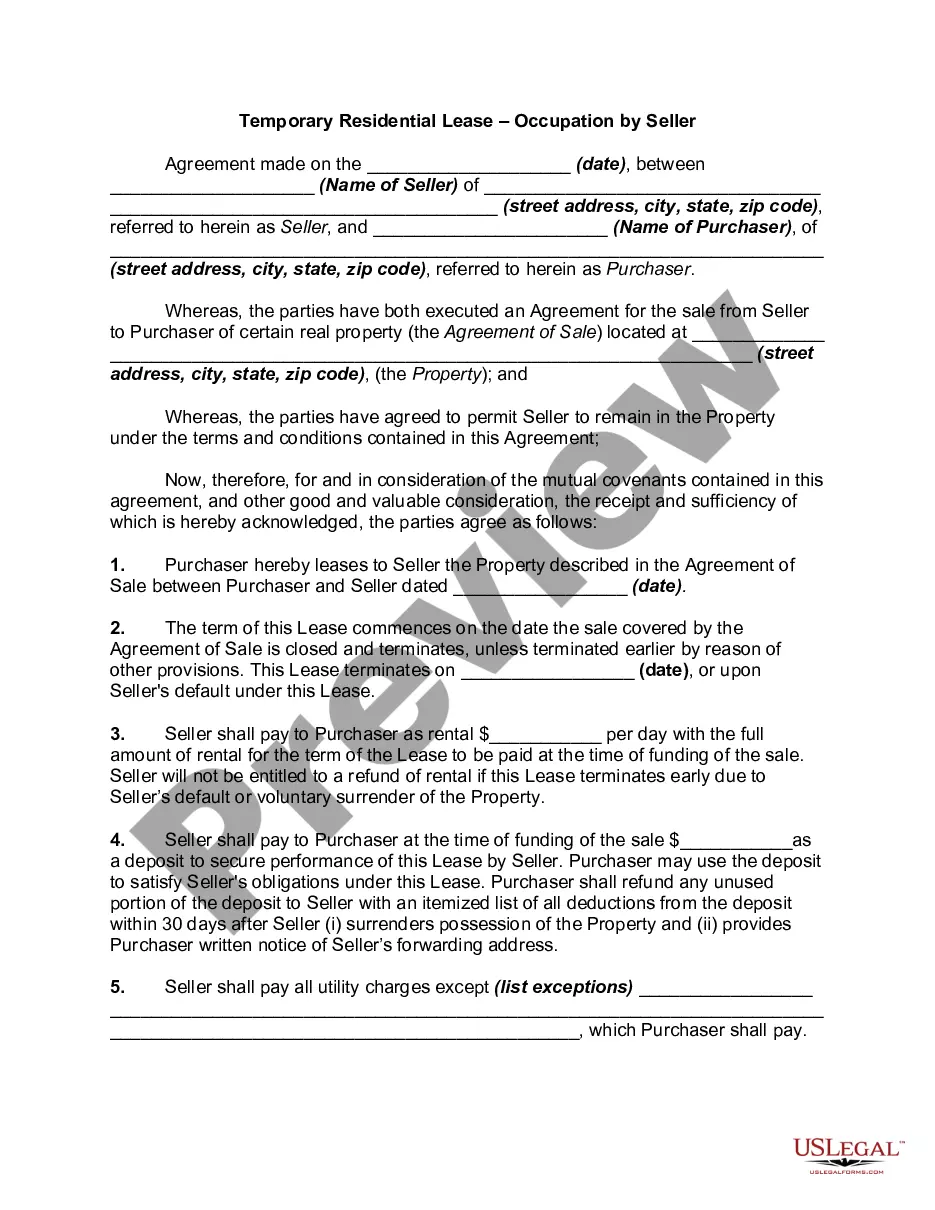

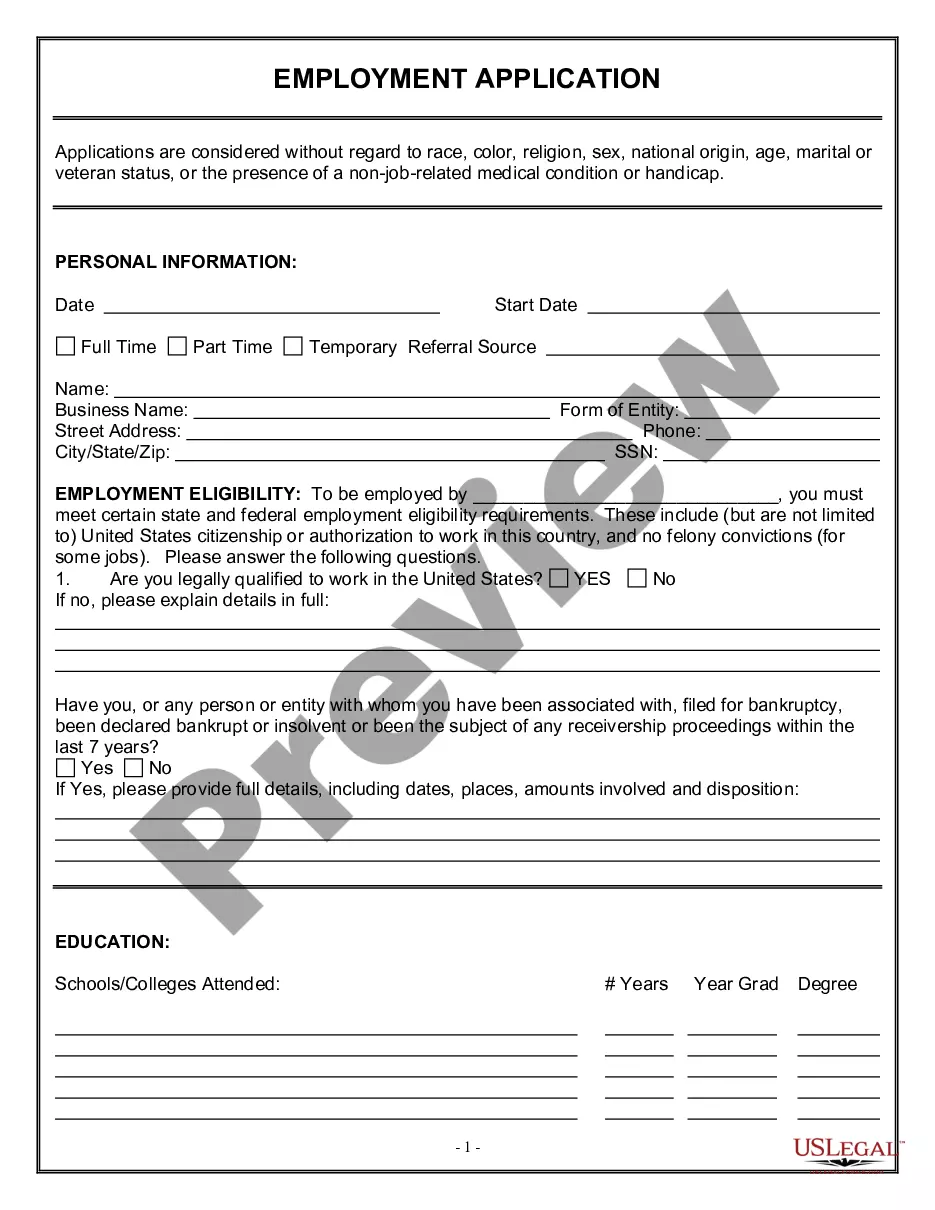

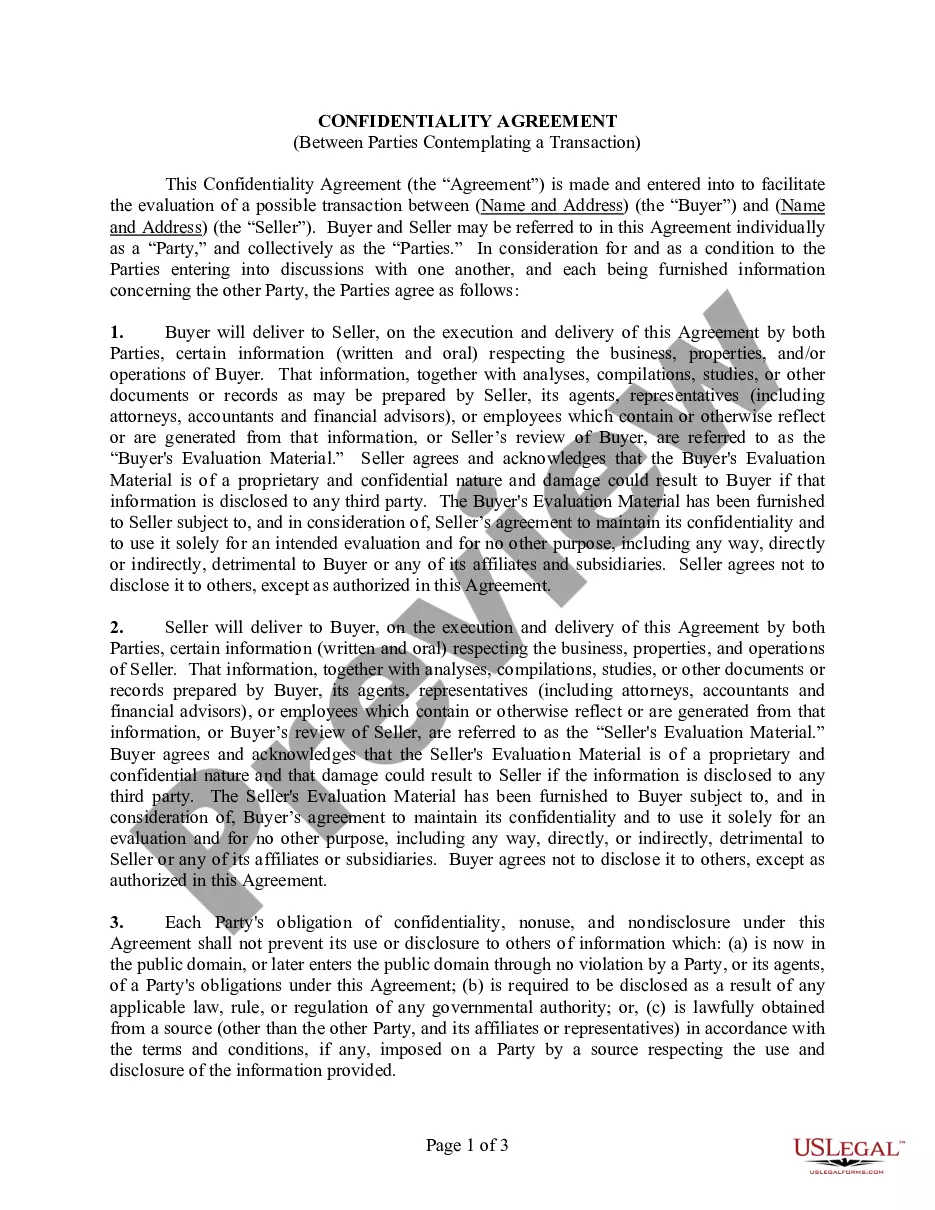

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Business Sale Asset With Section 179 In Hennepin

Category:

State:

Multi-State

County:

Hennepin

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

Free preview