Purchase Business Sale Purchase With Tax In Miami-Dade

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00418

Format:

Word;

Rich Text

Instant download

Description

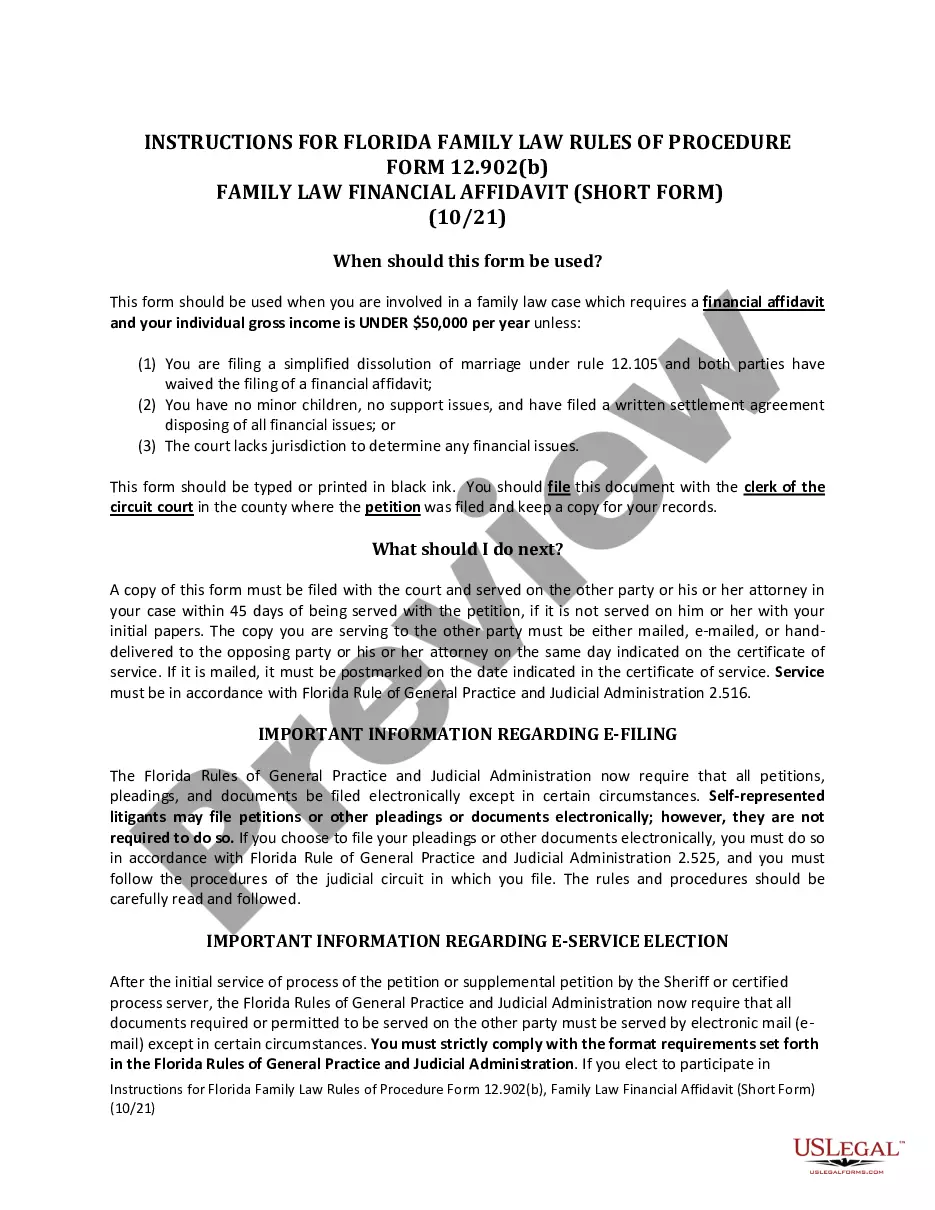

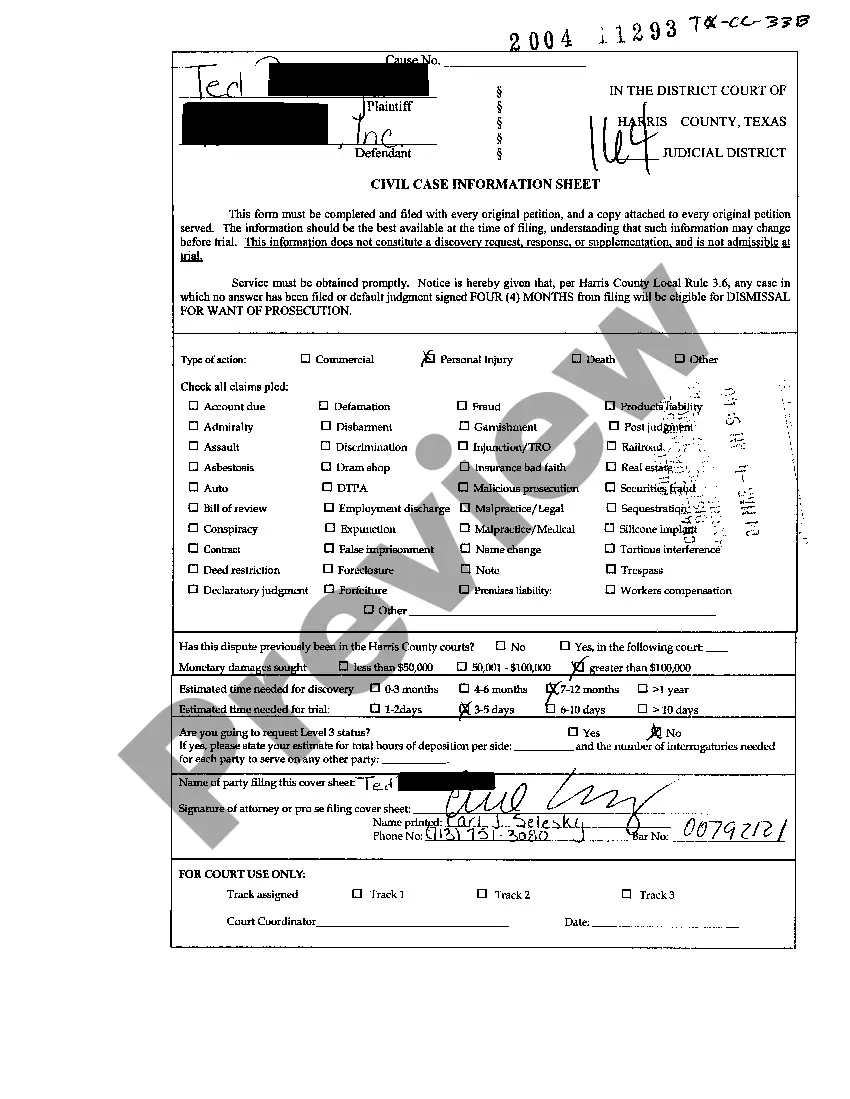

This form is an Asset Purchase Agreement. The buyer agrees to purchase from the seller certain assets which are listed in the agreement. The form also provides a listing of certain assets which will be excluded from the sale. The form must be signed in the presence of a notary public.

Free preview

Form popularity

More info

Apply for or renew your local business tax receipt, or request a change to your existing account. Each sale, admission, storage, or rental in Florida is taxable, unless the transaction is exempt.Sales tax is added to the price of taxable goods or services. 2024 Guide to Sales Tax in Miami, Florida. Local business tax categories cover various types of businesses and the associated cost of receipt for each. Complete Form DR-1 to register to collect, report, and pay the following taxes, surcharges, and fees: • Sales and use tax. • Communications services tax. Who needs to register? Generally, all businesses making sales in the state of Florida are subject to sales tax. What is the sales tax rate in Miami-Dade County?