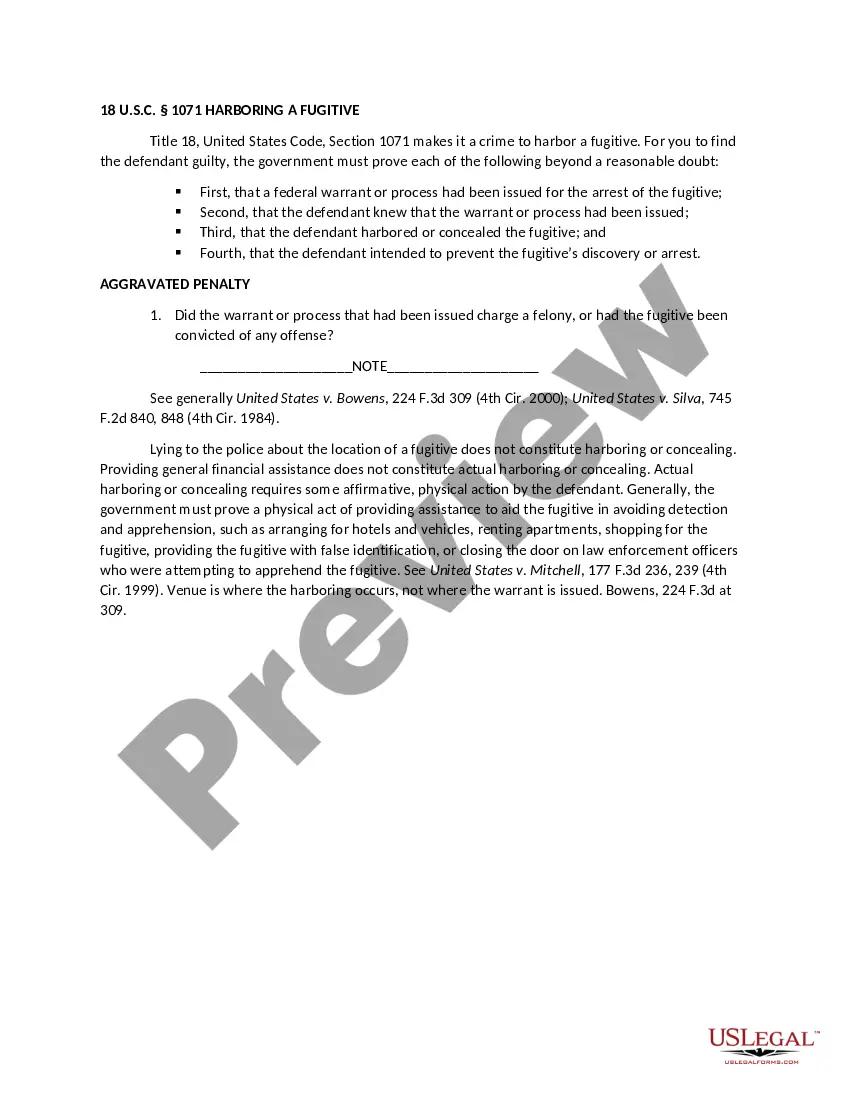

Form 8594 is essential for asset sales, particularly in cases involving contingent consideration, as seen in Fulton transactions. This form serves to report the transfer of assets and allocate the purchase price among various asset categories, impacting tax obligations for both buyers and sellers. It simplifies the asset categorization process by ensuring mutual agreement on the asset values between parties involved in the transaction. For attorneys, partners, and owners, understanding Form 8594's structure is crucial for effective negotiation and compliance with tax regulations. Associates, paralegals, and legal assistants will benefit from clear instructions on filling and editing the form, enabling them to support clients in document preparation and submission accurately. Users should ensure all sections are completed, especially concerning liabilities and transferred assets, to avoid disputes post-transaction. Key use cases include M&A transactions, business sales, or when contingent payments are contemplated based on future performance.

Free preview