Business Sale Asset With Trade In In Massachusetts

Category:

State:

Multi-State

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

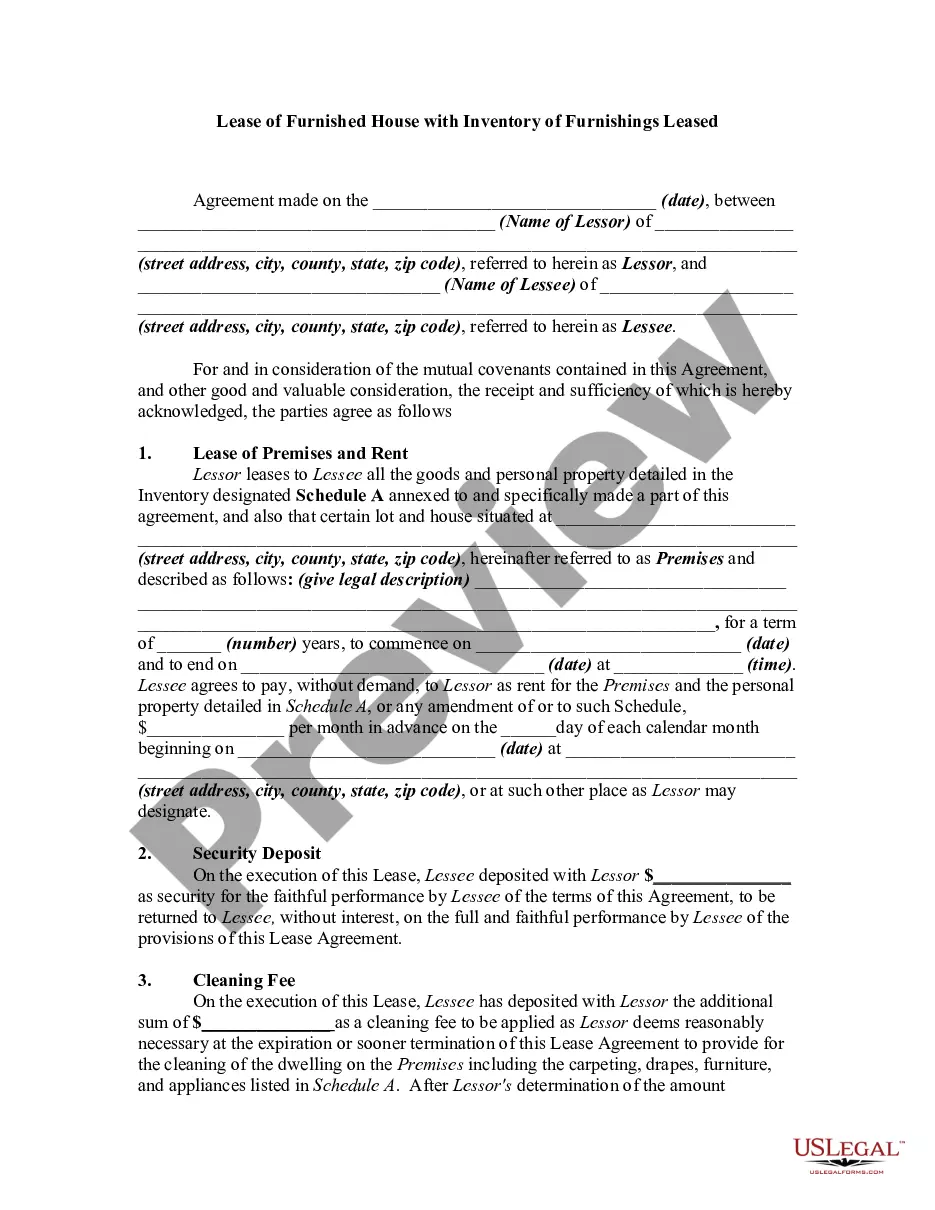

The Business Sale Asset with Trade In in Massachusetts form is designed to facilitate the sale of a business's assets, including equipment, inventory, and goodwill, while allowing for trade-in considerations. This comprehensive agreement outlines the responsibilities of both the seller and buyer, including asset descriptions, purchase price allocation, and the assumption of liabilities. Users are instructed to modify the form to fit their specific circumstances by deleting any non-applicable sections. Filling and editing guidelines are straightforward, ensuring clarity and ease of understanding for legal practitioners and business owners. The document has specific use cases for attorneys drafting sales contracts, partners negotiating asset sales, owners managing business transfers, associates assisting in transactions, and paralegals and legal assistants preparing necessary documentation. Key features include defined asset categories, multiple payment structures, covenants, indemnification clauses, and provisions for conditions precedent, making it versatile for various business scenarios. It is imperative for users to follow the outlined procedures to ensure effective execution of the agreement, safeguarding the interests of all parties involved.

Free preview